Sentiment poll reveals cautious optimism

8th June 2023 11:01

by Jemma Jackson from interactive investor

Fear of a global recession wanes, according to a new poll by interactive investor.

Investors appear cautiously optimistic about the outlook for the investment landscape as inflation recedes globally - with most backing UK stock markets to rebound, according to a new poll by interactive investor.

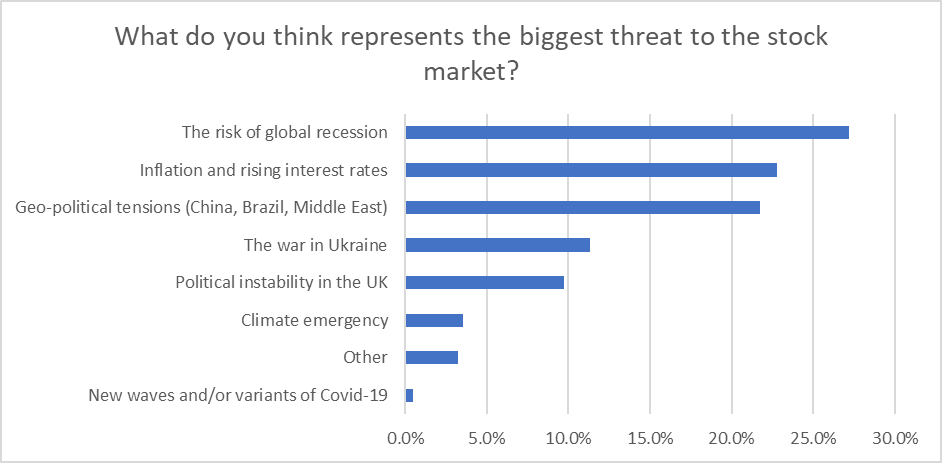

In a poll of 1,510 interactive investor website visitors conducted between 19 and 23 May, the largest percentage (27%) of respondents said the risk of a global recession is the biggest threat to global stock markets.

This represents a 13-percentage points dip from a similar investor sentiment poll conducted by ii in October last year in which the threat of recession was cited as the biggest concern by 40% of respondents.

In ii’s latest May poll, inflation and rising interest rates (23%) were recognised as the second-biggest threat to global stock markets after the risk of global recession.

Meanwhile, 22% cited geopolitical tensions and 11% of respondents said the war in Ukraine represented the largest threat, followed by political instability (10%) and the climate emergency (4%).

Majority investing same amount or more than last year

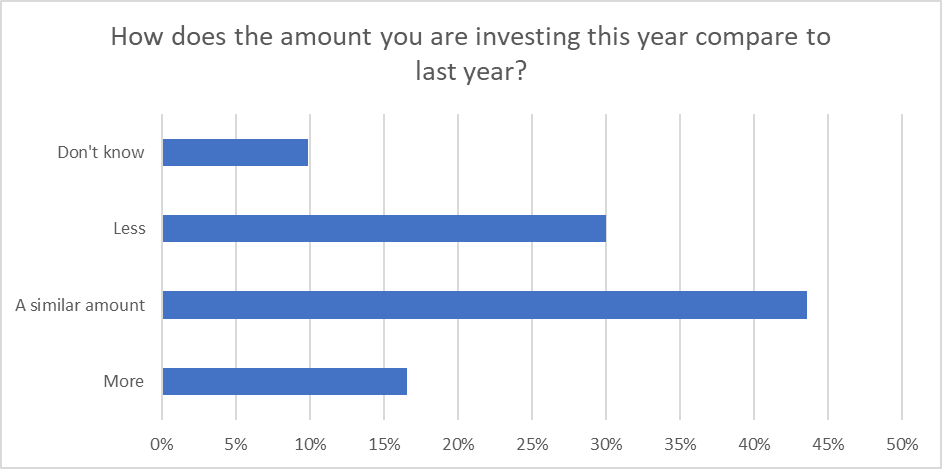

Despite cost-of-living pressures on household budgets, 61% of respondents said they are investing a similar amount or more this year compared to last year, but 30% said they were investing less.

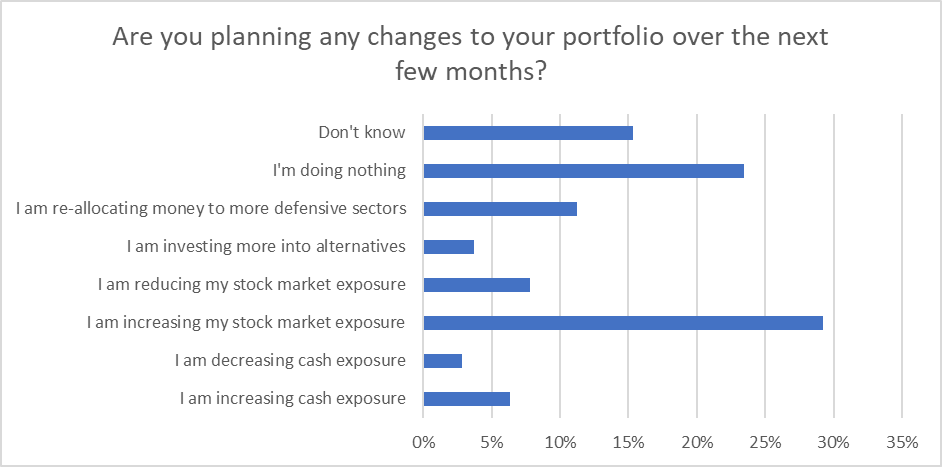

The belief that now is a good opportunity to invest appears to be manifesting itself at the portfolio level, the largest percentage of the respondents (29%) said they plan on increasing their stock market exposure versus 8% who said they were doing the opposite.

11% said they are re-allocating money to more defensive sectors, and 4% are turning towards alternatives with their investments.

However, some investors are sitting tight; with 23% stating they are leaving their investment portfolio alone. When it comes to cash savings, 6% of respondents said they plan to up their exposure, while 3% said they plan on cutting it.

Which regions are favoured among investors?

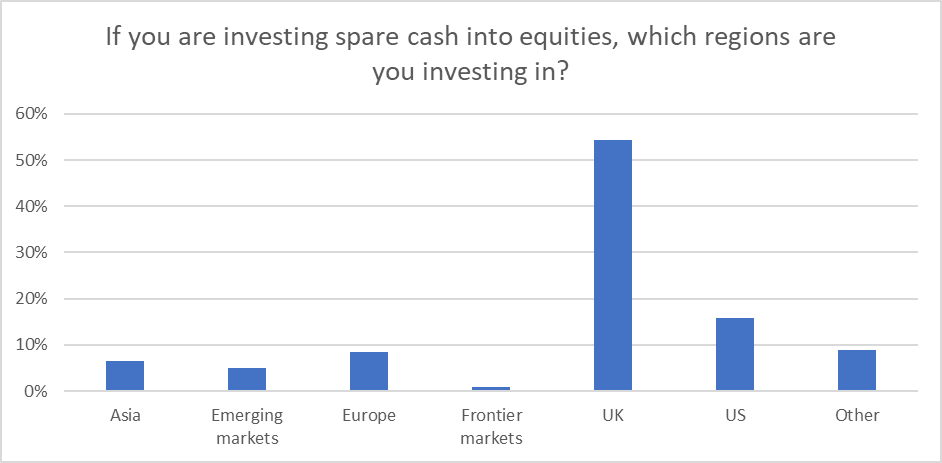

For those increasing their stock market exposure, the UK was the most favoured region (54%) followed by the US (16%). Some 8% of respondents said they are investing in Europe, 7% in Asia, 5% in Emerging Markets and 9% said they are investing in other regions.

Myron Jobson, Senior Personal Finance Analyst, interactiveinvestor, says: “The overarching sentiment from our poll is investors seem to believe that the investment landscape isn’t as bad as some have feared. While advanced economies are suffering from a pronounced slowdown in growth, a full-blown global recession has yet to materialise. This underscores the significant dip in the number of people who cite a global recession as the top threat to global stock markets from out last investors’ survey back in October.

"There are, however, variations between regions on the prospects of recession. Many economists now predict that the UK and Eurozone will escape recession this year, while the jury is still out for the prospect of the US, with a jump in new jobs created last month and the easing wage growth supporting the ‘soft landing’ narrative instead of a recession. Even so, with inflation still running hot, credit conditions could continue to tighten and, in turn, weigh on growth - which signals a long road to recovery.

“Ideally, even when markets are rough it is still worth keeping your money invested – that is, of course, for those who can afford to do so. If you don’t need to sell, waiting until the dust settles and then checking that your investments are still aligned to your long-term goals could prove prudent.

“It is interesting to note that over half of the respondents to our poll plan on investing in the UK, which could suggest that investors believes that the region’s recovery story still has a long way to go. Many people tend to invest in what they know, and domestic stocks are often easier to research and understand than overseas stocks, resulting in home bias. But longer-term, global markets have often tended to outperform, showing the importance of having a diversified portfolio.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.