This share could be a nice little earner

It’s not cheap, but a big yield means this AIM retailer could do well for the right kind of investor.

8th February 2019 12:30

by Richard Beddard from interactive investor

It's not cheap, but a big yield means this AIM retailer could do well for the right kind of investor.

An income oriented investor might think differently though. Shoe Zone (LSE:SHOE) is paying a total dividend for 2018 of 11.5p per share (yielding shareholders nearly 5%) and so long as it can start the year with £11 million in cash, the company pays any surplus out as a special dividend. The special dividend for 2018 is 8p per share, or another 3%.

I visited my local Shoe Zone on Wednesday. The shop is in an unfashionable location, the signage is written in a font filched from Windows 3.1, and fluorescent signs like cartoon "Bam!", "Zap!" and "Kapow!"'s from a 1960s Batman TV episode advertise bargains in baskets in front of the shop window.

As I approached the gaudy storefront I prepared myself for a dismal, neglected, Sports Direct style secret shopping experience. I had already read Shoe Zone’s average sale in the year to September 2018 is little more than £12, and felt a little self-conscious about my extravagant footwear as I entered the twilight zone...

Into the twilight zone

Inside, our Shoe Zone is spacious and ordered. The only visible member of staff was busily putting shoes on shelves. The only customer (it was very early) bought something. There were lots of boots, shoes, and trainers in common colours and styles, facsimiles of shoes that cost three to five times as much elsewhere.

Wondering how Shoe Zone can sell shoes so cheaply, I was drawn to a narrow column of a wide display, marked "leather uppers". The shoes were £19.99. I searched far and wide, but the materials used in other shoes were mysteriously identified as “other materials” or not identified at all. They smelled like shoes though.

Having clocked me as a leather snob and sensing perhaps I was baulking at the price, the shopkeeper directed me to last year's versions of the leather uppered shoes, marked down to £9.99. I asked whether any of the other shoes and boots in the shop are leather, they are not, and as I marvelled that I could buy a smart pair of leather shoes for a tenner, just a few quid more than the man made alternatives, she smiled and said:

"Our reputation is that nothing in the shop is expensive."

Shoe Zone says it is the market leading value retailer of shoes in the UK. A pie chart in the prospectus published when the company floated in 2014 shows it had a 2% share of the total shoe market, slightly behind a gaggle of posher High Street retailers like Schuh and Office, and a bit further behind fashion stores like Next, JD Sports and M&S. They all trailed Clarks, which had 9% of the shoe market.

Shoe Zone was founded in 1980 by two brothers who acquired and combined a number of long-established shoe businesses, including assets of Stead & Simpson (the only one I recognise), enabling the group to claim a heritage going back to 1917. Today, Shoe Zone is majority owned and run by the sons of the brothers, chairman Anthony Smith, and chief operating officer Charles Smith.

Uncanny stability

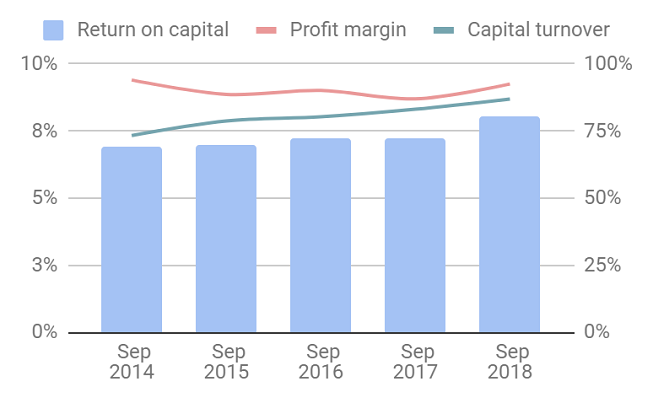

Revenue and profit have been flat since the flotation, and return on capital uncannily stable considering, to adopt a cliché, widely reported "carnage" on the High Street.

Source: interactive investor Past performance is not a guide to future performance

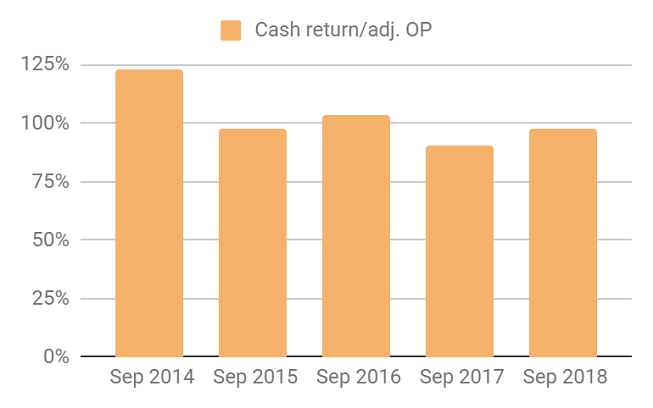

Eight percent return on capital is, perhaps, the mark of a viable business rather than a great one, nevertheless if the return comes with little risk and a low price tag, Shoe Zone could still be a good investment. At first blush it comes at little risk. Shoe Zone's cash return is almost as stable as the profitability measured by its accountants. It has no year-end borrowings.

Source: interactive investor Past performance is not a guide to future performance

Keeping a lid on costs

Shoe Zone is not going to grow by rolling out more stores though. In 2016, the company estimated 500 stores to be "about the right number", and it was a number it had already achieved.

Since the flotation, it has closed more stores than it has opened, typically closing smaller ones and opening bigger shops including "big box" stores in retail parks that stock a wider range of shoes and brands like Clarks, Crocs, and Wrangler, appealing to more affluent customers. In the last three years, the company has opened 19 Big Box stores and the growth rate is accelerating.

In 2019, it plans to open 20 more. Along with online sales, which are growing from a low level, Big Boxes may be a route to growth, but mostly, Shoe Zone is about keeping a lid on costs: the cost of shoes, the cost of staff, and the cost of rent.

The transition to bigger stores (and improving the company's systems) has allowed Shoe Zone to shed about a thousand staff since it floated, reducing the total number to about 3,500 (half work full time).

Fewer staff has enabled the company to keep staff costs fairly flat at between 22% and 24% of total revenue, even though wages have probably risen substantially due to the national minimum wage.

The rental bill is falling, maybe because Shoe Zone has fewer shops, but also because it is renewing leases on substantially better terms as retailing moves online and competition for retail space diminishes. Since Shoe Zone's average lease length is only 2.1 years, it has frequent opportunities to renew. The company sources 85% of the shoes directly from factories in the Far East, another factor keeping costs down.

Going the extra mile

Had I been after a pair of cheap shoes I reckon I would have left the store satisfied and the prospectus contains a statement that suggests my experience may be typical:

"Shoe Zone has a culture created over the last 20 years that celebrates length of service, internal promotion, “going the extra mile” for customers and raising money for charity."

The founders of successful businesses are often fanatical about pleasing customers, and since Shoe Zone is still run by its founding family, it would not surprise me if some of that spirit lived on. Despite the odd negative review from staff on recruitment websites and customers on review sites, the majority of staff and customers seem to appreciate what Shoe Zone is, a good place to buy cheap shoes.

Scoring Shoe Zone

As usual I have scored Shoe Zone to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Hmm. It is borderline. I do not think it is worth being in business for less than an 8% return on capital but Shoe Zone is also earning an 8% return in cash terms.

Score: 1

Adaptable: How will it make more money?

Shoe Zone has saturated the UK with stores, but it is adapting by increasing their size, widening the range, and selling online.

Score: 2

Resilient: What could go wrong?

I wonder whether Shoe Zone is moving away from what makes it special by selling premium brands, and, long-term, whether it can continue relying on falling rents to mitigate cost pressures in the rest of the business. Also the shoes are so cheap, I wonder whether online sales are economic. Currently Shoe Zone bears the cost of postage and returns.

Score: 1

Equitable: Will we all benefit?

I think the founders' mentality probably lives on in Shoe Zone's commitment to low prices and customer service, although it is slightly disconcerting that Charles Smith, the company's chief operating officer is a part-timer. He works three days a week.

Score: 2

Cheap: Is the firm's valuation modest?

The company trades on a debt and lease-adjusted multiple of about 17 times adjusted profit in 2018.

Score: 0

A total score of 6 is below my arbitrary threshold of 7, required to recommend a share.

An income oriented investor might think differently though. Shoe Zone is paying a total dividend for 2018 of 11.5p per share (yielding shareholders nearly 5%) and so long as it can start the year with £11 million in cash, the company pays any surplus out as a special dividend. The special dividend for 2018 is 8p per share, or another 3%.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.