Share Sleuth: I was going to sell, but changed my mind

Company bosses have reassured Share Sleuth that disappointing trading figures can be overcome.

1st August 2019 12:27

by Richard Beddard from interactive investor

Company bosses have reassured Share Sleuth that disappointing trading figures can be overcome.

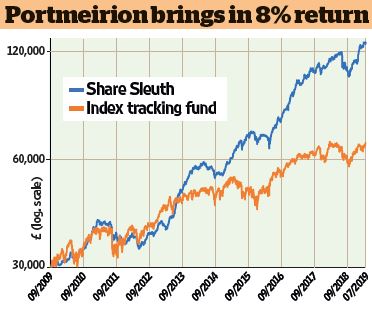

Last month's column ended with Portmeirion (LSE:PMP) on the brink of expulsion from the Share Sleuth portfolio. I feared the company, which owns popular tableware brands including Portmeirion Botanic Garden, Spode Christmas Tree and Royal Worcester, might be drifting strategically.

I have given the company a reprieve. The immediate cause for concern was the third decline in sales in South Korea in four years. South Korea is Portmeirion's biggest market outside the UK and the US, and it seemed plausible Portmeirion's very British brands have less enduring appeal in exotic markets than at home. The fact that Portmeirion's recovery plan in South Korea requires new product development stoked this fear, since it seemed to imply existing products had fallen out of favour.

In correspondence, the company's chairman and finance director have reassured me somewhat. One of the reasons why South Korean sales have fallen dramatically over the last four years is 'grey' imports from other export markets, which have grown strongly over the same period. By developing products specifically for Portmeirion's South Korean distributor, the company hopes to stem the grey tide and bring about a recovery in sales.

Since the split between South Korean sales and those to the rest of the world is somewhat fungible as importers are, despite Portmeirion's best efforts, selling its wares across borders, I have decided to consider South Korean and Rest of the World sales together. The resulting chart shows an upward growth curve, which is more comforting.

Adding additives maker Anpario

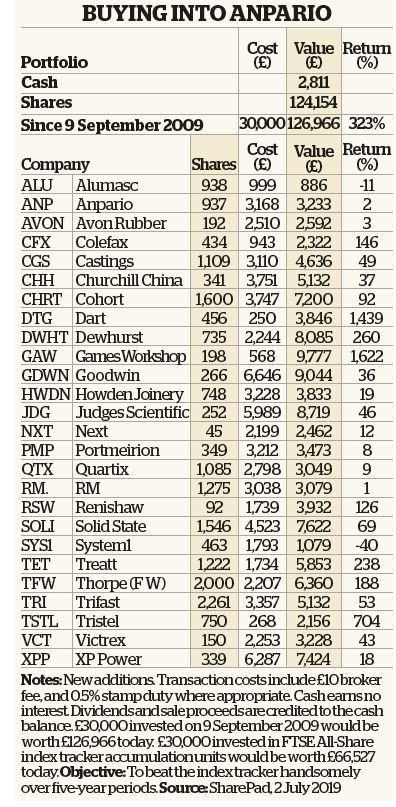

Instead of removing a share from the portfolio, I have added shares in animal feed additive manufacturer Anpario (LSE:ANP).

This is probably the longest courtship in the history of Share Sleuth. I first visited Anpario five years ago. Its head office, the lab, factory and warehouse are all on one site in Worksop. I liked the business, which supplies natural feed supplements that boost animal health and therefore productivity. The supplements are unique and relatively pricey, but necessary because governments are clamping down on the use of cheaper antibiotics as growth promoters.

Anpario's share price has tracked sideways, but the business has grown steadily though not spectacularly. Profit has grown faster than revenue at a compound annual growth rate of 7% over the past seven years as the company has rid itself of less profitable business (contract manufacturing for other feed companies and an organic animal feed business, for example). Revenues might pick up as Anpario focuses more and more on its speciality products.

What's in Boris Johnson's in-tray for pensions and personal finance?

The company has the statistical hallmarks of a good business; return on capital averaged over the past seven years is 30%, and profit margins average 11%. It has no debt, and considerable cash reserves. On 26 June I added 937 shares at a price of 337p each. The total amount invested including £10 for the broker was just under £3,168, putting about 2.5% of the portfolio's total value at risk and bringing the number of shares held to 26.

I did raise an eyebrow at the wide spread. This is the difference between the price quoted to buy the shares (354p) through the broker and the price quoted to sell (320p). Paying 354p would immediately deliver a notional 34p loss. Brokers usually execute trades inside the spread, though, and maybe I was lucky because the actual deal price when I asked my broker was exactly half-way between the quoted price to buy and the quoted price to sell. When it is time to remove the shares from the portfolio in many years' time, hopefully my broker can beat the spread, and the gains from the investment will dwarf the cost of buying it.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.