Share Sleuth: A third trade of 2019

Hoping he's got in before others spot the quality, another great company is added to the portfolio.

4th April 2019 14:25

by Richard Beddard from interactive investor

Hoping he's got in before others spot the quality, another great company is added to the portfolio.

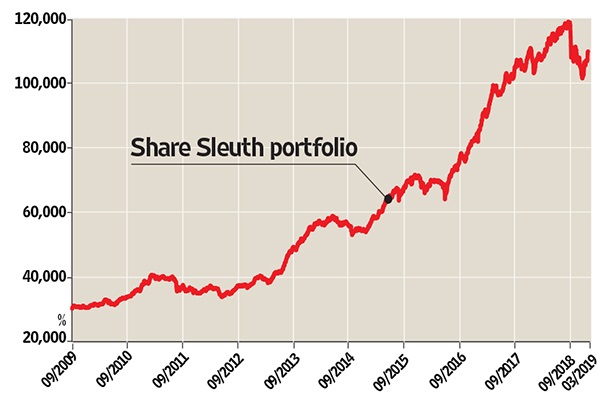

In what must be the most active start to a year in Share Sleuth's near 10-year history, I have traded for a third time in 2019, swapping a fraction of the portfolio's holding in Solid State (LSE:SOLI) for a small shareholding in Quartix (LSE:QTX).

Solid State, a manufacturer of electronic equipment and component distributor, has recently acquired Pacer Technologies, but I have yet to make my mind up about the transaction.

Acquisitions are a central part of the company's strategy, and for years it has promised a big one, valued at over £5 million, so I suppose we should not be surprised now it has happened.

There is usually more competition to buy bigger businesses, and as might be expected Solid State has paid a higher multiple of Pacer's annual profit than it did for its smaller acquisitions. It says Pacer will give the group footholds in the US and in the market for medical equipment, as well as a brand new factory.

The trade, however, was triggered because Share Sleuth's holding had grown to over £10,000, about 9% of its total value. To keep the portfolio well balanced, I reduced its stake in Solid State by 854 shares at a share price of 411p, the actual price quoted by a stockbroker, raising just shy of £3,500 after deducting £10 in lieu of broker fees. Now it accounts for 6% of the portfolio's value.

I added 1,085 shares in Quartix, which provides a vehicle tracking service. The share price was 257p. Including £10 in lieu of broker fees, the total transaction cost almost £2,800, 2.5% of the portfolio's total value. A trade size of 2.5% is my minimum.

There is a reason I went with the minimum even though I had more cash to burn. While I feel confident in Quartix's long-term prosperity, I feel more ambivalent about the short term.

Source: interactive investor Past performance is not a guide to future performance

Fleets vs insurers

Quartix has two kinds of customer. The first is fleet operators, typically small fleets of a dozen or so vans operated by local businesses. The trackers send information about the vehicles back to the fleet manager to ensure they are being driven safely and efficiently. It's a highly profitable business, growing almost like clockwork, mostly through direct sales of the low-cost service which earns Quartix a monthly fee.

The beauty of it is that there are millions of small businesses, so it has a large and growing customer base all using the same system. Quartix has a small but profitable operation in France and a loss-making start-up in the US. Both are growing faster than the UK operation, which was established in 2001. It has just launched in Spain and Poland as well.

The other customers are insurers. Typically, insurers buy the tracking service to monitor young drivers during their first year of motoring.

These customers are not 'sticky' like fleet operators, and competition for their business is more intense. The market is less profitable, and Quartix is withdrawing from it.

Revenue and profit from insurers is falling as revenue and profit from fleets is growing.

In the year to December 2018, Quartix installed 29% fewer units for insurers, while it installed 17% more units than it did the previous year in fleets.

Moreover, the fleet operation is bigger, earning three-quarters of total revenue in the year to December 2018. Even so, Quartix, which is valued on a growth multiple of about 17 times adjusted profit, might contract in 2019.

I have been following Quartix for about two years, trying to make sense of the dynamics of its two contrary lines of business.

Friends are wondering whether I have pulled the trigger too soon. We agree the fleet business is attractive but why not wait, they say, until the insurers are no longer shackling its growth.

By then, I fear, Quartix's quality will be apparent, and its valuation will have risen back to levels I cannot justify.

Trimming back Solid State

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 2,900 | ||||

| Shares | 109,557 | ||||

| Since 9 September 2009 | 30,000 | 112,458 | 275 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ALU | Alumasc | 938 | 999 | 1,065 | 7 |

| AVON | Avon Rubber | 192 | 2,510 | 2,362 | -6 |

| CFX | Colefax | 434 | 943 | 2,155 | 129 |

| CGS | Castings | 1,109 | 3,110 | 4,020 | 29 |

| CHH | Churchill China | 341 | 3,751 | 4,263 | 14 |

| CHRT | Cohort | 1,600 | 3,747 | 6,000 | 60 |

| DTG | Dart | 456 | 250 | 3,894 | 1,458 |

| DWHT | Dewhurst | 735 | 2,244 | 6,615 | 195 |

| GAW | Games Workshop | 198 | 568 | 6,148 | 983 |

| GDWN | Goodwin | 266 | 6,646 | 8,007 | 20 |

| HWDN | Howden Joinery | 748 | 3,228 | 3,684 | 14 |

| JDG | Judges Scientific | 252 | 5,989 | 7,182 | 20 |

| NXT | Next | 45 | 2,199 | 2,342 | 6 |

| PMP | Portmeirion | 349 | 3,212 | 3,909 | 22 |

| QTX | Quartix | 1,085 | 2,798 | 2,604 | -7 |

| RSW | Renishaw | 92 | 1,739 | 4,011 | 131 |

| SAG | Science | 2,660 | 2,908 | 5,453 | 88 |

| SOLI | Solid State | 1,546 | 4,523 | 6,524 | 44 |

| SYS1 | System1 | 463 | 1,793 | 949 | -47 |

| TET | Treatt | 1,222 | 1,734 | 5,102 | 194 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,240 | 183 |

| TRI | Trifast | 2,261 | 3,357 | 4,285 | 28 |

| TSTL | Tristel | 750 | 268 | 2,269 | 746 |

| VCT | Victrex | 150 | 2,253 | 3,561 | 58 |

| XPP | XP Power | 339 | 6,287 | 6,916 | 10 |

Notes: New additions. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £112,458 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £62,700 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 5 March 2019.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.