Should you really sell your shares in May this year?

We have run 20 years of data to show whether or not investors should exit the stock market now.

4th May 2020 15:59

by Graeme Evans from interactive investor

We have run 20 years of data to show whether or not investors should exit the stock market now.

No Wimbledon or live Test cricket to watch makes for a dull summer, particularly for investors who still follow that old adage about selling in May and going away until St Leger's Day.

Covid-19 may have removed the distractions of a glorious English summer, but that does not mean we can also ignore the important seasonal ebbs and flows of stock markets.

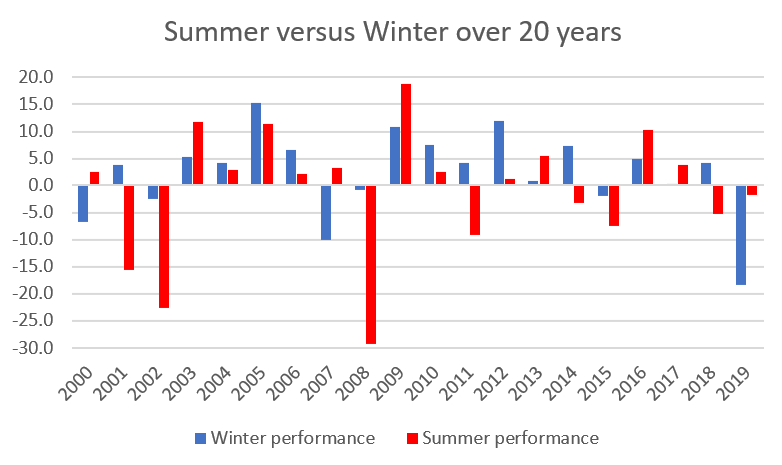

There are still some valuable lessons to learn, which we highlight today, with statistics showing that investors are statistically more likely to generate higher returns over the winter months (31 October-30 April) than the summer period (30 April-31 October).

The reasons why more money flows into the market over the winter months are open to interpretation. The longest-standing theory - as highlighted by the 'sell in May' adage - is that the City shuts down for the cricket or the rowing at Henley, and only returns in earnest until after the St Leger horse race in September.

Times have changed, of course, with trading algorithms and a more efficient financial system meaning this holiday seasonality is not as pronounced as it once was.

But recent evidence still shows that the FTSE 100 and FTSE 350 (see chart below) have fallen in four out of the last six summers, including after the top flight's near-record high in May 2018. One of the exceptions was in 2016, when the FTSE 100 rose despite the shock of the Brexit vote.

Source: SharePad, interactive investor analysis of FTSE 350 index

Looking back over the past 20 years, average returns across the FTSE 100, FTSE 350 and FTSE All-Share indices have been negative, despite positive returns in 12 of those summers.

Contrast this with the positive showing over the winter season, with the FTSE 100 index showing a 1.7% average return after 14 out of 20 positive summers.

The UK-focused FTSE 250 seems to love the wet and cold more than any other index, with 15 winters of growth out of 20 for an average return of 7%. That is beaten only by Shanghai's SSE Composite Index, which is up 11.5% on average despite only being positive in 10 of the 20 winters.

Summer vs Winter over past 20 years

| Name | Positive summers over 20 years | Positive years (%) | Average return (%) | Positive winters over 20 years | Positive years (%) | Average return (%) |

|---|---|---|---|---|---|---|

| FTSE 100 | 12 | 60 | -1.0 | 14 | 70 | 1.7 |

| FTSE 350 | 12 | 60 | -0.9 | 14 | 70 | 2.4 |

| FTSE 250 | 12 | 60 | -0.1 | 15 | 75 | 7.0 |

| FTSE All-Share | 12 | 60 | -0.9 | 14 | 70 | 2.4 |

| FTSE AIM All-Share | 7 | 35 | -3.9 | 13 | 65 | 3.6 |

| Dow Jones | 13 | 65 | 0.6 | 16 | 80 | 4.4 |

| S&P 500 | 13 | 65 | 0.5 | 15 | 75 | 4.0 |

| NASDAQ Composite | 14 | 70 | 2.4 | 13 | 65 | 3.8 |

| SSE Composite Index(Shanghai) | 8 | 40 | -2.3 | 10 | 50 | 11.5 |

| Hang Seng (Hong Kong) | 12 | 60 | 2.3 | 13 | 65 | 3.6 |

| DAX Xetra (Germany) | 11 | 55 | -1.0 | 13 | 65 | 5.1 |

| CAC 40 (Paris) | 11 | 55 | -2.4 | 13 | 65 | 2.4 |

| Nikkei 225 | 8 | 40 | -2.3 | 14 | 70 | 5.7 |

Source: SharePad, interactive investor

All the major global indices follow this pattern of winter outperformance, with Wall Street's Dow Jones Industrial Average and S&P 500 both 4% higher in the winter compared with less than 1% during the summer.

Admittedly, this research does not include dividend payments, the bulk of which are paid over the summer months, although there will, of course, be less of an impact this year given many companies have decided to suspend, or cancel entirely, this year’s payouts.

If we tweak the reporting period slightly by starting from 2003, after the dotcom crash, summer returns for the major indices in the UK (excluding AIM, which still fell an average of 0.7%) and the US turn positive - although only to 0.9% for the FTSE 100 and 2% for the FTSE 250.

It is 2.4% for the Dow Jones, and 6% for the tech-laden Nasdaq Composite. Do the same to the winter statistics and the FTSE 100 is up 2.4% and the FTSE 250 7.7%. The Dow is up 4.7% on average and the Nasdaq 6.1%.

Summer vs Winter over 17 years since dotcom crash

| Name | Positive summers over 17 years | Positive years (%) | Average return (%) | Positive winters over 17 years | Positive years (%) | Average return (%) |

|---|---|---|---|---|---|---|

| FTSE 100 | 11 | 65 | 0.9 | 13 | 76 | 2.4 |

| FTSE 350 | 11 | 65 | 1.0 | 13 | 76 | 3.1 |

| FTSE 250 | 11 | 65 | 2.0 | 14 | 82 | 7.7 |

| FTSE All-Share | 11 | 65 | 1.0 | 13 | 76 | 3.1 |

| FTSE AIM All-Share | 7 | 41 | -0.7 | 13 | 76 | 6.0 |

| Dow Jones | 12 | 71 | 2.4 | 14 | 82 | 4.7 |

| S&P 500 | 13 | 76 | 2.6 | 13 | 76 | 5.1 |

| NASDAQ Composite | 14 | 82 | 6.0 | 12 | 71 | 6.1 |

| SSE Composite Index (Shanghai) | 7 | 41 | -1.3 | 8 | 47 | 13.0 |

| Hang Seng (Hong Kong) | 12 | 71 | 5.5 | 11 | 55 | 4.0 |

| DAX Xetra (Germany) | 11 | 65 | 2.9 | 12 | 60 | 6.4 |

| CAC 40 (Paris) | 11 | 65 | 0.2 | 12 | 60 | 3.8 |

| Nikkei 225 | 8 | 47 | 1.3 | 13 | 65 | 6.8 |

Source: SharePad, interactive investor

One reason for the seasonal divergence might be that some of the big trading decisions are left until everyone is back in the office after the summer break. Investment strategies deployed at that point tend to boost liquidity as well as sentiment.

Then there is the Santa rally, when equity markets have historically done well in the weeks leading up to Christmas. You could attribute this to seasonal optimism, or possibly end of calendar-year window dressing of portfolios by funds and investment houses. Selling losers and buying successful stocks flatters the numbers that determine City bonuses.

Then, in the spring, at the end of the financial winter, investors take advantage of tax-efficient products in the run up to tax year end. In what is often referred to as ISA season, many investors rush to use their tax-free allowance in the final days, weeks and months of the tax year. So-called 'early birds' then use their ISA allowance as soon as the new tax year begins.

These trends are why interactive investor has spent the last six years compiling two Winter Portfolios to help investors exploit the seasonal anomaly. After five years of consistently beating the wider stock market, the Consistent and Aggressive portfolios have just ended their most volatile six-month period. We will publish the full results very soon, but it is clear that both portfolios gave a good account of themselves, and that consistency was the strategy to follow this time.

While a significant amount of damage was down in the first three months of 2020, they have benefited from the stunning market-wide rebound in April, with the FTSE 100 index up 1,200 points or 25% since falling to as low as 4,900 on the day Britain went into lockdown.

The recovery, which has been underpinned by the support of central banks including the US Federal Reserve, has made deciding whether to Sell in May particularly challenging this year.

Are we really over the worst, or is there another leg of this crisis to come as countries reveal the economic pain of the global shutdown? Whatever your view, investors need to be wary of crystallising losses from the start of the year.

As always, it is best not to become too fixated by events, particularly in these more volatile times. Remembering the stock market mantra about keeping a longer-term focus will serve investors well, although that does not mean they should ignore opportunities as they arise - such as those highlighted by our Winter Portfolios.

Lee Wild, interactive investor’s head of equity strategy, said: “Many will argue that investing is all about time in the market, not timing the market.

“For many investors, it is – with pension money and the like, many individuals do not have the time or inclination to ‘play the market’, so staying invested in good quality funds or other assets, while regularly checking performance makes sense.

“While it is clearly impractical and expensive to divest entire portfolios for six months every year, investors should not dismiss all strategies that rely on timing the market.”

"The data clearly demonstrates that equity markets have, historically, generated greater returns over the winter when there are clear drivers of outperformance, than during the long summer months. It remains to be seen whether this is the case in 2020."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.