A slow burner AIM share worth buying

This small-cap should be growing faster than it is, but our companies analyst thinks it will come good.

15th March 2019 15:43

by Richard Beddard from interactive investor

Given the need for alternatives to antibiotics, this small-cap should be growing rapidly but it is only growing slowly. Richard Beddard investigates...

Anpario (LSE:ANP) makes natural animal feed additives that increase the health and ultimately the output of animals bred for food. They help cattle, pigs and chickens put on weight, and increase milk and egg yields.

It combines additives, pathogen killing acidifiers and nutrients like Omega 3, with carrier matrixes that distribute them in the gut. The acidifiers kill bugs and keep the gut healthy, and the nutrients are absorbed by it. Other products bind with toxins like mold in animal feed and prevent them from being digested once they are eaten.

Growing slowly but profitably

Ten years ago or so, Anpario was growing rapidly having acquired Agil in 2007, Optivite in 2009, and Meriden in 2012.

Previously a loss-making business focused on fish, the acquisitions gave Anpario a broad product range and its factory in Worksop. Since 2012, growth has been more sedate as the company has focused on developing the businesses it acquired and, very recently rebranding the products with the Anpario name:

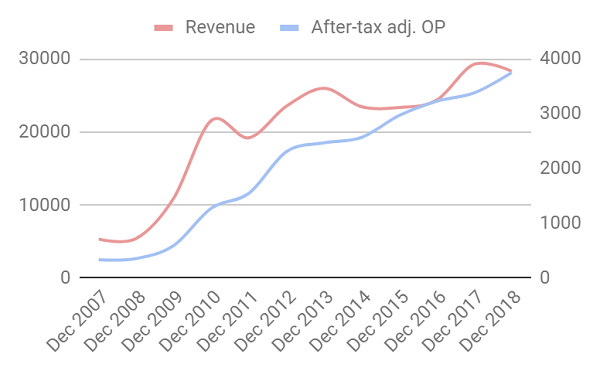

The result has been a compound annual growth rate (CAGR) in revenue over the last seven years of 3% to just under £30 million. Profit has grown faster, at a 7% CAGR. In the year to December 2018 revenue fell slightly, though, due in part to an outbreak of African Swine Flu in China that pushed some farmers into financial distress. Adjusted after-tax profit increased by 11%.

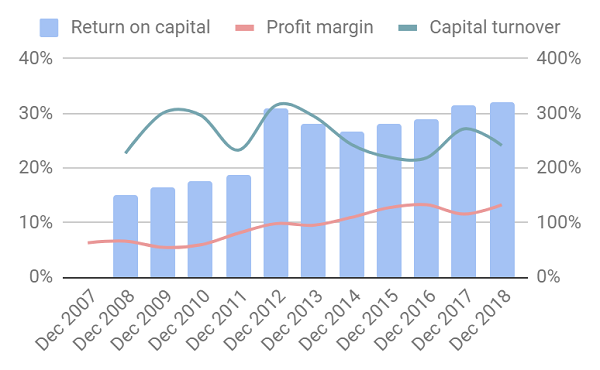

The company's ability to grow profit more quickly than revenue has resulted in an average return on operating capital of 30% during its post-acquisition phase, and healthy profit margins of more than 10%. High and growing returns are a sign of a good business:

Anpario should be growing profitably. Increasing global prosperity means more people can afford meat and a major competitor is apparently being taken out of the market. The use of antibiotics as growth promoters has been banned in the EU for over a decade because it encourages the development of antibiotic-resistant microbes in the human food chain.

Elsewhere, regulation is less strict but exporters sending animal products to the EU must comply with its regulations, and consumer and government pressure discourages antibiotic use. Anpario believes the industry is rapidly adopting antibiotic-free meat production, which is encouraging farmers to seek alternatives like Orego-Stim, an oregano supplement it describes as the market leading phytogenic (natural growth promoter). As the first oregano oil supplement, it is the most recognised and, Anpario says, efficacious brand.

Anpario's strategy is science-led and increasingly self-reliant. It uses the results of trials conducted in collaboration with farmers and universities to sell products directly to end users, typically large integrators that operate feed mills supplying their own farms, and by working closely with distributors to recruit new customers.

Its preference though is to handle distribution itself, particularly where it has large customers. In 2017 it acquired Cobbett, its Australian distributor. In 2018, it established a new subsidiary in Mexico to supply integrators who often operate across the USA, Mexico and Brazil. Anpario already has subsidiaries in the other two countries. It also opened a subsidiary in Turkey, and in total it has ten overseas subsidiaries including China and Malaysia.

The company is also on the cusp of launching Anpario Direct, an internet sales channel targetting a new market initially in the UK: small and medium-sized farms. It is supported by a new automated bottling plant and small packaging system.

What's holding Anpario back?

The story is so compelling, it is surprising Anpario is not growing more quickly.

One obstacle to growth is price. Since natural additives are much more expensive than antibiotic growth promoters farmers may settle for less healthy animals and lower output, especially when meat and dairy prices are low.

Weaning the industry off antibiotics has been more successful in some places than others. While there has been a decline in antibiotic use in the UK, France, and Germany since the EU ban, in other countries like Spain and Italy it has been far less effective. Farmers have switched from banned growth promoters to low doses of therapeutic antibiotics, but tighter regulations come into force in 2022.

Competition may also be a factor. In Orego-Stim Anpario has a market leading product, but in toxin binders, for example, its new brand Anpro is playing catchup to rivals like Alltech and Biomin.

A fourth drag on revenue growth must surely come to an end one day. Anpario has been cutting out dead wood, which is why profit has grown more quickly. Last year it ended low margin product sales in the Phillippines, which contributed to a decline in sales in Asia. It sold off Vitrition, a UK brand of organic animal feed, which also earned lower profit margins in 2016, and in 2015 it ceased manufacturing for another supplier.

Anpario's strategy requires the recruitment of sales personnel and then customers in new territories, which takes time, Perhaps efficiencies and faster growth will follow once overseas offices become establish.

The company says it is doing better two months into the current financial year than it was at the same point in 2018. It expects a return to revenue growth in 2019, but its performance could be affected by the spread of African Swine Fever in China, and Brexit.

Anpario imports raw materials from the EU and earns 37% of revenue in Europe (including the UK and non EU countries). Wary of disruption when we leave the EU, it is stockpiling raw materials here and has extended its terms for European distributors. It has also established a base in Germany, should it need to warehouse or manufacture additives in the EU.

With more raw materials and stock being warehoused, more finished goods in transit to its growing overseas subsidiaries, big bonuses earned in 2017 but paid in 2018, and increased investment due to the new bottling plant, cash flow was uncharacteristically weak in 2018. Most of these trends will probably reverse in 2019. The directors received no bonuses in 2018 and employees received lower bonuses so the cash cost will be lower in 2019, the bottling plant will be up and running, and maybe even Brexit will be resolved.

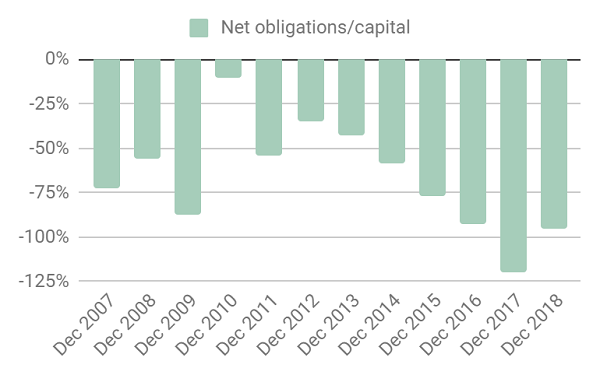

Anyway, Anpario is hardly short of cash. It has almost enough, net of financial obligations, to create another Anpario - at least in terms of tangible assets:

Scoring Anpario

As usual, I have scored Anpario to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Yes, Anpario is highly profitable (average return on capital is 30%) and reasonably cash generative (average cash conversion is 70%).

Score: 2

Adaptable: How will it make more money?

Anpario's sales reps are taking the science directly to intensive farmers around the world, and it is experimenting with direct internet sales to small and medium-sized farms.

I wonder if it is investing enough in research and development to maintain its technical edge. The published figures suggest Anpario spends less than 4% of revenue on its technical team and trials.

Score: 2

Resilient: What could go wrong?

There are plenty of short-term factors that will influence profitability: Brexit, fluctuating meat prices, and disease.

Long-term the big question is whether Anpario's products are worth the money. Some farmers clearly think they are.

Score: 1

Equitable: Will we all benefit?

Richard Edwards was first appointed as chief executive in 2006, the company communicates well with shareholders, executive pay is reasonable, staff are also remunerated with bonuses and more than 50% participate in share schemes.

Score: 2

Cheap: Is the firm's valuation modest?

The current share price of 340p values Anpario at about 18 times adjusted profit, which is reasonable.

Score: 0.4

Despite pedestrian growth, a total score of 7.2 means I think Anpario is probably a good long term investment. If we are patient enough, growth may pick up as Anpario as its overseas subsidiaries mature.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.