The ‘standout’ UK fund we’ve bought

Saltydog Investor looks at UK fund options as the FTSE 100 makes a new high and the FTSE 250 hits levels not seen since early 2022.

22nd July 2025 09:34

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

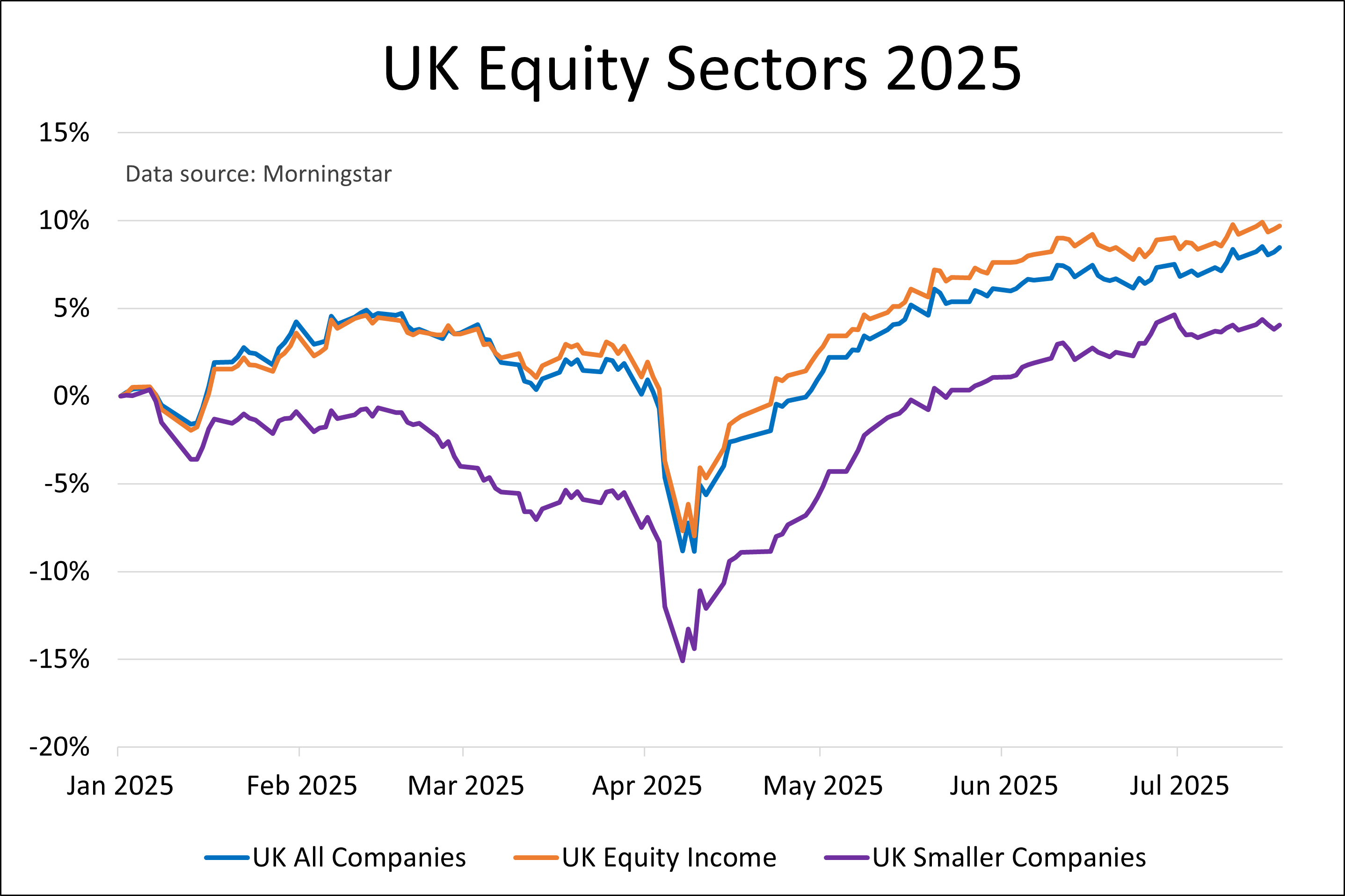

There are three main Investment Association (IA) sectors for funds investing in UK equities. They are UK All Companies, UK Equity Income, and UK Smaller Companies. They all stipulate that at least 80% of assets are invested in the equities of UK companies.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Funds in the UK All Companies sector have the flexibility to invest in any UK company, but should have a primary objective of achieving capital growth. UK Equity Income funds are also free to choose from across the UK market, but their focus should be on generating income. According to the sector definition, they aim to deliver “a historic yield on the distributable income in excess of 100% of the FTSE All-Share yield at the fund’s year end on a three-year rolling basis, and 90% on an annual basis”. Although the funds in both sectors have the freedom to select companies of any size, they tend to favour large blue-chip multinationals.

The UK Smaller Companies sector, as the name suggests, is defined more narrowly. Funds must invest in “UK equities of companies which form the smallest 15% by market capitalisation”.

All these sectors have rallied strongly in the past few months, after a sharp fall in April, and are now showing year-to-date gains.

Past performance is not a guide to future performance.

The UK All Companies and UK Equity Income sectors, which are more exposed to the global markets, had a reasonable start to the year. By mid-February, they had both risen by almost 5%. The UK Smaller Companies sector, which is more closely related to our domestic economy, was down by around 1%.

Then came a broad sell-off triggered by renewed concerns over Donald Trump’s unpredictable approach to trade policy. The market’s reaction peaked in early April, following his so-called Liberation Day tariff announcements.

Since then, all three sectors have recovered.

- FTSE 100 breaks 9,000: which funds have led the rally?

- Ian Cowie: a decade of disappointment, but I’ll hang on

In our weekly analysis, we track the performance of thousands of UK-domiciled funds. We organise them into our Saltydog Groups, based on the past volatility of their sectors. The UK All Companies, UK Equity Income, and UK Smaller Companies sectors are in our “Steady as She Goes” group, along with the Flexible Investment, Property, UK Gilts & Index-Linked Gilts, and non-UK bond sectors.

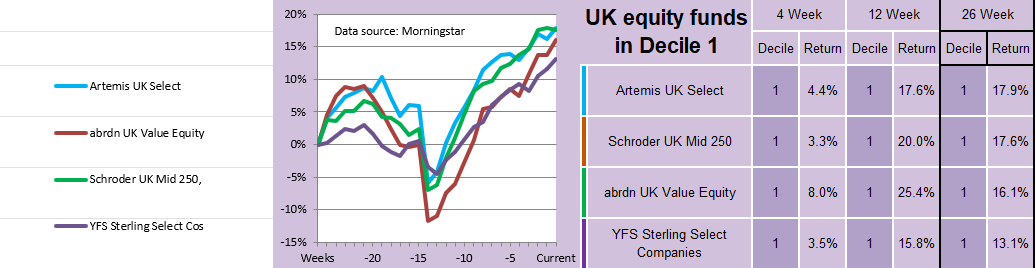

We compare all the funds in each group and rank them based on their performance over varying time frames. Last week, only four funds in our “Steady as She Goes” group were ranked in decile one over four, 12, and 26 weeks. Three were from the UK All Companies sector and one was from the UK Smaller Companies sector.

Past performance is not a guide to future performance.

We have added the Artemis UK Select fund to one of our demonstration portfolios.

There are several reasons why the UK stock market might be coming back into favour.

It will have benefited from global investors diversifying away from the US amid uncertainty over Trump’s trade war. The UK has the advantage that it reached a trade agreement with the US in early May, unlike the European Union and many other major nations.

- Funds and trusts four pros are buying and selling: Q3 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Low valuations of London-listed stocks will also have helped. The FTSE 100 trades at a price-to-earnings ratio of about 18 times, compared with 25 for the S&P 500, or 34 for the Nasdaq.

The value of the pound has also risen. Sterling is up over 7% against the dollar since the beginning of 2025. This would make the UK appear more valuable to foreign investors, especially in the US, if the currency continues to appreciate.

Against this backdrop, and with several UK equity funds delivering strong, sustained performance, we believe it is a good time to increase our exposure to the UK market. Artemis UK Select stood out in our recent analysis and now forms part of our Tugboat portfolio.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.