Is this stock coming to the boil?

This kettle component maker is highly profitable but trades on a debt-adjusted PE of just 13.

17th May 2019 14:55

by Richard Beddard from interactive investor

This kettle component maker is highly profitable but trades on a debt-adjusted PE of just 13.

Strix (LSE:KETL) only floated in 2017, but it traces its history back to 1951 when Eric Taylor founded a company called Castletown Thermostats. Taylor had invented thermostats used to control heated flying suits worn by bomber crews in the second world war.

Strix's flying suit days are over. The business has evolved into the dominant supplier of a small but critical component found in an everyday item: the electric kettle - hence the stock market ticker code: KETL.

The company's main products are thermostatic controls that disconnect the power once a kettle has boiled. In "regulated markets" like Western Europe, the USA, and Japan, where safety requirements are stringent and it is easy to prevent rivals from cloning Strix's products, Strix supplies 61% of the market.

In China, which Strix describes as "improving" in terms of regulation, it supplies 46% of the market. In unregulated markets it supplies 20%. With 38% of the global market, Strix is a formidable competitor. In the year to December 2018 it sold 218,000 products a day on average.

Flotation that proves the rule

Flotations are known to make poor investments, but that is because they are often immature businesses around which it is easy to spin an exciting but hopeful growth story. Strix may be the opposite: A seasoned business that has already done so much growing it may have limited options to grow further.

Strix does not not think so. The global market for kettle controls grew 4% in 2018 led by the USA where electric kettles are not so popular. Only 13% of households in North America own kettles but the continent is developing a taste for tea and Strix says the market is growing between 14% and 15%. In the tea-loving United Kingdom, there are more kettles than households so this trend may have some way to go, as might 10% growth rates in less regulated markets.

Due to its size, though, Strix is unlikely to grow faster than the market as a whole unless it finds a way to broaden it. That was the story in 2018, when, at constant currency, Strix's grew revenue 4.5%, pretty much the market rate.

Two-pronged attack

The company has two solutions to the growth challenge. It has developed low-cost versions of its products to grow market share in unregulated markets and fight off competition in China where it lost business to a rival last year. It is also using its technology in similar products, reducing its dependence on kettles from just under 90% of revenue to about 75% in three to five years time.

The most significant newer product is Aqua Optima, a water filter brand spun-off from a project to develop a filter kettle in 2005. It has grown to be number two in the UK with a 25% share in terms of volume. Aqua Optima plans to launch in China in 2019. A small acquisition in terms of outlay (about £1m), brings Strix capabilities to filter lead from water, a requirement in some parts of the USA, and microbes, which is important in China.

The Chinese use kettle-like appliances for steaming and boiling food, like noodles, too, so Strix has developed controls for these products.

Sheriff Strix

Strix may have got the idea to enter the multi-cooker market after finding clones of its controls in products supplied by a rival. A legal challenge stopped the rival from manufacturing copies, and it won the business for itself.

This is an essential part of Strix's response to another challenge: Enforcing patents, and protecting designs even after patents expire, through the courts and by testing rival components and referring unsafe kettles and patent and copyright infringers to the authorities.

So central is intellectual property to its strategy it reports the outcomes of these battles through the stock market. This may be advantageous in another respect. The more visible Strix's defence of its intellectual property, the less likely rivals are to copy it.

The same might be said of Strix's business model. Companies rarely give away so much information about their position in the market, and how they plan to maintain it, unless they are dominant. Then the game changes from stealth to deterrence. Nobody wants to go up against an impregnable competitor.

Debt conundrum

By my calculation, Strix's financial obligations, net debt plus capitalised lease payments, exceed the value of the capital in the business, analogous to a homeowner's mortgage exceeding the value of the property. In the case of Strix, though, this statistic may not be telling us much.

The debt element was created by the company's former owners who extracted money from the business, rather than past failure. And the capital element does not account for Strix's considerable intangible assets, the patents, expertise, and close working relationships with major kettle manufacturers and brands. These are impossible to value accurately, but if we were to include them somehow in Strix's balance sheet, the company would look a lot less indebted.

It is these intangible assets that enable Strix to be so prodigiously profitable (return on tangible assets is close to 100%) and Strix earns over 90% of that return in cash each year. Though the company's public track record is short, the prospectus published when it floated claimed adjusted EBITDA, a profit measure, had not fallen below £30m since 2007. In 2018, it earned just over £36m, so it has been a reliable earner. Unusually, while the risk section of Strix’s annual report does include external factors that could reduce profitability (silver and gold prices, competitors, forex, changes to tax regimes and Brexit (low risk)), the general state of the economy is not one of them.

Strix's earnings are probably dependable, which means it can afford the debt. It could pay its 2018 interest bill out of operating profit 16 times over.

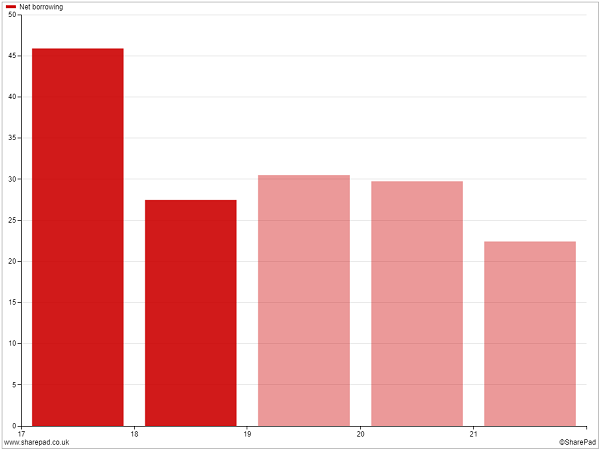

The affordability judgment is important because Strix's debt is unlikely to come down much in the near future despite prodigious cash flows and a big reduction in net debt in 2018. The company is about to move its main factory in China to a new purpose built facility nearby at a cost of £20m. In the annual report, finance director, Raudres Wong says the speed of debt reduction "may reduce" because of the funding requirement. It will. According to SharePad, which provides forecast data, analysts reckon net debt will be marginally higher in 2019 and 2020 than it is today:

As usual, I have scored Strix to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Does Strix make good money?

Strix's financial history is shrouded in its private equity past, but it is almost certainly highly profitable and a reliable earner. It is the dominant supplier of a vital component of an inexpensive everyday product. People probably still buy kettles even if they are feeling hard up.

Score: 2

What could prevent it from growing?

Strix has not grown much over the past decade-or-so, and it faces formidable challenges, principally how to grow when it is already so big, and low-cost copycats churning out cheap facsimiles.

It also pays phenomenally little tax (4% in 2019) because it operates in the Isle of Man, where there is no corporation tax, and China where it pays little tax. It worries the regime in China might change but my calculations indicate Strix would still be a good investment at the standard UK corporation tax rate.

Score: 1

How will it overcome these challenges?

Strix's "mission" is:

"To shape a safer future in the design and supply of innovative hot water and filtration systems which provide enhanced convenience and functionality to the global consumer."

The policy is guiding the company to build on its size and technical strengths in safety, thermostats and water filtration for consumer appliances - an attractive market because they are becoming ubiquitous in so many places.

Coherent actions flow from it, for example:

1. Acting as an industry sheriff and shopping rivals and their customers to the authorities, Strix defends its intellectual property and sometimes wins their business.

2. By providing design expertise, market intelligence, and faster testing and accreditation through its laboratories Strix holds onto customers and grows the market by co-developing new products (though this can take time).

3. By automating its production lines and manufacturing at scale Strix can reduce costs, improve quality, and outcompete low-cost competitors on their own turf, preventing them from becoming global competitors.

Score: 2

Will we all benefit?

Generally, Strix's annual report explains the business well, but I would like a more emphatic commitment to debt repayment and am surprised it did not tell shareholders earlier that it was likely to have to find a new premises at considerable cost.

When Strix floated it gave large amounts of shares to the directors and all salaried staff resulting in eye-watering share-based payment charges of nearly £5m in 2018.

Because management had no prior shareholdings, the company thought it necessary to make them shareholders and it now committed to "normalising" pay. From 2018 it will limit free shares to 100% of base salary. While I don't agree that should be normal, it is, and making the broader staff shareholders is a good thing.

The company reports employee engagement but according to its own index, its score is only average.

Score: 1

Are the shares cheap?

Probably. The share price is just over 150p, which puts Strix on a debt-adjusted earnings multiple about 13.

Score: 1.7

This is the first time I have scored Strix and I have my doubts about companies that dominate industries, they can become complacent and gouge customers, but Strix is showing ambition and appears to be paying attention to its customers.

A score of 7.7 means Strix may well make a good long term investment.