The stock that makes my top three

It’s ranked third out of stocks our companies analyst follows. Find out why the verdict troubles him.

6th March 2020 16:12

by Richard Beddard from interactive investor

It’s ranked third out of stocks our companies analyst follows. Find out why the verdict troubles him.

RM (LSE:RM.) is a bit of a conundrum so, as an incentive to keep reading, let me dangle a couple of statistics in front of you. The company, which aims to help teachers to teach and learners to learn, earned a return on operating capital of nearly 50% in the year to November. A share price of 264p values the enterprise at only 12 times adjusted profit. That’s a rare combination, especially as RM may be on the cusp of growing revenue convincingly for the first time in a decade. Profit has been on the up since 2017.

Paradise postponed

I looked forward to revenue growth last year, though, and in the intervening period RM has mustered a measly 1% more revenue, and 1% more profit. A small acquisition contributed an immaterial amount to both revenue and profit, but a change in accounting standards means the results were worse than they would otherwise have been. If RM had measured its performance in 2019 the same way it had measured its performance in 2018, revenue would have increased 2% and adjusted profit 6%.

Covid-19 permitting, it looks as though shareholders will have to wait another year to celebrate unambiquous growth on all fronts, after 10 hard years of restructuring as the company ran down contracts to supply schools with IT, largely won in the noughties when schools spending was booming (you can read more about the history of RM in last year’s profile). Bear with me though, the glimmer of growth is still visible at the end of the tunnel.

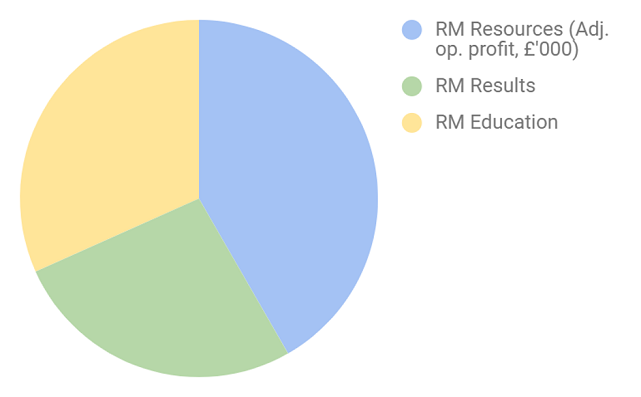

This is where the profit came from in 2019:

Selling stuff to schools

RM Resources is RM’s biggest revenue and profit earner. It supplies schools with curriculum equipment through two brands TTS and Consortium. At the moment TTS is big on robots:

Source: tts-group.co.uk

And Consortium is promoting old school supplies:

Source: consortiumeducation.com

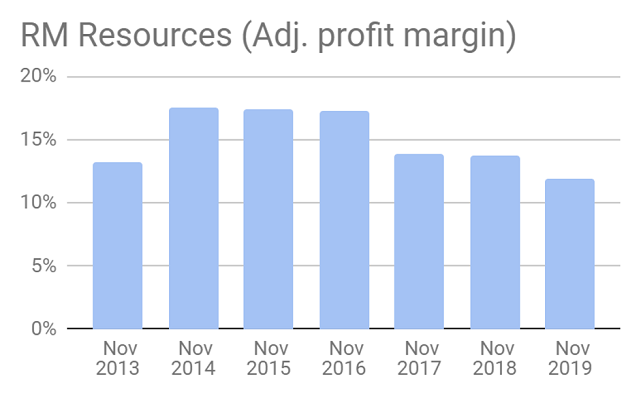

I hoped RM’s acquisition of Consortium in 2017 would, as the company wrangled its warehouses into one automated facility, earn higher profit margins. The combination reportedly made RM the market leading educational supplier to primary schools, and bolstered its position in secondary schools, so perhaps its stronger position would translate into more revenue too. So far, though, that has been wishful thinking. The combination earns less revenue than it did as separate entities and profit margins have fallen:

RM says half of the £6 million decline in revenue at RM Resources in 2019 was deliberate.

The result of a previously announced decision to stop selling TTS’ own-brand products through competitors. Since TTS’ strategy is to differentiate itself by developing products, it makes sense to stop other people selling them.

Since RM is an education specialist, it has stopped selling Consortium products in other markets.

The company also lost revenue due to uncertainty about the additional pressure of increased teachers’ pensions on school budgets, which has been resolved by the promise of government funding.

Despite all this TTS increased revenue 4%, it was the new-boy Consortium that dragged the division down.

As is so often the case, there are two ways to look at these developments: glass half-full and glass half-empty. The transition to a single automated warehouse won’t be complete until 2021, and lost revenue this year is probably transitory, so perhaps I am being impatient and the benefits of the acquisition will be visible in future results.

But Consortium was a big acquisition, and perhaps RM is struggling to make it pay. It put RM into the red, and a poor performance in terms of cash flow in 2019, when the company earned just 34% of adjusted profit in cash, has put it further in the red. RM Resources was partly to blame, as reduced sales meant it had more cash tied up in stock. A £4.9 million increase in capital expenditure used up cash (perhaps related to reorganising RM Resources) and so did the annual £4.6 million contribution to plug the deficit in RM’s defined benefit pension schemes, which have been augmented by Consortium’s scheme.

These outflows plus the acquisition of SoNet for £7.8 million resulted in a £15 million increase in borrowing, which added to RM’s roughly capitalised lease obligations and pension deficit means RM’s operations are 93% funded by outside capital. When I’m feeling glass half-empty, I wonder why RM chose to invest so much to make RM Resources the biggest but least profitable division!

My biggest objection to investing in RM right now is its financial position, which is the direct result of the acquisition of Consortium. The build-up of stock is likely a one off, but the drip drip drip of funds into the pension scheme means investors aren’t really getting a 50% return on capital. In cash terms it’s much lower, 27% if we average this year and last.

That’s still a very healthy return though, because RM’s other divisions are genuine success stories.

Selling e-testing to exam boards (mainly)

The SoNet acquisition is not about chasing short-term profit, SoNet barely makes any. It supplies Assessment Master, a software service which allows exam boards to create exams and test students online. RM Results is a well-established provider of e-marking software to educational and professional exam boards, but the company believes the next big transformation in assessment will be on-screen assessment, which promises to make exams a lot more efficient and a lot less error-prone, and it wants to be able to offer a complete solution.

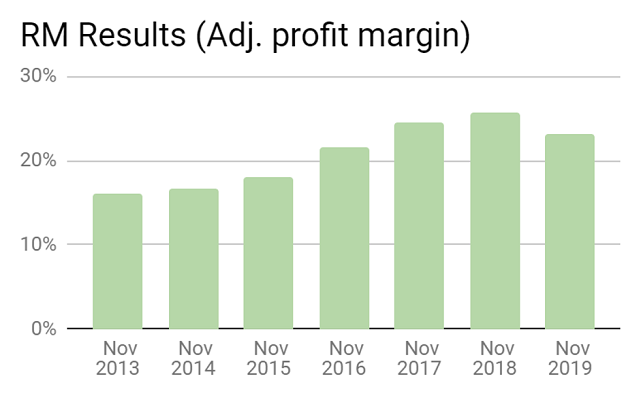

The decline in profit margin in 2019 is partly a figment of the change in accounting standards and partly a result of the acquisition of SoNet, which has increased revenue but not profit.

RM Results is probably remains the jewel in the crown. It’s growing revenue and profit, earns a bigger proportion of revenue abroad than the other divisions (26%) and even though one client is bringing e-marking in-house, RM says the outlook is positive.

Selling software (mostly) to schools

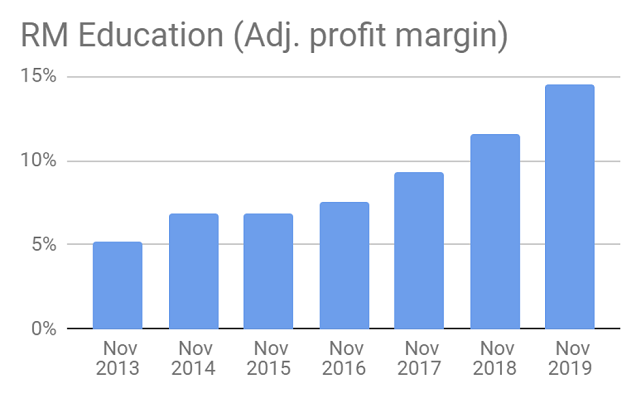

RM Education has completed its recovery. For the first time since I’ve been counting revenue increased in 2019, and profit margins improved too, not by any means for the first time:

Revenue increased 6%, even though RM Education continued to wind down often relatively unprofitable contracts. This has been RM’s millstone, preventing the company from reporting revenue growth. It’s more like a small pebble now, and it expects to have materially concluded all legacy contracts this year.

The division once relied on selling hardware, indeed hardware sales drove revenue growth in 2019, but 65% of revenue now comes from IT services and software platforms for school management. In both categories the company claims retention rates of 90% or more. During 2019, it signed an agreement with the UK’s largest multi-academy trust to supply outsourced services to all its schools.

So, RM is complicated. What’s good is very good, what’s bad is disturbing. I hate scoring companies like this

Does RM make good money?

In 2019, RM earned a return on capital of nearly 50%. Even though the pension fund is leaching cash, shorn of the unprofitable contracts it has been shouldering for a decade RM appears to be a high-quality business.

Score: 2

What could prevent it from growing profitably?

RM is constrained by its financial obligations, dependent to quite a high degree on UK government funding for schools, and exposed to technological disruption. Of these, it’s the financial obligations that bother me most. They bother me a lot.

Score: 0

How will it overcome these challenges?

Strategically, the company is focusing its resources on generating repeating revenue from its software platforms, which achieve retention rates of above 90%, and managed IT services contracts, which, achieve retention rates of about 90%.

It is seeking international growth, which increased 18% in 2019 to 14% of total revenue. The company says TTS’ range of robots for use in primary-age coding classes drove an increase in international sales at RM resources.

The acquisition of SoNet shows the company is responding to technological change in its markets. Generally, it is developing and acquiring IP that should strengthen its competitive position. It codes its own software platforms and about 40% of TTS revenue is from own-branded products.

It is also improving efficiency, for example at RM Resources, where it is combining warehouses, and by doing more software development, customer service, and administration at its Indian subsidiary.

Score: 2

Will we all benefit?

RM’s remuneration report is 16 pages long and I can find little sign of pay restraint. In 2019 chief executive David Brooks received £553,000, which was low by the standard of recent years because he received a diminished bonus and no share options vested in the year.

Brooks, though, is a lifer, and perhaps an example of the opportunities available to staff. He joined as a graduate trainee and worked his way up to chief executive by 2013. RM is promising to tell us more about its culture in next year’s annual report when it will provide more detail about ‘5 to Drive’, a recently launched programme to get everybody working together. The company lists the loss of employees as a key risk and says it monitors employee engagement and operates talent management programmes. Both RM, and David Brooks, are rated highly by large numbers of employees on Glassdoor, the recruitment site.

The annual report is informative and comprehensive.

Score: 2

Are the shares cheap?

An enterprise multiple of 12 times adjusted profit is modest, to say the least.

Score: 2

With a score of 8, RM is ranked 3rd out of the 30 shares I follow most closely.

It’s a verdict that troubles me a bit because the company’s borrowings and pension obligations are so high, but the shares probably are a good long-term investment.

Richard owns shares in RM.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.