Stock market slump: reality check after grim data

With global financial markets remaining volatile, our head of markets analyses latest events.

12th June 2020 08:31

by Richard Hunter from interactive investor

With global financial markets remaining volatile, our head of markets analyses latest events.

A June jolt has resulted in share price falls not seen since the March melee.

Concerns that the market had come too far too fast can be put to one side for the moment as the stern reality checks emanating from the OECD and the Federal Reserve earlier in the week came home to roost.

The suggestion that economic recovery could be as sharp as the correction seems to have evaporated, with reported spikes of coronavirus cases in Florida, Texas and California prompting fears of a second wave and, in any event, a dampening of consumer sentiment just as it was showing tentative signs of returning.

As such, tourism and travel stocks find themselves under pressure once more, while the Fed’s implication of low interest rates for a prolonged period of time saw bank shares tumble against what will be a difficult trading environment for them in the foreseeable future. A further lurch down for the oil price added to the general malaise, with the manufacturers also lost ground on fears of further lockdowns.

- Stock market rally poll: too much too soon?

- Chart of the week: my most important post for some time

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

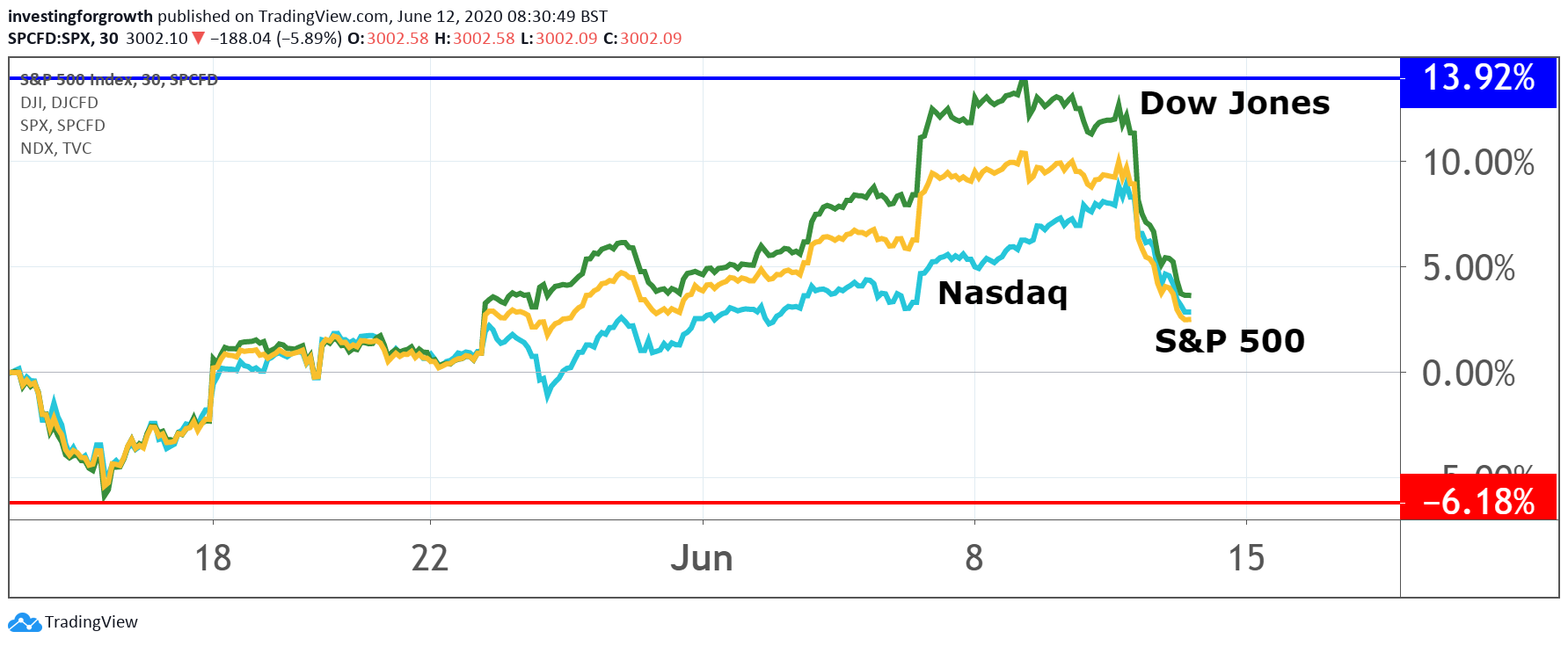

The net result is that in the year to date, the Dow Jones Industrial Average is now down 12% while the S&P 500 has lost 7%. The Nasdaq continues to be in the vanguard of any economic recovery, with the focus on tech stocks particularly given the changes to work and home life during the pandemic, and the index remains up nearly 6% in the year to date, although off the record highs recorded earlier in the week.

Meanwhile, confirmation of a 20% contraction in the UK economy in April has further dampened sentiment nearer to home, with the opening weakness bringing the FTSE 100 index down 20% in the year to date.

Source: TradingView. Past performance is not a guide to future performance.

It may be that the reset was overdue and that the renewed sense of realism will make any market gains from here more measured. There are certainly elements for optimism, not least of which is the underpinning of developed economies provided by extraordinary stimulus from global governments and central banks.

Loose monetary and fiscal policy will enable companies to recover more quickly than would otherwise have been the case, while the case for equities as the investment destination of choice is still in play.

As ever, the market does not ascend in a straight line and sharp corrections such as these should not detract from the longer-term view. Benjamin Graham famously noted that in the short term, the market is a voting machine but in the long term it is a weighing machine. This particular correction may have come at an apposite time.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.