Chart of the week: Lloyds Bank and the bond traders

For clues as to the outlook for Lloyds and the stock market, investors should watch savvy bond traders.

8th June 2020 11:21

by John Burford from interactive investor

For clues as to the outlook for Lloyds and the wider stock market, investors should watch savvy bond traders rather than a ‘second wave’ of coronavirus.

I am fighting the Fed

One of the first lessons investors learn is this: Don’t fight the Fed.

Sounds like great advice, doesn’t it? After all, the US Federal Reserve has unlimited firepower, and has not been afraid to use it, especially since 2008 when it embarked on the greatest financial experiment in modern history with its Quantitative Easing (QE) schemes.

And suddenly, casting our minds back to the March Corona Crash, the Fed made some panic moves in response – first by lowering policy rates to an all-time low of 0% – 0.25%. But that failed to staunch the share market selling, so then they announced they would do an ‘unlimited buying of Treasury debt and mortgage-backed securities’. The mainstream media called this 'QE Infinity' - which was on a much grander scale than in the 2010s.

But that also failed to reverse the tide of selling, so they announced a further plan to buy corporate debt and Exchange Traded Funds (ETFs) that track the sector. They also set up a separate company to lend to troubled companies and buy distressed assets and crucially indicated it would intervene in the stock market directly. They received a guarantee from the Treasury they would suffer no losses on these ‘investments’.

By thus manipulating all financial markets, they have moved a million miles from their original mandate to "promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates". Previously, they only used their policy interest rates to do this. But that is a story for another day.

And they are also actively buying junk debt -and even hold bonds of the bankrupt Hertz car rental outfit! Is this American capitalism? Seems more Chinese to me.

- 25 years of AIM: how the junior market has become less risky

- Two fallen star stocks good enough to stage a comeback

- The Week Ahead: three FTSE 100 stocks to watch

So, with that kind of firepower, who in their right mind would fight the Fed?

And who would be brave/foolish enough to forecast a rise in bond yields – and short the Treasury Bonds? Well, if you did, you would be greeted with this chart of the US Treasury 30-year Bond yield.

Source: interactive investor. Past performance is not a guide to future performance.

Yes, yields are now rocketing up and, in the past six weeks, have risen by 50% to a recent 1.8% (as a reminder: they were at a crazy 0.65% in March, and averaged 2.5% last year!).

How’s that for volatility? They are suddenly no longer boring!

And, crucially for the economy, the spread with short-term rates that made the famous inversion a few months ago has now stretched into highly positive territory, thus confirming early on the reliable signal that the economy is heading for a large slow-down.

And this yield improvement is being matched in other sovereigns. Many are wondering why the share prices of banks are now advancing if we are staring at almost-certain job losses later this year, with some companies destined to go under in a contracting economy. A growing list of bad debt owned by the banks is surely on the cards.

Of course, when yield spreads improve, bank loan margins likewise improve as they recover from their wafer-thin returns in recent months/years. Naturally, this is a scenario for higher mortgage rates to come. As if the housing market doesn’t have enough worries.

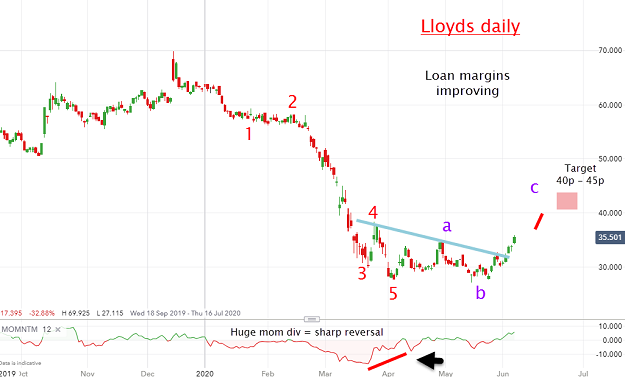

Here is my outlook for Lloyds:

Source: interactive investor. Past performance is not a guide to future performance.

My possible target is the 40-45p region, where expanding loan margins will likely meet fewer mortgage approvals in a classic stand-off.

But my main point is that, with rising sovereign bond yields, many over-indebted companies will be hit hard and would be best avoided by investors. Also, government budgets will be blown apart as a rapidly rising interest expense on the already-exploding new issuance of debt will create havoc for planners.

- The Ian Cowie Portfolio: how I’m receiving inflation-busting income

- IPO schedule for 2020 just got interesting

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It would be totally fitting that instead of investors’ main focus of worry being on the pandemic and possible more waves to come, perhaps we should be looking at the bond markets instead.

It is often said that bond traders are much more savvy than equity traders as they usually sniff out major changes in the economy first.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.