Stocks that could defeat the Covid booze slump

Lockdown means we are drinking less, but some large alcohol brands are in a good position.

5th August 2020 12:54

by Rodney Hobson from interactive investor

Lockdown means we are drinking less, but that trend might not continue and some large alcohol brands are in a good position.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

So we didn’t all spent lockdown drinking ourselves silly. In fact, the past three months have been particularly challenging for producers of alcohol, as loss of sales at clubs, pubs and restaurants have more than offset any rise in solitary boozing.

Paula Lindenberg, president of Budweiser, admits that many people in the UK have continued to moderate their drinking during lockdown. Nonetheless, the drinks sector is worth considering in the search for possible investments.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Buy International Shares

Alcohol is a vast international market dominated by a few big players with wide geographic spread. It is rare that every region is hit at the same time, as has happened with Covid-19, so there is every reason to believe that the sector will recover comparatively quickly as life gets back to something like normal. Poverty does not stop people from drinking, so higher levels of unemployment will not necessarily hit sales. Rather it is likely to push drinkers to consume beer in place of more expensive wine and spirits.

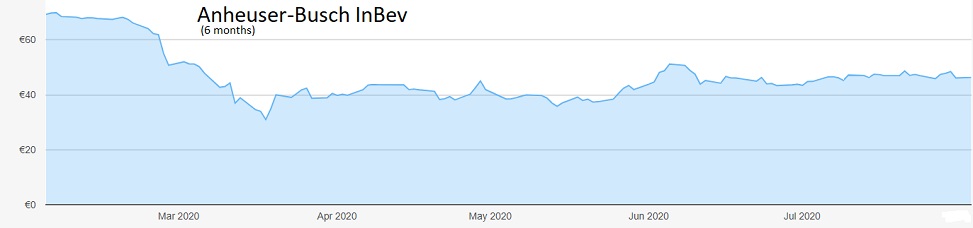

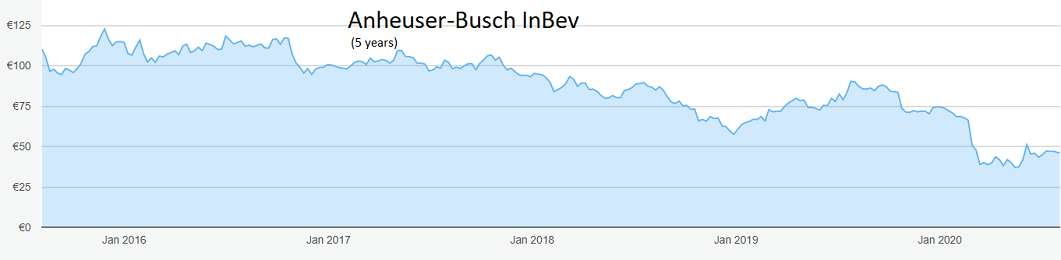

Anheuser-Busch InBev (EURONEXT:ABI), the world’s biggest brewer, was badly hit in the second quarter, with underlying earnings down 34.1% to $3.4 billion (£2.59 billion). A $2.5 billion writedown of the value of the South African business was only partly offset by a $1.9 billion profit on the sale of the Australian operations and the one-off hit produced a statutory loss of $1.9 billion.

Source: interactive investor. Past performance is not a guide to future performance.

Total revenue was down 17.7% in the April-June quarter. Even the global brands – Budweiser, Stella and the perhaps unfortunately-named Corona – slipped by 16.6%.

The encouraging aspect, though is that sales picked up as the quarter progressed with the fall reduced from 32.4% in April to 21.4% in May, followed by a 0.7% uptick in June. Although the coronavirus outbreak shows some signs of creating a second wave in Europe and the first wave is still raging through the United States and elsewhere, the tentative reopening of pubs in the UK should help to ensure that the worst is over for beer sales.

Source: interactive investor. Past performance is not a guide to future performance.

AB InBev claims it gained market share in the UK in the second quarter to become the biggest brewer in the country with just under a quarter of all beer sales. Even Corona lager defied its name with heavy sales in UK grocery stores.

Another plus point is the success of low-alcohol and alcohol-free brands. Budweiser Zero and Stella Artois Alcohol-Free have been added to the portfolio.

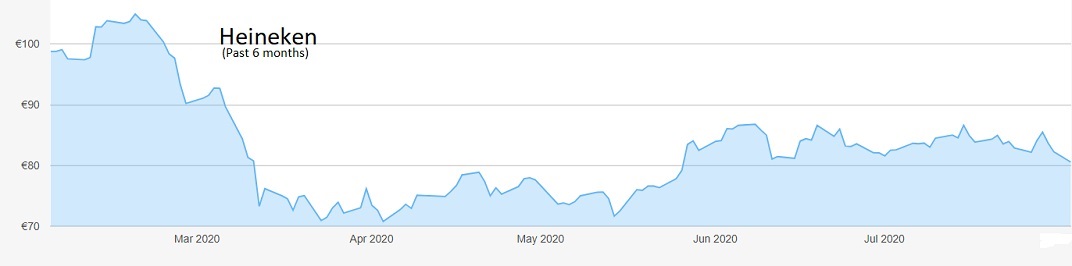

Source: interactive investor. Past performance is not a guide to future performance.

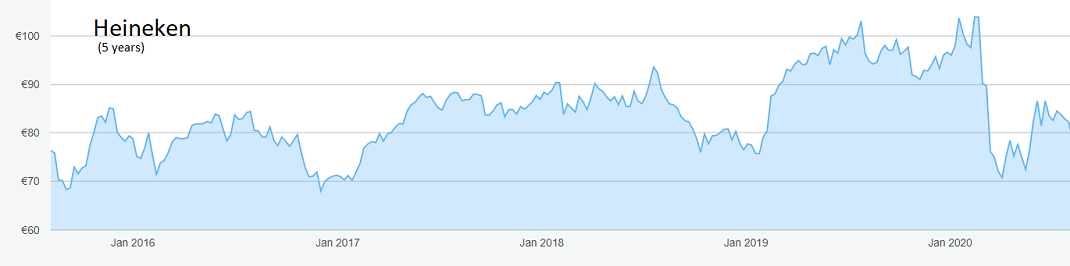

An alternative is Dutch rival Heineken (EURONEXT:HEIA), the world’s second largest brewer with 165 breweries in more than 70 countries and the largest cider producer. It is market leader in several European countries, most notably the Netherlands, Italy, Austria and Greece. Also, like AB InBev, it has developed a range of non-alcohol beverages.

The second quarter was if anything worse than at AB InBev, with beer volumes down 19.4% but showing a clear improvement over the three months. First half underlying net profit slumped by three-quarters and writedowns took the group into a €297 million (£268.4 million) loss.

Source: interactive investor. Past performance is not a guide to future performance.

The shares fell sharply from €105 in mid-February but found a solid floor at €71 that has held on three separate occasions since. However, a subsequent rally seems to have petered out and the shares have slipped below €80 again, opening up a possible buying opportunity.

Hobson’s choice: I suggested in April that AB InBev had been heavily oversold during the coronavirus crisis and the shares were worth buying for recovery at around €43. They are now up to €47, where the yield is 2.8%. My advice in April to ‘buy’ up to €50 still stands.

I prefer AB InBev to Heineken, which I feel is struggling more in the current difficult circumstances. The yield is lower at 2.1%. Investors who disagree should not pay more than the recent ceiling at €86.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.