Stockwatch: choosing between these two mid-cap shares

Both these well-known companies have improved in recent years, making some level of share price recovery from historic lows. Analyst Edmond Jackson studies the form to decide if there’s more to go.

20th June 2025 10:10

by Edmond Jackson from interactive investor

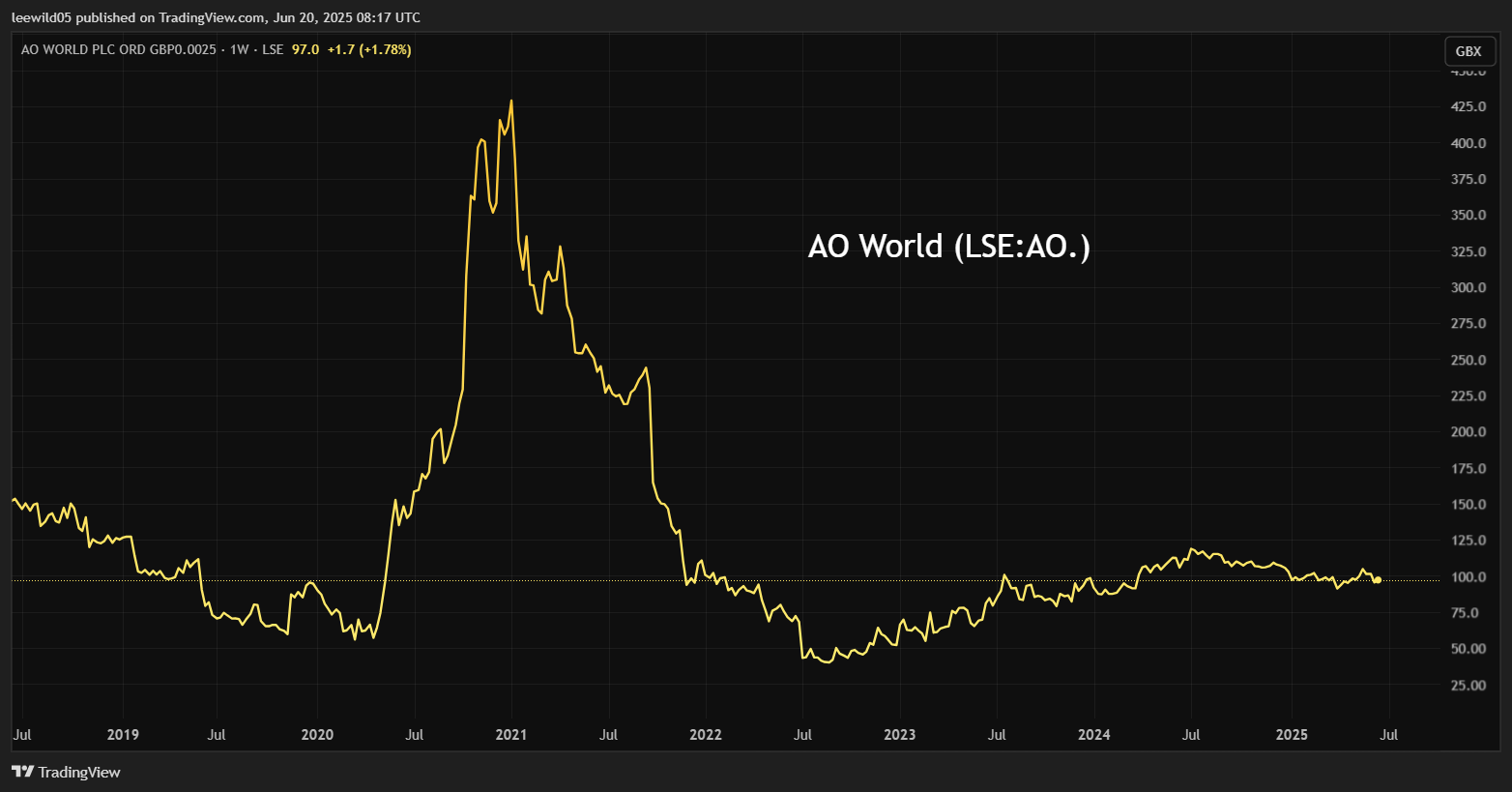

Currys (LSE:CURY) versus AO World (LSE:AO.) is an interesting comparison where I have broadly called both right in the past, but missed a 40p low that marked a turn in AO, versus a current price of 96p after its latest annual results to end-March.

In October 2021 I made a detailed “sell” case on AO at 158p, somewhat late but still fair. Yes, the company had benefited from lockdowns, but its shares had soared to 430p in January 2021, which was above any reasonable sense of value.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

After the 40p low in August 2022, the shares steadily recovered to 118p by last July, but had declined to 90p by April. The chart appears to convey a steadily improving turnaround, if lacking conviction over the last 12 months:

Source: TradingView. Past performance is not a guide to future performance.

I was more intrigued by Currys, rating it a “buy” at 57p in May 2023, which became a target for two possible offers in February 2024 versus a 65p share price. I noted this as “finally a wake-up call, how UK equities are attractive...if operating margins could be proven to around 3% (as per five years previously) then Currys should leverage enough profit on £9 billion revenue to justify an equity value of at least 100p if not nearer 200p”.

Currys has also steadily re-rated, especially from around 90p last April to 120p currently:

Source: TradingView. Past performance is not a guide to future performance.

Both are low-margin operators although AO has improved over Currys, aiding a normalised return on capital of around 20% versus more like 4% respectively.

UK discretionary spending makes both hard to decipher

On the face of it, various economic constraints would force people to defer buying electrical goods. Yet it seems that enough wages are nowadays inflation-protected, and a Labour government has been generous towards an extensive public sector, such that AO and Currys have been able to grind out revenue advances – even if only a little more than 3.5% inflation.

AO actually achieved 12% growth on its retail side, accounting for 73% of total but mobile-related revenue fell 11% and business-to business similarly, hence 9% growth overall. Currys has guided for 4% growth in the UK and flat performance in the Nordics, meaning 2% overall for its financial year to 3 May. Since the Nordics have previously been a problem area with aggressive discounting by rivals, it has only needed this region to stabilise for sentiment in the shares to improve modestly.

Yet with Currys saying on 21 May that its year had closed “on a high note with encouraging momentum and accelerating sales growth in both the UK/Ireland and Nordics”, it is a different picture from woes in discount retail – where Poundland is closing 68 stores and attention is on whether a new CEO at B&M European Value Retail SA (LSE:BME) improve declining like-for-like sales. The lower-income bracket seems chiefly under pressure.

The second main fear has been higher costs, especially from April, but as yet that’s been offset by Currys’ sales and gross margin improvements. AO says: “despite macro challenges particularly employment cost increases we are confident in our ability to grow revenue and profit” and for the medium-term “reiterate our ambition of a pre-tax margin over 5%”.

AO’s 32% jump in adjusted pre-tax profit to £44 million is thus commendable given higher employment costs drove a 13% rise in overheads.

AO’s guidance for adjusted pre-tax profit of £40-50 million in its March 2026 year invites no change to consensus for £34 million net profit and normalised earnings per share (EPS) near 6p. It implies a forward price/earnings (PE) ratio above 16x versus around 10% earnings growth, whereas Currys trades on a forward PE of 11x albeit with only 2% earnings growth expected in its May 2026 year.

On a snapshot earnings view, both shares appear up with events and, while AO pays no dividends, the yield on Currys is below 2%.

Currys - financial summary

year-end 3 May

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 10,242 | 10,525 | 10,433 | 10,170 | 10,330 | 10,122 | 8,874 | 8,476 |

| Operating profit (£m) | 436 | 321 | -225 | -30.0 | 136 | 220 | -371 | 106 |

| Net profit (£m) | 295 | 166 | -320 | -163 | 12.0 | 71.0 | -481 | 165 |

| Operating margin (%) | 4.3 | 3.1 | -2.2 | -0.3 | 1.3 | 2.2 | -4.2 | 1.3 |

| Reported earnings/share (p) | 26.6 | 20.3 | -26.8 | -13.9 | 0.0 | 6.0 | -44.6 | 2.4 |

| Normalised earnings/share (p) | 31.7 | 26.0 | 21.3 | 10.4 | 17.1 | 15.7 | -14.0 | 18.1 |

| Operational cashflow/share (p) | 31.4 | 26.9 | 24.7 | 50.4 | 70.7 | 36.4 | 24.5 | 32.4 |

| Capital expenditure/share (p) | 21.0 | 16.1 | 14.3 | 16.5 | 10.2 | 11.3 | 10.1 | 4.3 |

| Free cashflow/share (p) | 10.5 | 10.8 | 10.4 | 33.9 | 60.5 | 25.1 | 14.4 | 28.2 |

| Dividend per share (p) | 11.3 | 11.3 | 6.8 | 2.3 | 3.0 | 3.2 | 1.0 | 0.0 |

| Covered by earnings (x) | 2.4 | 1.8 | -4.0 | -6.2 | 0.0 | 1.9 | 0.0 | 0.0 |

| Return on total capital (%) | 9.4 | 7.0 | -5.5 | -0.6 | 3.2 | 5.2 | -10.7 | 3.3 |

| Cash (£m) | 147 | 168 | 622 | 628 | 140 | 96.0 | 67.0 | 89.0 |

| Net debt (£m) | 333 | 309 | 308 | 1,680 | 1,192 | 1,253 | 1,360 | 943 |

| Net assets (£m) | 3,055 | 3,196 | 2,640 | 2,280 | 2,381 | 2,501 | 1,892 | 2,072 |

| Net assets per share (p) | 265 | 276 | 228 | 196 | 204 | 221 | 167 | 183 |

Source: historic company REFS and company accounts.

So, can adept marketing and cost control squeeze out value? The real profit leverage looks with Currys given around £8.7 billion revenue versus £1.1 billion for AO. At least its Nordics businesses are now achieving adjusted profit growth with the main recent headwind being currency translation. Meanwhile, AO needs to resolve its problems on the mobile side where, unlike Currys, it seems not to have recognised falling demand for phones on contract (as opposed to SIM-only) early enough, hence lower commissions from phone networks.

A quibble with AO’s cash flow statement is it writing back annually a circa £7 million payment for shares to an employee benefit trust, which to me should be a deduction under investment activities. This compromises AO’s claim as to a 9% increase in free cash flow to £23 million.

AO World - financial summary

year end 31 Mar

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 599 | 701 | 797 | 903 | 1,046 | 1,661 | 1,368 | 1,139 | 1,039 | 1,138 |

| Operating margin (%) | -1.8 | -1.7 | -2.0 | -1.7 | -0.4 | 1.8 | -0.5 | 1.1 | 3.5 | 1.9 |

| Operating profit (£m) | -10.6 | -12.0 | -16.2 | -15.2 | -4.3 | 29.7 | -7.5 | 12.5 | 36.2 | 21.1 |

| Net profit (£m) | -6.0 | -6.6 | -13.4 | -17.5 | 0.8 | 17.1 | -30.4 | -2.6 | 24.7 | 10.5 |

| EPS - reported (p) | -1.4 | -1.6 | -2.9 | -3.8 | 0.2 | 3.7 | -0.8 | 1.1 | 4.3 | 1.8 |

| EPS - normalised (p) | -1.4 | -1.5 | -2.7 | -3.1 | 0.6 | 4.1 | -0.6 | 1.9 | 4.3 | 5.7 |

| Return on equity (%) | -14.6 | -22.4 | -23.3 | 1.4 | 21.2 | -4.2 | 6.9 | 20.3 | 7.3 | |

| Return on total capital (%) | -19.0 | -20.3 | -10.5 | -8.7 | -2.6 | 16.2 | -4.4 | 6.9 | 18.3 | 5.1 |

| Operating cashflow/share (p) | -0.8 | 0.8 | -3.4 | -4.5 | 3.0 | 23.8 | -10.9 | 4.4 | 10.3 | 10.0 |

| Capital expenditure/share (p) | 1.6 | 1.4 | 1.2 | 1.0 | 1.7 | 1.9 | 2.0 | 0.4 | 1.4 | 2.3 |

| Free cashflow/share (p) | -2.4 | -0.6 | -4.5 | -5.5 | 1.3 | 21.9 | -12.9 | 4.0 | 8.9 | 7.7 |

| Cash (£m) | 33.4 | 29.4 | 56.0 | 28.9 | 6.9 | 67.1 | 19.5 | 19.1 | 40.1 | 27.4 |

| Net debt (£m) | -25.4 | -12.0 | 34.6 | 83.6 | 99.2 | 28.2 | 134 | 76.2 | 30.8 | 35.9 |

| Net assets (£m) | 48.3 | 42.2 | 77.5 | 72.4 | 69.6 | 97.7 | 73.4 | 106 | 138 | 145 |

| Net assets per share (p) | 11.5 | 10.0 | 16.9 | 15.3 | 14.6 | 20.4 | 15.3 | 18.3 | 23.8 | 24.9 |

Source: historic company REFS and company accounts.

No clear clues from trend in director dealings

Insider deals support a sense of how tricky it is to have firm convictions about either share, despite management’s confidence when reporting.

At Currys, the last director “buy” was £31,000 worth at 90p last January by a non-exec who joined the previous April, hence possibly quite duty-driven to buy shares at some point. Otherwise, three directors bought a total £374,000 shares at around 49p from September 2023 to January 2024. There has not been any buying into the rally from April, ahead of the pre-results restriction.

The trend at AO is characterised by options exercising, sometimes selling only enough to pay a tax bill; the directors might say this shows they are increasing their holdings, although it’s “for free”, so not the same as cash purchases.

- AIM’s 30th birthday: best stocks and what the future holds

- Why Warren Buffett could back Britain in final mega-deal

AO began to rally around 12 May despite news a day later of the founder CEO selling (via an incorporated charity) £2,285,350 worth of shares at 94-98p during April and May. This did, however, follow what looks like an options exercising of 5.4 million shares at 0.0p last January, as if he retains just over three million shares given the sales are linked to tax arising. He also holds 17% of the company overall – its third-largest shareholder – which is manifestly a motivator for delivering value.

But he also sold £8,073,000 worth at 117p last August, coinciding with a non-executive director - who is also a former City financial analyst - selling £2,346,000 worth also 117p. The CFO also sold £48,000 worth.

Interestingly, the ex-analyst had been a substantial cash buyer from 66p in March 2023 to a 92p to 90p level that autumn, and also in March 2024. But his August 2024 selling cleared all those trades out and by an extra 250,000 shares.

The CFO also sold all his shares arising from options he exercised in July 2023 at 97p. In fairness, he has also kept significant portions of shares from options exercising going back to 2020.

The overall pattern of AO director trades therefore looks as if they prefer to take profits from options-exercising, although it’s unclear whether that is a culture arising from share options or reflecting wariness.

In other AO dealings, it should be noted that Frasers Group (LSE:FRAS) added 5.8 million shares to now own 145.1 million, or 25% of AO as its largest shareholder.

Continuing to favour Currys for longer-term profit leverage

I defer to the Occam’s razor principle where complexity may be best engaged by parsing what is most essential. Currys’ annual results on 3 July will therefore be interesting in terms of what light management can shine on its margin growth, where the scale of turnover perhaps offers more potential than AO.

I still would not underestimate the AO founder-CEO to deliver value, but both share valuations seem up with events for now, hence “hold”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.