Stockwatch: a FTSE 100 stock to buy for better times ahead

This blue-chip is primed to capitalise on improving consumer confidence and increasing attractiveness of UK assets, argues analyst Edmond Jackson.

5th July 2024 11:50

by Edmond Jackson from interactive investor

Is the budget hotels and restaurants group Whitbread (LSE:WTB) now a prime example of UK stocks being overdue a recovery?

Yesterday, the FTSE 100 stock rose nearly 2% over 3,000p to hit a 50-day moving average line it has trended beneath since 3,575p last February.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

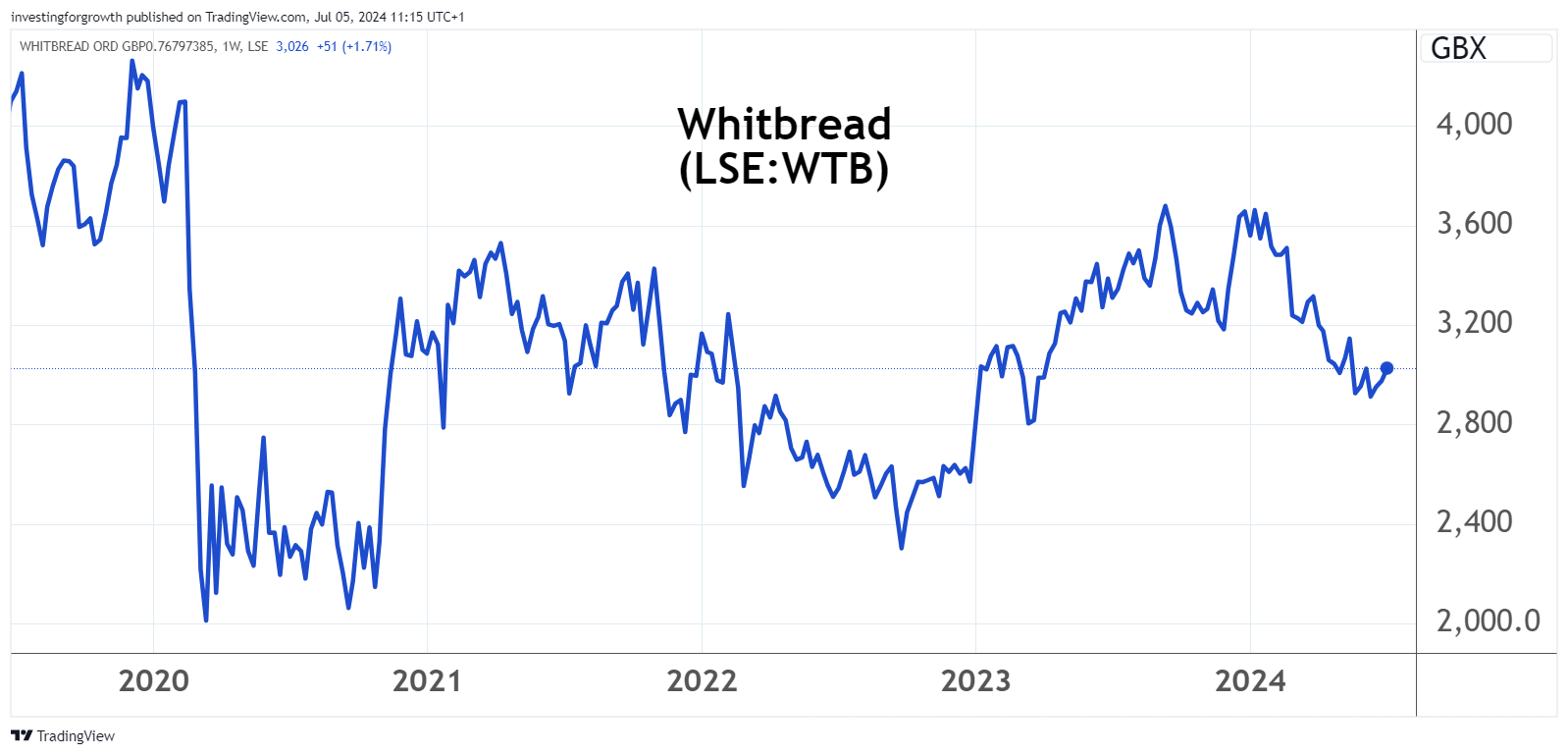

Mind that on five- and 10-year perspectives, Whitbread is essentially trading volatile-sideways – with Covid marking a break from a circa 3,000p to 4,500p range down to 2,000p in March 2020, then roughly 2,500p to 3,500p. It is as if the market has, since Covid’s intervention, applied a penalty for the risk of another virus or major event causing major disruption, although who knows how realistic that is.

Source: TradingView. Past performance is not a guide to future performance.

Reversion to fair value as spending may start to improve

I think the stock did enjoy quite a valuation premium pre-Covid, hence is nowadays priced more fairly on a forward price/earnings (PE) ratio around 14x with a modest 3.4% prospective yield.

Previous PE multiples in the high teens and twenties seemed to me rather rich for the likes of Premier Inn, Beefeater and Brewers Fayre pub-restaurants.

The broad technical and fundamental case now is 3,000p (just achieved) being median the stock’s trend since 2020, just as key UK consumer stocks start to try and price in recovery.

That obviously assumes UK interest rates come down, consumers do respond, and a Labour government spares them tax hikes in line with manifesto promises to protect working people.

- ii view: Premier Inn owner Whitbread bets on German growth

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Whitbread’s revenue profile remains predominantly UK at 94%, with its German operations the remainder (approaching break-even hence yet to contribute profit). The group is also spending towards £600 million in the current financial year alone to increase hotel capacity and continue refurbishing restaurants.

In the UK, some 750 to 1,250 new hotel rooms are being introduced in the current financial year, relative to 85,443 overall at end-February. Premier Inn is ideal for spontaneous-decision, short breaks on a budget, versus pricier hotels and the decent AirBnB’s which get booked up well in advance.

Some 400 new rooms are coming in Germany relative to 10,506 – albeit a said to have a “committed pipeline” of 6,286 rooms overall.

Management claims every 1% change in accommodation sales has a £16-17 million impact on pre-tax profit; additionally, a 1% change in food-and-drink sales has a £2.5 million effect.

Strong 2023 performance albeit weak Q1 to end-May

The annual results to 29 February showed strong performance for the key Premier Inns operation, with revenue up 10% to £2,770 million and adjusted pre-tax profit up 19% to £588 million, as revenue per available room beat inflation with a 10% rise near £66 million. Germany was even better in revenue terms, up 62% to £190 million equivalent, albeit helped by a much smaller base. An adjusted loss of £36 million was struck.

Commendably, management has been able to sustain operating margins relatively well amid inflation despite easing from 19.1% to 18.6% year-on-year:

Whitbread - financial summary

Year to end-Feb

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 2,047 | 2,062 | 589 | 1,703 | 2,625 | 2,960 |

| Operating margin (%) | 17.6 | 19.9 | -145 | 13.3 | 19.1 | 18.6 |

| Operating profit (£m) | 360 | 411 | -851 | 227 | 503 | 552 |

| Net profit (£m) | 3,731 | 218 | -906 | 42.5 | 279 | 312 |

| EPS - reported (p) | 82.7 | 125 | -482 | 20.9 | 137 | 160 |

| EPS - normalised (p) | 200 | 201 | -363 | -84 | 150 | 226 |

| Operating cashflow/share (p) | 282 | 134 | -208 | 251 | 394 | 450 |

| Capital expenditure/share (p) | 256 | 225 | 121 | 109 | 256 | 261 |

| Free cashflow/share (p) | 26 | -91 | -329 | 142 | 139 | 189 |

| Dividends per share (p) | 85.6 | 28.1 | 0.0 | 34.7 | 74.2 | 97.0 |

| Covered by earnings (x) | 1.0 | 4.4 | 0.0 | 0.6 | 1.9 | 1.7 |

| Return on total capital (%) | 4.0 | 5.7 | -10.6 | 2.6 | 5.5 | 6.4 |

| Cash (£m) | 3,403 | 503 | 1,256 | 1,132 | 1,165 | 697 |

| Net debt (£m) | -111 | 2,944 | 3,278 | 3,561 | 3,787 | 4,397 |

| Net assets (£m) | 5,653 | 3,749 | 3,834 | 4,119 | 4,111 | 3,519 |

| Net assets per share (p) | 2,689 | 2,395 | 1,899 | 2,039 | 2,034 | 1,906 |

Source: company accounts.

An 18 June update in respect of Whitbread’s first quarter to 30 May therefore did little to improve sentiment. Its narrative cited “trading performance strengthened during the quarter” but revenue was essentially flat: total UK sales 0.2% easier, helped to 1% at group level by a 17% rise in Germany.

In inflation-adjusted terms, however, it was a slip and 1% is not enough to offset two years’ growth in the minimum wage given this is quite a people-intensive operation – staff wages were equivalent to nearly a third of group revenue.

Not surprising then, management is currently engaged on a £150 million share buyback programme to help squeeze earnings per share (EPS) a bit better, albeit modestly given a £5.4 billion market value.

Investors’ dilemma is therefore whether to await proof of better trading, at some risk the market continues to try and price in better performance – anticipating interest rate cuts and with the general election result having reduced some uncertainty about the UK. Politics elsewhere – especially the US and France – makes those countries look relatively riskier now.

It might only need international investors to make modest re-allocations to UK assets for the likes of Whitbread to rise.

Off-chance of US private equity interest

The main UK hotel rival is Travelodge, which used to be known as Trusthouse Forte, nowadays owned by Golden Tree Asset Management – a US private equity operation. Now is potentially the right time to make an approach, ahead of a possible consumer recovery. A new Labour government will have enough on its hands, so is less likely to meddle in any takeover.

While lease liabilities edged up very slightly to £4,098 million, bank debt was a modest £995 million and all long term, substantially offset anyway by £697 million cash. Altogether, this meant a net £113 million interest charge that swiped 17% of normalised operating profit. So it is quite a close call whether this balance sheet should accept further debt – the likely game-plan for private equity. Potentially, such owners could sell and lease back more of the circa £4.6 billion property on the balance sheet, where nearly £3.6 billion additional is designated “right-of-use assets”. That might however reduce the appeal for a subsequent private owner of Whitbread.

- eyeQ: a bearish signal on Barclays Bank shares

- Share Sleuth: the double trade that cleared my cash pile

So a takeover approach is possible but by no means likely. Net tangible assets per share were 1,845p at end-February hence the stock trades at a 65% premium to such. An acquirer might not want to pay substantially more. Meanwhile, the board can argue in defence that Whitbread is at a cyclical turning point in the UK and Germany is moving into profit.

Yield element is admittedly less competitive

With the stock edging up further to 3,030p as confidence returns to UK-facing equities, it implies a prospective dividend yield of 3.2%, assuming consensus for the 97p dividend to be held in respect of this financial year. With the EPS consensus at 210p, that implies fair 2.2x earnings cover albeit well backed by free cash flow (which is Whitbread’s history).

There are plenty other UK equities offering 6% or higher, as I considered in my last piece on Halfords Group (LSE:HFD), implying scope for a de-risking of the dividend yield which can help re-rate capital value.

- Stockwatch: a rare income stock capable of capital growth

- 18 FTSE 100 stocks about to return billions in dividend income

Personally, I think Whitbread should prioritise raising its dividend rather than pursuing buybacks – despite so many other companies following such “returns” policies currently. It’s unclear whether buybacks come into question if Labour hikes capital gains tax, as this would chiefly affect private investors, whereas equities are nowadays held predominantly by non-tax-paying institutions. It seems to me that boards are favouring managers given buybacks enhance EPS, to which performance-related bonuses are often geared.

Despite my moderate expectations for Whitbread, I still think it timely to note the stock – the market presently showing with a circa 100p rise in the last few days, it is at a level responsive to better expectations for UK consumers.

The evidence is yet to appear, hence a speculative aspect is involved here, but unless Labour makes a bad start in the months ahead, I suspect Whitbread is a good example how UK equities will price for better times ahead. Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.