Stockwatch: How to play this winning tip ahead of results

Our companies analyst has made a 42% profit on this tip, but might a 'break-out' imply something is up?

7th May 2019 11:59

by Edmond Jackson from interactive investor

Our companies analyst has made a 42% profit on this tip, but might a 'break-out' imply something is up?

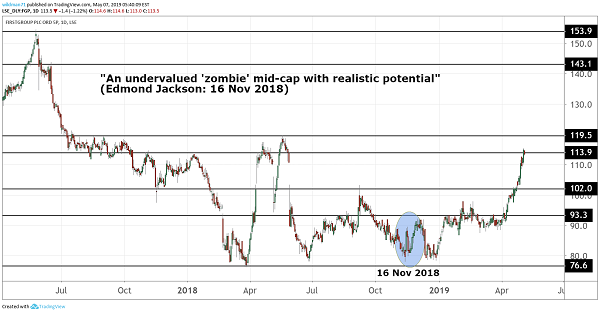

April has seen a parabolic 21% rise on the chart of mid-cap transport firm FirstGroup (LSE:FGP) which serves the US, Canada and UK.

Due to its groaning balance sheet, industrial action and rail infrastructure, the stock had previously been range-bound – roughly 80p to 100p – since early 2018. That was only interceded by a first-half 2017 rally from 100p to 153p when management anticipated good overall progress and was also benefiting from a strong dollar.

The stock ended last week at 115p, with mild profit-taking after the latest Bank Holiday to around 114p.

This tallies with exactly a year ago when private equity group Apollo made approaches to acquire FirstGroup for cash, which the board rejected as undervalued and Apollo did not "go hostile".

Market price see-sawed between 100p and 115p, then fell to near 80p during the summer as nothing else materialised. The 17 July AGM statement noted:

"The board is examining all appropriate means to mobilise the considerable value inherent in the group, and to deliver shareholder value in a sustainable way while enhancing the services we provide to our customers and communities."

That Apollo made a move at all, backs up this claim despite FirstGroup often speaking in terms of "customers and communities" as if one of those "stakeholder" type companies where shareholders' status is somewhat in doubt. Then, of course, there is Labour's agenda to renationalise the railways, for what that is realistically worth.

Even so, last November I argued the case for FirstGroup shares as a 'speculative buy' at the prevailing 83p, with FirstGroup showing useful if early stages of turnaround in context of "sum-of-parts" break-up potential.

Despite coming across as a "zombie" company – one so indebted, the service costs leave no worthwhile returns for shareholders – capitalism is dynamic and something would eventually give, like taking FirstGroup off-market and refinancing it.

Source: TradingView Past performance is not a guide to future performance

I noted a Canadian activist investor, West Face Capital, vocal in the press about how the UK rail side was "extraordinarily destructive of capital" with losses up to £106 million projected until the contract ends in 2023.

Interestingly, a peer US school bus company had been acquired for an enterprise value (equity plus debt and pension liabilities, minus cash) of £770 million equivalent.

FirstGroup – with its spread of interests – currently has a market cap around £1.4 billion, net debt of £1.05 billion and £0.3 billion pension liabilities.

It's hard to judge intrinsic value, although as part of its bid approach rebuttal last May the board would have commissioned its own review.

Window re-opens for Apollo and there's other stakebuilding

Takeover rules pre-empted Apollo making another offer for a year, and the current stock rally has a "no smoke without fire" feel to it, although strictly speaking the stock has risen over 20% in the last month with nothing declared like there was on 11 April 2018, "noting the recent movement in the share price and confirming it has received a preliminary and highly conditional proposal from Apollo..."

Last Friday 4 May, it was announced that Coast Capital Management LP – a financial planning/investment firm, no swashbuckling hedge fund – had raised its stake from 7.6% to 8.8%, a circa £123 million commitment that's grown significantly of late.

I'd be surprised if this kind of institution was simply making a takeover bet: from a US perspective they would have satisfied themselves as to FirstGroup's underlying value.

| FirstGroup - financial summary | Consensus estimates | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| year ended 31 Mar | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||

| Turnover (£ million) | 6717 | 6051 | 5218 | 5653 | 6398 | ||||

| IFRS3 pre-tax profit (£m) | 58.5 | 106 | 114 | 153 | -291 | ||||

| Normalised pre-tax profit (£m) | 32.2 | 106 | 116 | 152 | 197 | 231 | 277 | ||

| Operating margin (%) | 2.7 | 3.9 | 4.6 | 4.9 | 5 | ||||

| IFRS3 earnings/share (p) | 5.1 | 6.2 | 7.5 | 9.2 | -24.2 | ||||

| Normalised earnings/share (p) | 2.6 | 6.2 | 7.7 | 9.2 | 12.3 | 13.0 | 13.4 | ||

| Earnings per share growth (%) | -68.3 | 138 | 23.9 | 18.8 | 33.7 | 5.7 | 3.1 | ||

| Price/earnings multiple (x) | 8.9 | 8.5 | 8.2 | ||||||

| Annual average historic P/E (x) | 40.2 | 22.8 | 13.9 | 13.5 | 11.3 | 7.6 | |||

| Cash flow/share (p) | 27.8 | 27.2 | 34.1 | 43.3 | 52.1 | ||||

| Capex/share (p) | 24.8 | 31.7 | 32.0 | 30.0 | 31.5 | ||||

| Dividend per share (p) | 4.0 | ||||||||

| Yield (%) | 3.6 | ||||||||

| Covered by earnings (x) | 3.4 | ||||||||

| Net tangible assets per share (p) | -42.8 | -33.0 | -24.0 | -4.3 | -8.7 | ||||

| Source: Company REFS | |||||||||

Attractions of a cash flow valuation perspective

Despite last November's interims showing £52 million of finance costs wiping out £46.3 million of operating profit, the cash flow profile (see table) is substantially ahead of earnings per share, although the group does engage hefty capital expenditure.

Last 19 February's trading statement was "in line"

It cited robust 13.7% revenue growth to date in respect of the financial year to end-March, at constant currency, excluding the South West Rail franchise up 5.5%. It's a mixed bag operationally, and it's hardly as if any new owner could provide a silver bullet to re-rate performance.

Growth is divided between the largest division – First Student buses in the US/Canada – and First Rail in the UK, up 5.8% and 5% over nearly 11 months of the March 2019 financial year. First Bus (UK) and First Transit (buses for US public authorities) are up 1.4% and 0.9% respectively.

First Student has benefited from price rises and higher contract retention rates despite driver shortages amid strong US employment, with cost-efficiency actions supporting profit growth.

First Rail has seen like-for-like passenger revenue up 5% recently slowing to 4.2% this last September to January period – chiefly due to infrastructure issues disrupting services in late 2018. Great Western Railway is rolling out the Hitachi Intercity Express Train fleet and "continues to manage customer journeys around the substantial infrastructure upgrade work being undertaken by Network Rail."

First Bus saw 1.3% passenger revenue growth more than offset a like-for-like passenger volume decrease of 1.9%. Contactless ticketing has been introduced to improve customer convenience and efficiency.

Showing the capex needs of transport services, a total 175 new ultra-low emission vehicles form part of a £71million investment in a partnership with Leeds, helped by the £11.2 million sale of a Manchester bus depot.

First Transit is broadly flat with contract awards and organic growth offsetting some relatively large contracts ending, including high-margin business in the Canadian oil sands region. Also, Greyhound bus in the US eased 0.4% year-to-date, though it had slightly improved by 0.2% September to January.

Its trading environment remains difficult but "early signs of improvement" derive from commercial and operating changes across the network. Services have been cut back in Canada and the sale of a facility in Chicago raised $38 million.

Final results are due on Thursday 30 May which should clarify more. If you hold this stock, then pay attention: if no announcement is forthcoming to justify a 21% rise it is liable to fall somewhat. You might want to lock in some gains for prudent risk management. But ahead of the results, and with improving narrative, on a long-term view: Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.