Stockwatch: results reinforce appeal of this momentum play

There are lots of reasons to believe this high-quality AIM company will continue to do well. Analyst Edmond Jackson updates this successful share tip.

8th October 2024 12:42

by Edmond Jackson from interactive investor

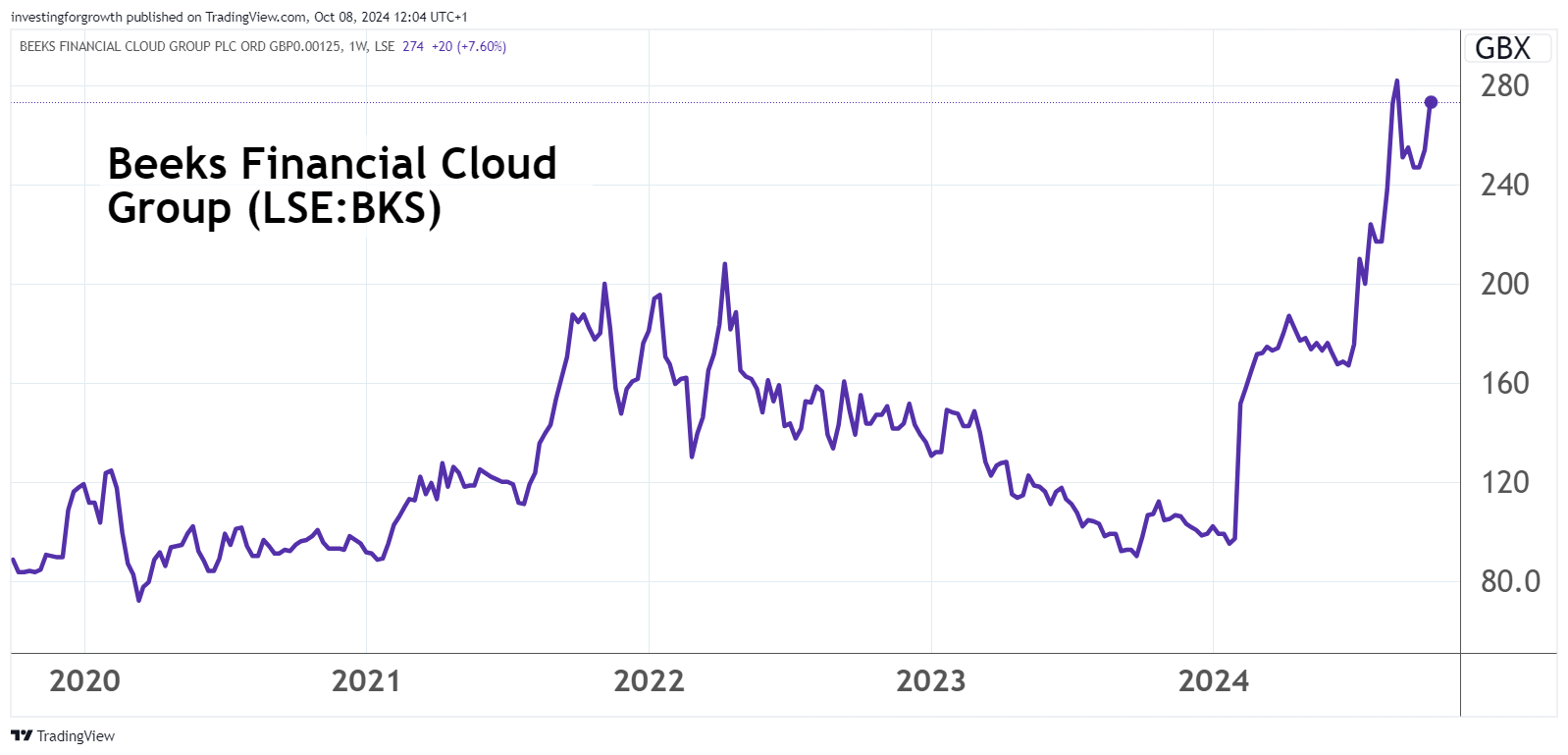

Despite some risk, the possible abolition of business relief could cause volatility among AIM shares around Budget time at the end of October. But investors are prioritising the commercial momentum at Beeks Financial Cloud Group (LSE:BKS), evident in its annual results to 30 June.

Market price closed up 7% at 272p yesterday, approaching the all-time high of 286p last August, albeit they’re slightly easier this morning at 270p, in sympathy with the market.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Beeks was founded in 2010 and listed on AIM in 2018 when on course for just £5 million of revenue, growing more significantly since 2021 – possibly with around £40 million in prospect to June 2025. Latest results for this Glasgow-based provider of cloud computing for financial firms and exchanges have delivered broadly in line with recent guidance, and the forward price/earnings (PE) multiple may be up to 40x.

Yet with interest rates seen easing into 2025, it is a good example of how minds are again attuned to growth stocks as the best means to play such a financial environment. Attention is on revenue dynamics, especially in smaller firms able to transform their numbers. Beeks has eliminated debt beyond modest leases and growth now looks self-financing with no dilution.

I first drew attention to the stock as a long-term “buy” at 80p in early September 2018 and its price breached 200p but, with interest rates then rising, it traded down below 100p again by late 2023.

Source: TradingView. Past performance is not a guide to future performance.

I repeated a “buy” stance last February at around 140p after Beeks had jumped at end of January on substantive contract news – as if this marked an inflection point for this business. Again, we saw a volatile progression – it appears holders here need to be steeled for more – with the shares up near 190p by April yet easing to a 160p range before re-rating to 275p over July and to August.

A pre-close trading update essentially affirmed profit expectations, then on 14 August came regulatory approval for a contract for “one of the largest exchange groups globally” (speculated as being the US Nasdaq) which “marks the initial phase of an intended multi-year partnership between Beeks and the exchange.”

It is the third international exchange to sign up, and the latest outlook statement continues a theme of more in the offing.

‘Priced for perfection’ but hard to see what goes wrong

Reputational damage from technology failures appears the most significant risk, yet nothing material has manifested over the years.

- 11 AIM companies that doubled in the third quarter

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

There does not appear to be competition capable of knocking Beeks off a lead position for delivering information instantly and ubiquitously. Obviously, that could change in time, but long-term contracts for IT that is evolving as the industry benchmark is going to get rated highly.

Exactly how high hinges on what view you want to take of normalising earnings. The latest income statement shows near £11 million earnings before depreciation, amortisation and share-based payments; the biggest deduction being £5.1 million for depreciation which the cash flow statement adds back – such that net cash from operations has risen from near £7 million to £10.6 million. Reported operating profit, however, gets whittled down to £1.6 million.

Beeks Financial Cloud Group - financial summary

Year end 30 Jun

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 1.3 | 2.7 | 4.0 | 5.6 | 7.4 | 9.4 | 11.9 | 18.8 | 22.7 | 28.5 |

| Operating margin (%) | 34.5 | 8.4 | -17.0 | 16.1 | 16.2 | 10.1 | -3.8 | 2.1 | -1.5 | 5.6 |

| Operating profit (£m) | 0.5 | 0.2 | -0.7 | 0.9 | 1.2 | 1.0 | -0.5 | 0.4 | -0.3 | 1.6 |

| Net profit (£m) | 0.3 | 0.1 | -0.8 | 0.8 | 1.1 | 0.6 | 1.6 | 0.8 | -0.1 | 2.2 |

| EPS - reported (p) | 0.6 | 0.3 | -1.6 | 2.3 | 2.1 | 1.1 | 3.1 | 1.4 | -0.1 | 3.1 |

| EPS - normalised (p) | 0.6 | 0.5 | -0.1 | 3.0 | 2.3 | 1.6 | 4.8 | 1.5 | 0.0 | 13.5 |

| Return on total capital (%) | 118 | 45.8 | -756 | 17.0 | 18.6 | 7.6 | -2.6 | 1.0 | -0.9 | 33.4 |

| Operating cashflow/share (p) | 1.4 | 1.9 | 1.3 | 1.3 | 4.1 | 6.3 | 10.5 | 7.6 | 10.6 | 15.9 |

| Capital expenditure/share (p) | 0.6 | 1.6 | 1.7 | 4.3 | 5.5 | 6.9 | 12.9 | 21.0 | 10.9 | 10.2 |

| Free cashflow/share (p) | 0.8 | 0.3 | -0.4 | -3.0 | 1.4 | -0.6 | -2.4 | -13.4 | -0.3 | 5.7 |

| Dividend/share (p) | 0.0 | 0.0 | 0.0 | 0.30 | 0.35 | 0.35 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cash (£m) | 0.07 | 0.03 | 0.02 | 2.9 | 2.3 | 1.4 | 3.4 | 10.2 | 7.8 | 7.7 |

| Net debt (£m) | 0.05 | 0.2 | 0.3 | -2.1 | -1.0 | 0.8 | -1.9 | -4.3 | -2.0 | -7.7 |

| Net assets (£m) | 0.3 | 0.4 | -0.4 | 4.8 | 5.6 | 6.7 | 13.8 | 30.8 | 32.8 | 37.5 |

| Net assets per share (p) | 0.6 | 0.8 | -0.8 | 9.7 | 11.1 | 13.1 | 24.6 | 47.0 | 50.0 | 56.2 |

Source: historic company REFS and company accounts

There is scope to take differing views on what is added back to “normalise” earnings. Beeks adds back £304,000 for amortisation specifically on acquired intangibles, but also £2.3 million for share-based payments – which to me are a genuine cost to shareholders. I would therefore put normalised pre-tax profit at £1.6 million, after which a £734,000 tax credit (also in question, if you want to “see through” to genuine performance?) takes net profit to £2.3 million or earnings per share of 3.5p – versus the company’s presenting 6.4p.

With market price currently around 275p, it makes for a whopping PE multiple range of 43x up to near 80x – though would not be out of line with US valuations were Beeks listed there or a US acquirer ultimately materialises.

Yesterday at least, enough buyers here were prepared to look at a circa £180 million market cap, with revenue growth in the order of 30%, and reckon on tucking the shares away as another example of a “momentum” business growing into a hefty valuation.

When I drew attention in 2018, it was significantly due to sensing a parallel with Fidessa Group – another “infrastructure-as-a-service” share which 20 years and more ago also traded on a big PE. Similarly in 2018, Fidessa ended up being acquired for £1.5 billion. I do not imply anything similar for Beeks, although there was a lesson in tolerating a high PE and how yet another British technology success story gets taken over.

The US accounts for a majority 39% of revenue, UK 25%, Europe 10% and rest-of-world 26%. Hence, though small, Beeks has true international reach.

Modest revenue roll-over into current financial year

Admittedly, the price/sales ratio is also high – factoring in expectations of strong growth – at 6.3x in respect of the last year, easing to 4.5x assuming (guidance to) the company broker which projects around £40 million revenue to June 2025. PS ratios do vary markedly, though 2-3x might typically be the high.

In due respect, the recurring revenue element is now up to 84% and annual growth is in the order of 30% - possibly over 40% this year – albeit from a relatively small base.

- The future of AIM: how the small-cap market can survive

- The funds most at risk of AIM stocks losing IHT relief

The crux for a PS ratio might also include the extent of operating margin. If high, then revenue growth may swiftly drop through to profit.

So, again with Beeks, it rests on what charges you want to add back. Management proclaims an earnings before interest, tax, depreciation, amortisation (EBITDA) margin of 37.5%, but my “normalised” view would be as low as 6.7% at the operating level – nothing special.

Continuing down the income statement, net interest costs were just £124,000 due to income on near-£8 million cash and no financial debt beyond £3 million leases. The aspect of tax credit relates chiefly to “origination and reversal of temporary differences” than R&D, so it’s unclear whether we should rely on this continuing (to the same extent).

Contract news likely to sustain investor interest

The outlook statement teases with “material growth in sales pipeline for Exchange Cloud, with several major international exchanges entering the final stages of contracting, and others at earlier points in the sales funnel.” This does however re-iterate a 14 August update.

So unless markets slide on Middle East conflict jacking up oil prices, or the 30 October Budget disrupts the AIM market, this share is likely to remain firm – even responsive – to news.

The wider trend in interest rates also appears supportive. I say “gently” because investor hopes for rate cuts appear to exceed what central banks may do, according to inflation. The trend should however be broadly downwards now, compared with expectations of rises, helping explain why this share fell from 2022 and 2023.

Beeks can therefore be seen as a classic momentum play where you would buy a short-term drop. It is likely to remain relatively volatile, with the long-term prize potentially a takeover.

In the wake of positive news from the results, and respecting current macro risks, I adjust to “hold” without implying a downgrade.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.