Stockwatch: time to buy a slice of this FTSE 250 share again?

It’s recently bounced off levels not seen since 2022, and a change in strategy could eventually double this company’s dividend. Here’s what analyst Edmond Jackson thinks ahead of a trading update this month.

6th May 2025 10:33

by Edmond Jackson from interactive investor

Have the FTSE 250 shares in “food to go” retailer Greggs (LSE:GRG) derated to a level that’s attractive for value – or are they fairly priced after a period of overvaluation and, since the second half of last year, tougher conditions for this type of business?

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

When I have looked at Greggs in the past, its shares often seemed highly rated for a sandwiches and sausage rolls operation. That was possibly justified when retail conditions were good and UK roll-out was in full swing, although having achieved over 2,600 outlets relative to 3,000 as the long-term objective, it could be said that near 90% of the growth potential has been achieved.

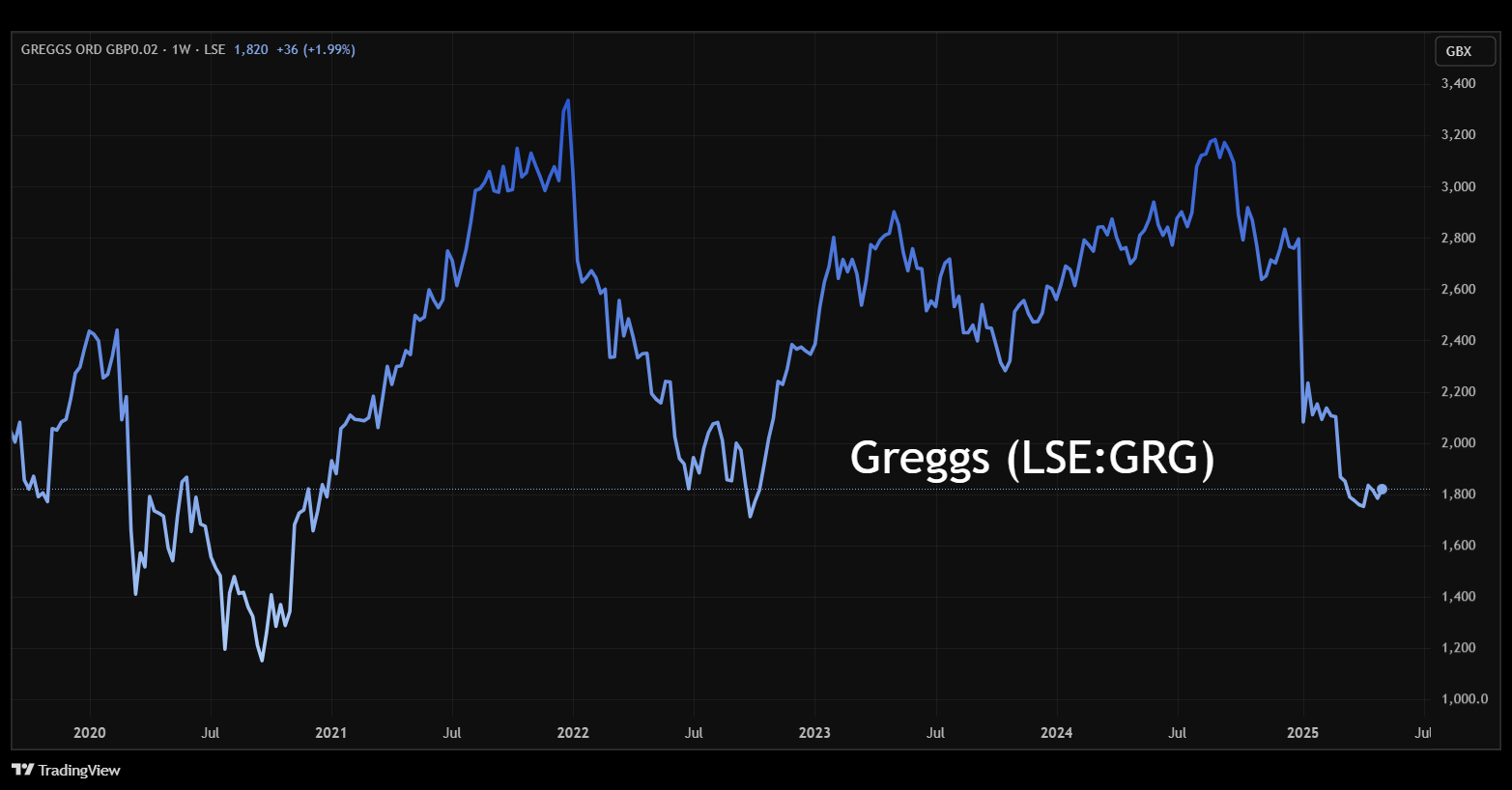

Might a recent derating from over 3,000p nine months ago to around 1,780p partly reflect an inevitable sense of “ex-growth” encroaching, in order to start pricing the shares for a meaningful yield? Such a life cycle from growth to income can quite often manifest. Even at this level, and with the dividend covered around twice by projected earnings, the yield is below 4%. Conceptually then, Greggs might be “falling between two stools” of growth and income where strictly you would wait at least for the chart to affirm support.

Source: TradingView. Past performance is not a guide to future performance.

Looking further back, within an overall rising trend from around 400p in 2013 there have been some half-dozen big swings, as if Greggs is more a share to trade than hold.

On a 10-year view, and for what chart support levels are worth, the retracement does look pretty much complete unless a trading update due Tuesday 20 May re-affirms a downward trend in revenues.

Perhaps one should just be pragmatic about this and accept that Greggs has undertaken another mean-reversion to potentially set up another self-reinforcing trend. What however could be the trigger?

Something indigestible in tasty 2024 headline results

The key recent problem for perception has been a declining trend in like-for-like sales growth, from 7.4% in the first half of 2024 to 5% in the third quarter and 2.5% in the fourth. In the first nine weeks of 2025 it was just 1.7%, with bad weather blamed for January albeit improved trading cited for February.

Otherwise, headline numbers for 2024 at the 4 March results were respectable, with underlying operating profit up 13.7% over £195 million on sales up 11.3% to £2,014 million. The dividend rose 11.3% to 69.0p per share, as if underlining confidence, the only niggle being a disparity between headline earnings per share (EPS) up 7.5% to 149.6p versus underlying profit up 11.1% to 137.5p.

- Stockwatch: a status change for this once troubled share

- Insider: directors buy at FTSE 250 firm and high-flying Haleon

- AGM alert: Haleon, Greggs, Raspberry Pi

In fairness, this was a respectable achievement in context of relatively low consumer confidence and no growth in the “food to go” market. It testifies to Greggs’ management capability and the business set-up, although it was helped by the opening of a net 145 shops, which took the estate to 2,618, and with a similar target for this year. Delivery sales saw a 30% rise albeit from a low base.

At this time, management expressed confidence it could manage inflationary headwinds (such as the rise in employment costs from 1 April) and deliver “another year of progress in 2025”. Expectations were “unchanged”.

It’s unclear whether that benchmarked against guidance a few months ago, being similar to now, where consensus expects a 9% fall in net profit this year to £139 million, or reflects more recent downgrading within the range of forecasts. Its median forecast also now looks for a circa 6% slip in EPS to 135p, then 2026 to achieve £143 million profit and EPS of 140p. It’s not clear how conjectural that might be amid current uncertainties.

Such a scenario implies a PE multiple of 13.2x easing to 12.7x, which to me looks fair enough, with further possible downside if the next trading update due on 20 May is more cautiously toned.

Greggs - financial summary

Year-end 31 Dec

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 1,168 | 811 | 1,230 | 1,513 | 1,810 | 2,014 |

| Operating margin (%) | 9.8 | -0.9 | 12.5 | 10.2 | 10.6 | 10.4 |

| Operating profit (£m) | 115 | -7.0 | 153 | 154 | 192 | 209 |

| Net profit (£m) | 87.0 | -13.0 | 118 | 120 | 143 | 153 |

| Reported earnings/share (p) | 85.0 | -12.9 | 114 | 118 | 139 | 150 |

| Normalised earnings/share (p) | 93.7 | -1.5 | 116 | 119 | 143 | 144 |

| Operating cashflow/share (p) | 214 | 43.2 | 278 | 246 | 304 | 303 |

| Capital expenditure/share (p) | 87.1 | 61.0 | 52.8 | 101 | 194 | 235.0 |

| Free cashflow/share (p) | 127 | -17.8 | 225 | 145 | 110 | 68.3 |

| Dividend/share (p) | 11.9 | 0.0 | 57.0 | 59.0 | 62.0 | 69.0 |

| Covered by earnings (x) | 7.2 | 0.0 | 2.0 | 2.0 | 2.3 | 2.2 |

| Return on total capital (%) | 19.8 | -1.2 | 22.5 | 21.1 | 22.4 | 20.7 |

| Return on equity (%) | 25.1 | -3.9 | 31.3 | 27.5 | 29.2 | 27.9 |

| Cash (£m) | 91.3 | 36.8 | 199 | 192 | 195 | 125 |

| Net Debt (£m) | 184 | 255 | 84.6 | 110 | 124 | 290 |

| Net assets per share (p) | 343 | 317 | 421 | 437 | 519 | 558 |

Source: company accounts.

Notwithstanding the Covid disruption in 2020, this year’s expected earnings drop means Greggs no longer qualifies for any price/earnings-to-growth (PEG) ratio, and even disregarding that, the 2026 expected recovery is tepid.

Investors for total return have to assume management can achieve something else special on the marketing front, otherwise the price/earnings (PE) ratio based on expected numbers does look high enough. To me, Greggs seems a bit curiously positioned; cheaper, say, for coffee than most outlets but not offering hot pastries like some others.

An income share?

With twice earnings cover, consensus anticipates a dividend per share of 68.1p rising to 70.6p, which implies a yield close to 4%. Despite the market’s rebound from April lows after Trump unleashed tariff chaos, more compelling yields remain within UK equities.

There is also less balance sheet protection from downside risk, with the shares over three times (tangible) net asset value. But there is no financial debt beyond £415 million leases offset by £125 million cash, relative to £571 million of net assets.

But Greggs’ 2024 cash flow statement shows nearly 80% of £311 million net cash flow from operations going on investment in new store openings, relative to £107 million on dividends. So, if the strategy was to change with business maturity – returning more cash – then potentially the dividend could at least double.

- Shares for the future: new scoring splits my Decision Engine

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This is a speculative view, but if such a strategy is pursued, say, after two to three years, buyers at current prices might possibly lock in a 125p dividend equating to a 7% yield. Even in a worst-case scenario, where sales and profits trend broadly flat and the shares drift further, it could be a catalyst for such a change in returns policy. The business does currently look as if it can support higher payouts if investment falls as store expansion matures.

Alternatively, and in a more positive scenario of limited downside for 2025 then 2026 recovery, management might exact further growth, hence modest capital upside for the shares even if the PE remains quite similar.

Potentially, the board could later on still change the strategy to run operations more like a cash cow – for dividends and buybacks.

A possible ‘buy’ case now exists

Much hinges on the next trading update. I do not find this an overly short-term view given the declining like-for-like revenue trend since the second half of last year, but we do need to see this rebuilding.

According to your risk appetite, if the share price fall stabilises this month as if sellers have tired, then it could be time to take a starter position before the update. Risk lies also to the upside in the sense the shares could rise simply if it avoids disappointment.

It really needs to show like-for-like sales continuing to improve since February and management succeeding to pass on costs like they said they could.

Somewhat disconcertedly, the price fell 2.5% last Friday relative to a strong market, although hopefully this is just a re-allocation to shares performing better in the current rally rather than well-informed selling.

It would be reassuring to have seen insiders buy meaningful shares if they have derated excessively, rather than just option grants for the chief executive and chief financial officer in March.

Strictly on an investment view, you would await required evidence in the update, and possibly for the chart to signal support. The stance is properly “hold” unless you fancy speculation.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.