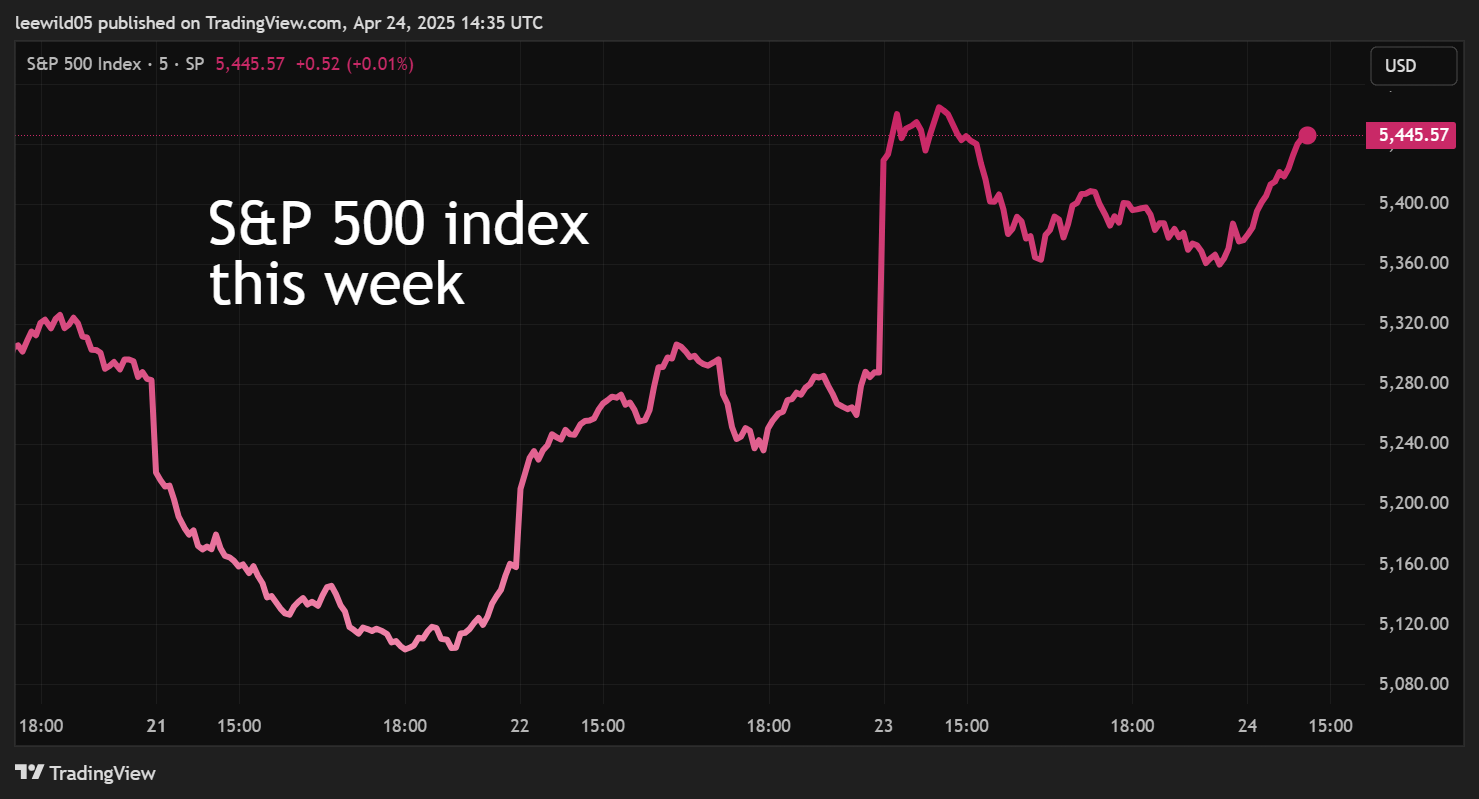

Stockwatch: is trade tariff risk really receding?

In a week when all the world’s major stock markets are in positive territory and US tech is up 4%, analyst Edmond Jackson takes stock of where we are and what the future might hold.

25th April 2025 09:28

by Edmond Jackson from interactive investor

Roller-coaster markets over the past week appear to have affirmed a “buy the drop” approach - especially in many UK shares - amid President Trump lurching between aggressive tariffs, then softly backing off against China.

The US-China relationship is axiomatic for US smaller businesses, which provide around 80% of jobs and rely on it to achieve their manufacturing and retailing goals. A US downturn would affect us all, and despite a sense of recovery in stock markets we have yet to see how the chaos will really affect business.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Source: TradingView. Past performance is not a guide to future performance.

A moderate turn in US administration rhetoric

US Treasury Secretary Scott Bessent has seized control of the narrative, asserting on Wednesday an opportunity for a “big deal” between the US and China on trade, if China balances its economy with less dependence on export-led manufacturing growth.

It was also reported that a White House official said the administration was considering reducing China tariffs to between 50% and 65% but that it would have to be bilateral, with China reducing tariffs as well. It’s unclear whether 50%-plus would accord with China, which recently set out conditions to include being treated with respect.

Ironically, and despite being welcomed by stock markets, there could be a worse near-term impact on the US economy if importers wait for tariffs to drop, compounding shortages.

- Ian Cowie: four ways to tap into a potential trade war winner

- FTSE 250 shares round-up: mid-caps fess up to tariff impact

Second, and for the medium to longer term, why should firms embark on complex costly repatriation of manufacturing or look for alternatives to China, if “something greater than zero” on tariffs (one of Trump’s quotes from late Tuesday) is an eventual possibility for Chinese imports to the US.

Tariffs are in Trump’s DNA. He seems unlikely to abandon this crusade, and a baseline 10% tariff is going to have consequences anyway. But at least that would make the prospect of a US recession more like 50:50 rather than a certainty if the current situation of 145% tariffs on Chinese goods and 125% vice versa persists.

What is likely to be China’s next move?

Contributing to stock market falls at the start of this week was China warning of “resolute and reciprocal” countermeasures against other countries negotiating with the US, if they make a deal at China’s expense during the trade war.

These words may have been a response to declared US plans to impose levies on Chinese ships docking at US ports. This is to take effect in six months, with another phase involving liquefied natural gas in three years.

Perhaps both leaderships, having peered into an abyss, will now start a new trend of edging back, in which case markets could settle somewhat. Or, if China feels emboldened, might the clashes continue? It rather looks as if China has won round one.

The big outstanding dilemma is Trump’s liability to lash out and blame others, especially when things are not going his way. Can things really improve for the US while he is president?

Interesting facts to get tariffs in perspective

Research on the effects of the 2018 Trump tariffs shows every 1% rise in the general level hits US gross domestic product by around 0.25%. So, with the average tariff rate currently hiked from 3% to 18%, multiplying by 15 implies a hit of around 4%. There is the additional impact to confidence, currently a wealth effect from the US stock market fall and reduced tourism to the US.

Big US business may have the financial capacity to pay tariffs – albeit at some cost to earnings – but they will hit smaller firms hard. Amazon.com Inc (NASDAQ:AMZN) sources 70% of its goods from China, and 40% of US imports from China go to smaller US businesses.

Bessent says he wants China to change its economic set-up but implicitly asks the same of many US firms.

Yet a consistent message from business interviews is of Chinese manufacturing being the global “gold standard”; that moving production to a new region is very hard, regardless how high tariffs are.

- ‘Cockroach shares’ the pros are backing to survive market turmoil

- Anatomy of a stock market crash and playbook for the recovery

Every consumer electronics manufacturer relies on China, and even if manufacturing does get moved to the US, the loss of a broader ecosystem would compromise the quality and price that American consumers have enjoyed.

International trade analysts say China’s lower prices are not necessarily linked to lower wages; the country has moved up the value chain thereby enhancing quality. That workers have now spent decades in the same industry means they are highly skilled and specialised, enabling factories to easily adapt customisation demands.

China is thus well-adapted to serving small-batch production runs, which again is why US smaller business will be compromised. US firms will otherwise have to import some raw materials from China, with production viable only beyond a minimum order.

For example, the US tattoo industry says setting up domestic production of needle cartridges would be prohibitively expensive and there is no global alternative to sourcing than China.

Meanwhile, China has adapted since 20% tariffs were initiated by the first Trump administration and maintained by President Biden, diversifying its exports such that nowadays the US constitutes only around 15%.

Pharmaceuticals remain a risk for Europe, especially the UK

Trump has ordered an investigation into US medicine imports as a first step, suggesting a 25% levy in the “not too distant future”. Time will tell where that gets struck, but I would be surprised if he abandons the principle, and the UK be exempted as part of a bilateral trade deal.

Reportedly, the UK government presented a draft trade deal to the US some weeks ago but could rip it up if pharmaceuticals are hit.

Remarkably, UK equities have shrugged off Trump’s impetuous behaviour, which may reflect the fact that international investors are re-allocating from the US and individuals are seizing big yields offered mid-week.

Mind ‘extrapolation bias’ within economic modelling

If the World Trade Organization’s (WTO) forecast for a mere 0.2% slip in global trade this year after 3% growth in 2024 is fair, investors may have little to worry about. They may be happy to buy the next drop given the WTO also contends that even if the US re-asserts “reciprocal” tariffs after the current 90-day amnesty, it could lead to a 1.5% decline in trade before growth of 2.5% resumes in 2026.

I think such projections need a big pinch of salt given the difficulty in quantifying the medium-term downside to persistent draconian tariffs.

- Six things to know about volatile markets and your pension

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Similarly, the International Monetary Fund (IMF) has trimmed its global growth forecasts only from 3.3% in 2025 and 2026, to 2.8% and 3.0% respectively. But if the US-China relationship is broken, things could get a lot worse.

Modelling involves significant extrapolation of historic trends, easily overturned by force majeure like we sometimes see in company earnings forecasts.

A silver lining overall this week

It still appears overall positive how reality has begun to sink into the US administration. Reportedly, big business warned Trump of empty shelves if he did not dial back.

Yes, tariffs can occasionally be justified to protect specific domestic industries – steel being a typical example given its importance for defence production. But even then, the wider economy starts to suffer, and the effect worsens the wider and greater tariffs are applied.

The verdict will not be clear until we see more economic data and mid-year company updates.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.