Supermarket shares: the ones to buy and sell

After the latest industry data, one of the big grocery chains is in favour, another has headed lower.

28th April 2020 15:19

by Graeme Evans from interactive investor

After the latest industry data, one of the big grocery chains is in favour, another has headed lower.

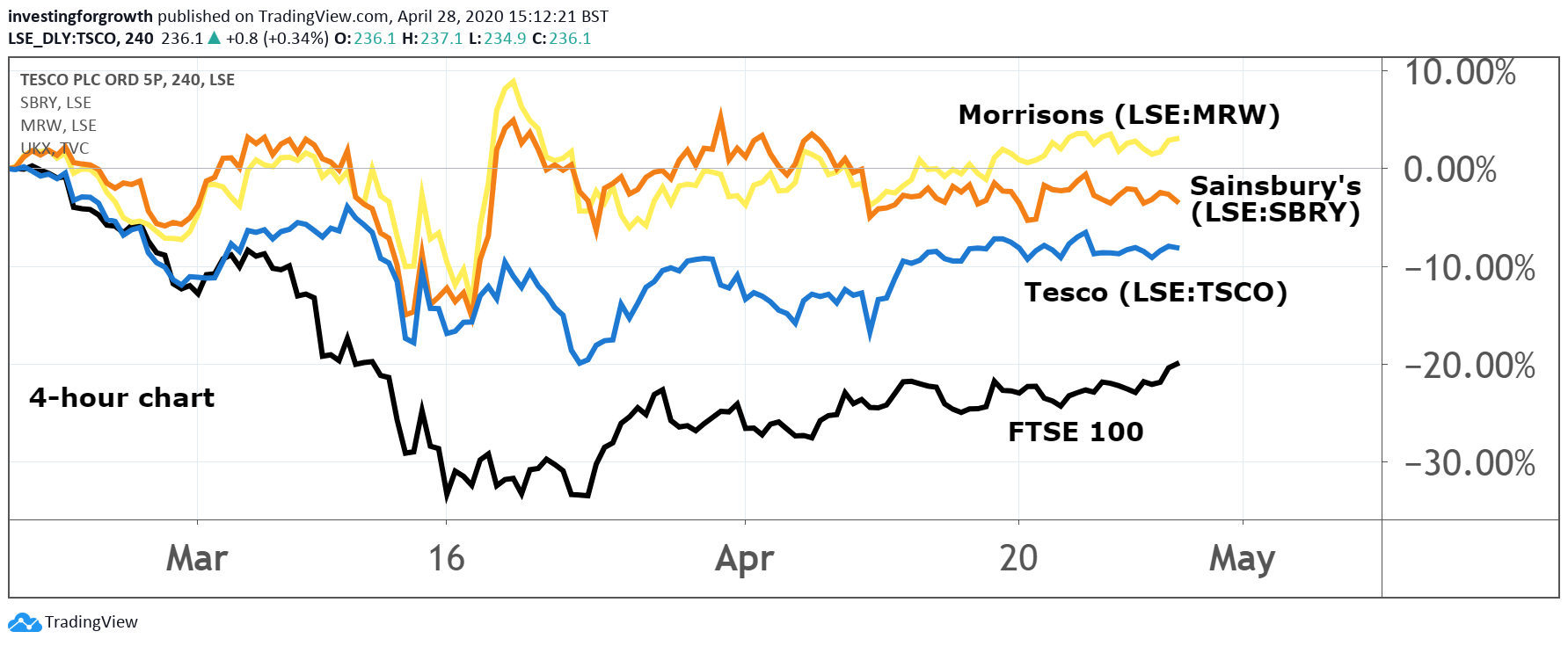

The safe haven appeal of Britain's supermarkets was put to the test today as Tesco (LSE:TSCO) and Wm Morrison (LSE:MRW) emerged as the blue-chip stocks most likely to benefit from surging demand.

Sainsbury's (LSE:SBRY) was left out in the cold, however, with German bank Berenberg changing its recommendation from “buy” to “sell” due to fears over potential exposure to bad debt provisions from the supermarket's banking operation.

Berenberg's updated view on the sector elevates Morrisons to a “buy” rating alongside Tesco, with the target price lifted to 213p from 200p. Tesco was already favoured due to its strong cash generation and expectations for a share buyback in 2021.

As well as no banking operations, Berenberg said the limited exposure of Morrisons to non-food categories left it well placed to cope with any drop in discretionary spending by consumers. It should also benefit from accelerated online grocery sales due to favourable consumer trends and its developing relationship with Amazon.

And the closure of pubs and restaurants for the foreseeable future means the whole sector is unlikely to see any let-up in food and drink demand from stay-at-home consumers.

This change in spending patterns was highlighted by today's Kantar industry data, with grocery sales in Britain up by 5.5% year-on-year in the four weeks to 19 April. This compares with record growth of 20.6% in March when shoppers were in panic-buying mode ahead of Britain going into lockdown.

Source: TradingView Past performance is not a guide to future performance

The stockpiling phase of the crisis is now over, with the eating-at-home benefits for supermarkets offset by the disruption of social distancing measures in stores and the loss of other areas of business, such as tourism-driven sales or general merchandise trade.

Kantar noted that households were venturing out on fewer occasions, with the average number of shopping trips in the month down to 14 from 17 in more normal times. This trend is likely to favour traditional grocers and retailers with strong online exposure over the discounters.

- Sainsbury’s ex-boss Justin King on Covid-19, shares and shoppers

- M&S’s dividend shock, Games Workshop amazes

- Why Tesco just hiked its dividend by over 58%

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The drop in frequency was matched by an uplift in the amount spent on each trip, which was £7 higher than last year at £26.02. Analysts at Morgan Stanley said: “We note that, even when things stabilise, we would still expect more in-home consumption, which should benefit grocers.”

They said reports suggesting that Tesco had started laying off the first wave of the 45,000 temporary workers it hired in response to Covid-19 were a sign that a more normalised spending environment had emerged.

This could mean that potential costs flagged recently by Tesco of more than £650 million may end up being less than expected. Morgan Stanley has a price target of 285p, compared with the current 235.5p.

Sainsbury's is due to present its annual results on Thursday, when the focus will be on whether it goes ahead with a £247 million dividend at the same time as being eligible for taxpayer relief on business rates. Profits for the year are likely to be down slightly to £590 million.

The shares have remained close to 200p during the lockdown period, having fluctuated between 173p and 215p in the days beforehand. Morrisons was 1% higher today at 188p.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.