System1: Testing its powers of recovery

17th August 2018 15:39

by Richard Beddard from interactive investor

It's been a "miserable year" for the behavioural marketing firm System1 (formerly BrainJuicer). Richard Beddard asks whether its earnings power can recover to make the current share price look cheap.

The share price of market researcher System1 is behaving badly after a dramatic fall in profit. While the company is innovating its way out of trouble, it seems as though the market is moving faster.

"In short, a miserable year"

Not my words, but the words of System1 Group's charismatic and normally ebullient chief executive John Kearon.

Profit for the year to March 2018 fell dramatically, as System1's big customers - large consumer goods companies like Unilever and Procter & Gamble Co - cut marketing spend just as System1 was rebranding (it was called BrainJuicer) and recruiting heavily. The decrease in revenue and increase in costs had a big impact on profit.

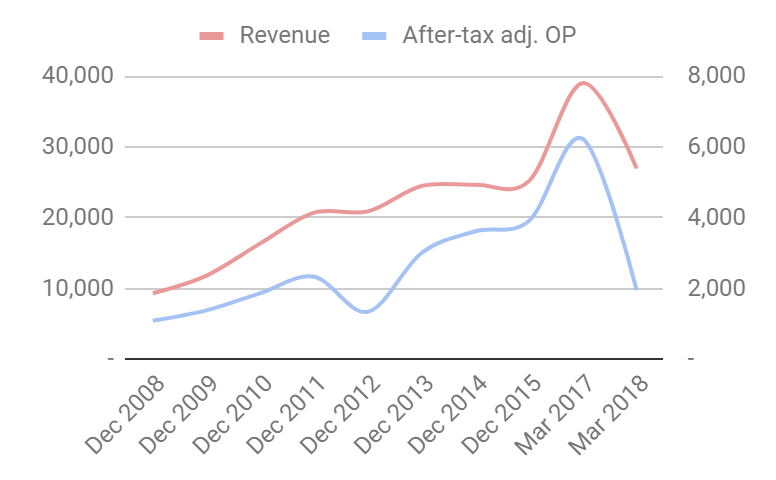

Source: interactive investor Past performance is not a guide to future performance

An excellent performance in 2017, depicted in the chart above, is inflated somewhat because that year System1 changed its financial year-end. The year to March 2017 includes the results of the 15 months since December 2015. The depth of the plunge in profit in 2018 to levels the company achieved much earlier in the decade is all real, though.

An unaudited comparison between the 12 months to March 2018 and the 12 months to March 2017 shows a 17% decline in revenue and 68% decline in pre-tax profit.

There had been warning signs. In 2012, System1 experienced a temporary reduction in spending by clients, and it has subsequently reported budget tightening.

It says it was caught out in 2017, after Heinz’s bid for Unilever demonstrated even the largest consumer goods companies were vulnerable to hostile takeovers if they didn’t boost profit in the short-term by cutting costs.

Unlike in 2012, System1 believes client budget cuts are probably permanent this time.

Scoring System1

As usual, I’m scoring System1 to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

I am not going to lie, scoring System1 was difficult.

Profitable: Does it make good money?

Score: 2

System1 is a market researcher. Its objective is to help clients create profitable marketing using behavioural science. It tests advertisements, tracks brands and tests new product and packaging concepts, essentially asking people what they feel rather than whether they might be persuaded to buy a product.

It says it can determine which advertisements and concepts will succeed but the one part of the business that grew gross profit in 2018 was the smallest, Brand. The company has a new framework for analysing brands and gross profit from this division increased 35%, contributing 20% of total gross profit.

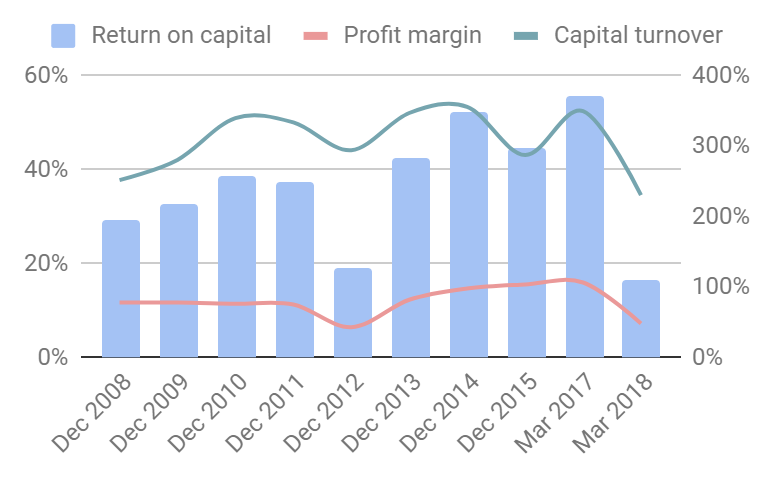

Amazingly, after such a dramatic decline in profit overall, System1 still earned a return on capital of 17%.

Source: interactive investor Past performance is not a guide to future performance

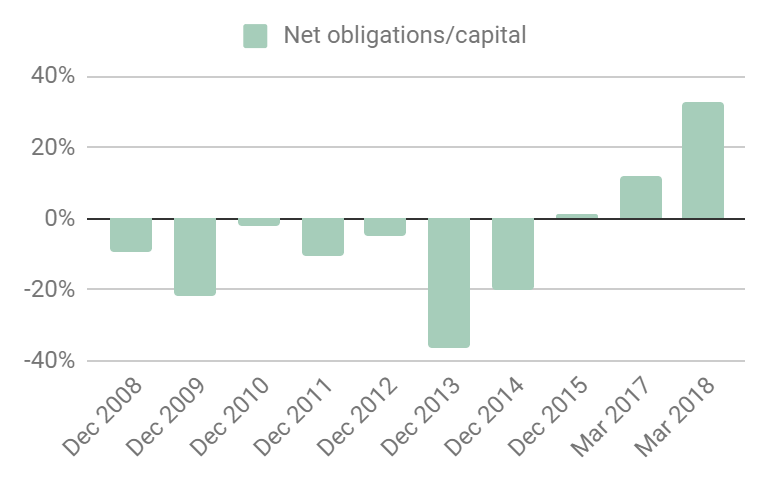

Though it has plenty of cash in the bank and no bank borrowings, its financial position has deteriorated somewhat, partly due to the payment of a special dividend in 2017 and partly due to increased rental commitments, presumably office space to support its expansion, which I count as quasi-debt.

Source: interactive investor Past performance is not a guide to future performance

Nevertheless, overall indebtedness is still relatively low. Judging by the numbers there is little to fear, except the future...

Adaptable: How will it make more money?

Score: 1

The company is responding to clients, who have been seeking to drive down advertising and market research costs for years now, while simultaneously requiring quicker results.

In the short-term, System1 has curbed its expansion plans and closed a small office in Shanghai.

Its strategic response is to separate the provision of testing, which can be automated, from advising clients on how to improve their marketing. The hope is more clients will adopt System1’s testing products as a routine element of their creative process, buying data repeatedly in bulk, while the company uses ad-hoc consulting gigs to promote more testing.

The good news is, System1 was headed in this direction already. The bad news is what it had already done was obviously not enough.

Separating the data provision from creative guidance has allowed System 1 to reorganise its account management teams, the consultants that provide the creative guidance, into specialist groups supporting each of its three key activities, advertisement testing (Communications), brand tracking (Brand), and concept testing (Innovation). This, and the outsourcing of routine tasks to Bulgaria, should allow them to do a better job.

It is also launching System1 Ad Ratings later this year, an online subscription service that rates new UK and US adverts and tracks the advertising performance of brands and companies. The service will show clients how their advertising compares to competitors’ to see whether they are getting good value for money.

The strategy is plausible, but veteran System1 watchers are probably wondering whether the company’s restless invention is getting it anywhere. Every year there are new products. Some of them stick. Others wither on the vine. 2016’s big launch, an advertising agency, has yet to profit. It is now described as “"..as much a showcase for how to develop "5-Star" adverts," as the promised new business stream.

Resilient: What could go wrong?

Score: 0

System1 is not promising anything more than an interesting year ahead.

It believes the predictive power of its techniques would be difficult for customers to replicate. That’s because it has been doing behavioural market research for longer than rivals and it claims the world’s largest and most global normative behavioural database, required to benchmark test results.

Its competitors, though, long established market research agencies like Millward-Brown are bigger and better resourced. It may not be taking them that long to build databases of their own.

System1 has long expected them to adopt the techniques of behavioural science, thinking that would thrust System1 into the limelight. This year’s annual report says competitors are adopting the behavioural approach, but it may have lost the belief it is a good thing!

System1's annual report doesn’t explain why it believes client budget cuts are permanent. Mergers and acquisitions activity ebbs and flows, so while Heinz's bid for Unilever was the catalyst for the latest cut in client spending, the permanent squeeze likely has a different cause - probably Google’s search and social media sites, particularly Facebook.

Online advertising platforms monitor our activity to offer us products and services when we need them. Companies can test different versions of the offer in the market, rather than asking people how they feel. It may be System1’s bad luck to have revolutionised market research surveys just as the scattergun approach of brand building that used them is, partially at least, displaced by targeted advertising.

Not only might consumer goods companies have more ways to spend their marketing budgets, but they might have less to spend if new marketing methods undermine the power of their brands.

I’m also troubled by System1’s bonus policy. It rewards staff handsomely when the company does well, but the lack of bonuses could result in a brain drain if the lean period stretches to two, or three years.

Equitable: Will we all benefit?

Score: 2

System1 may be re-calibrating its expectations but in the past the company has sought to double in size every four years. To grow, it needs to be able to attract new staff with good contacts and expertise from larger companies where they are are already paid more than System1 can really afford.

System1’s solution has been to offer very generous bonuses. If the company grows, staff get paid more because they’re working for a bigger firm. If it doesn’t, they don’t get the bonus.

On the face of it, it seems like a fair policy, and without it profit would have collapsed further (In the year to March 2017 it paid out over £2.2m in bonuses. In the year to March 2018 it paid £0.1m, over £2m less. If it had paid out £2.2m in 2018, it may have made a loss).

John Kearon, the founder and chief executive, owns 26% of the shares and long standing finance director James Geddes owns 2%. They have every incentive to ensure the business prospers.

Cheap: Is the firm's valuation modest?

Score: 1

The shares trade on a multiple of eighteen times adjusted profit in 2018. Profit in 2018 was very low by historical standards, but the commoditisation of research raises doubts about whether System1’s earning power will recover sufficiently to be confident the shares are cheap now.

Verdict: Speculative

System1 may well be be a good long-term investment, but it scores 6/10, below my arbitrary benchmark of 7/10.

I admire the entrepreneurial spirit and vision of its founder and the profitable growth System1 has achieved, but I’m not sufficiently confident the new techniques of the last decade will be relevant in a decade's time.

Contact Richard Beddard by email: richard@beddard.net or on Twitter:@RichardBeddard

Richard owns shares in System1.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.