Taking a chance on two US funds

I’m breaking rules hanging on to these great funds, but they’re for the chop if my faith is not rewarded.

26th July 2021 13:42

by Douglas Chadwick from ii contributor

I’m breaking the rules hanging on to these great funds, but they’re for the chop if my faith is not rewarded.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week, two funds triggered one of our selling rules and yet we have decided to give them the benefit of the doubt for one more week.

The funds in question are Baillie Gifford Long-Term Global Growth and Baillie Gifford American.

The Saltydog system is based on a proven set of algorithms that crunches vast amounts of UK fund data, and presents it in a way that is designed to help private investors take advantage of market trends. Our unique software, reports and information cover thousands of funds, highlighting which sectors are on the up, which are retracting, and then pinpointing the best-performing funds.

We also run a couple of demonstration portfolios showing how our data can be used to run a balanced range of investments.

Selecting which funds to invest in is relatively simple. We are looking for the leading funds in the best-performing sectors. To control the overall risk of the portfolio, we combine the sectors into our own Saltydog Groups, going from the lowest volatility, ‘Safe Haven’ to the most volatile, ‘Full Steam Ahead’.

- How Saltydog invests: a guide to its momentum approach

- Should investors prepare for an autumn market correction?

Having invested in a fund, we then review its performance each week and have to decide whether to keep it, add to it, reduce our holding, or sell all of it. This is a harder process and tends to be more subjective. If we only want to be holding the very best fund from each group, based on its recent performance, then we would be chopping and changing every week. Not only would this be very time consuming, but trading costs would quickly mount up and when we did our original back testing it did not prove effective.

Unfortunately, the same funds rarely stay at the top of our tables for weeks on end. It is very common to see a fund drop down the rankings for a couple of weeks, but then recover. That is why we developed our ‘three weeks in decile six or worse rule’.

Every week, we compare all the funds in each of the Saltydog Groups. We give each one a decile ranking for various different time periods. The best 10% of funds are in decile one, the next 10% are in decile two, and so on down to the worst 10%, which are in decile 10. If a fund has three consecutive weeks with a weekly decile ranking of six or worse then the rule is that we reduce our holding.

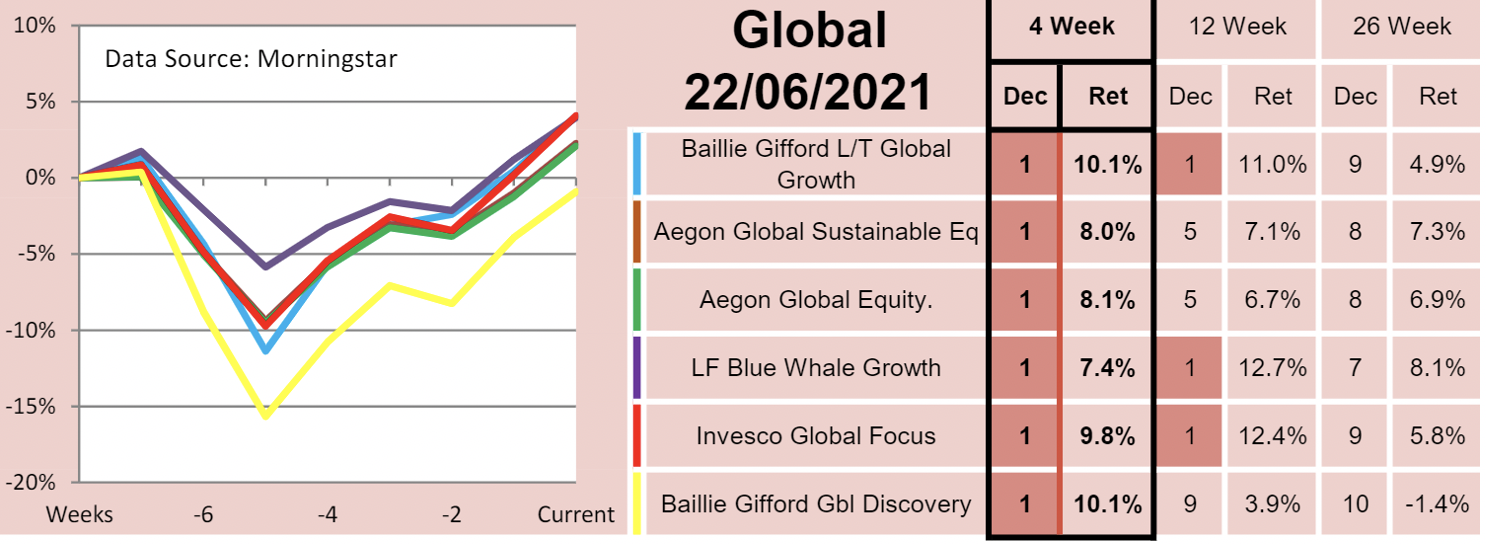

We invested in the Baillie Gifford Long Term Growth fund at the end of June. Although it is from the Global sector it has a strong bias towards the US, with around 65% of the portfolio invested in North American companies. At the time, it was the leading fund in our Full Steam Ahead Developed Markets group.

Past performance is not a guide to future performance.

It was in decile one based on its four-week and 12-week cumulative returns. It also had individual weekly decile rankings of one for the previous two weeks.

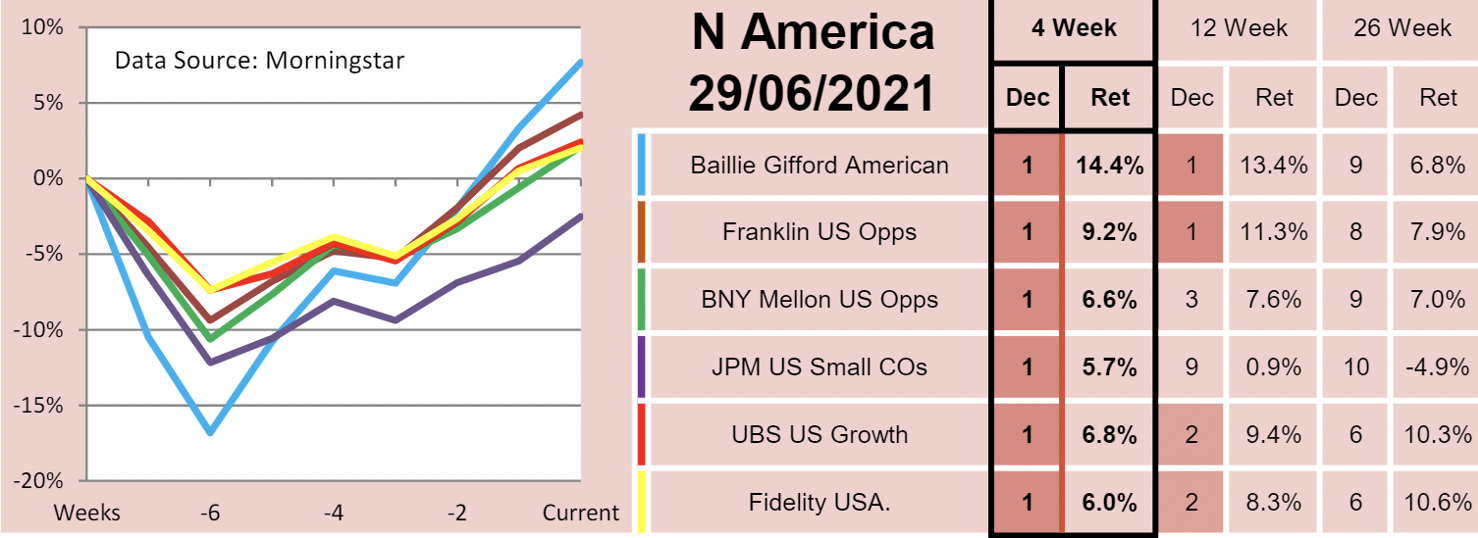

It had a great first week, was in decile one again, and when we reviewed the portfolios was showing a gain of 4.1%. We considered adding to our holding, but opted for the Baillie Gifford American fund instead.

Past performance is not a guide to future performance.

The following week was not so clever. Both funds were in decile six for the week. The return on our Baillie Gifford Long Term Growth fund had dropped to 2.4% and the Baillie Gifford American fund was showing a loss of 1.4%.

Things did not improve and when we reviewed the portfolios last Wednesday, the Baillie Gifford Long Term Growth fund’s gain was down to 1.8% and the Baillie Gifford American fund’s loss had grown to 2.8%. Both funds had been in the lower deciles for the previous three weeks, but there were signs that things might be on the turn.

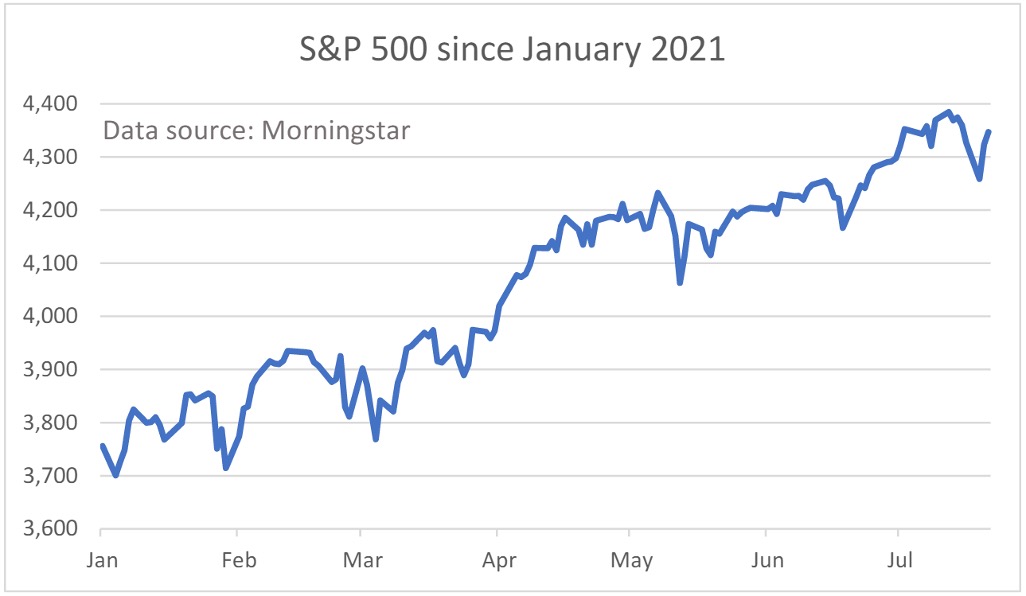

The US stock markets had struggled for a few weeks, along with stock markets all over the world, and that would have weighed heavily on these funds. However, at the beginning of last week there was a slight improvement - the graph below shows the upturn in the S&P 500 that we could see at the time.

Past performance is not a guide to future performance.

On Wednesday afternoon, the index was at 4,346.98. It ended the week at 4,411.79.

In last week’s portfolio update, I wrote “There are a couple of funds in the Ocean Liner portfolio that have broken our three weeks in decile six or worse rule, but we have decided to make an exception and give them a week's grace.”

I went on to say, “It would be a shame to bail out of these funds when it looks as though they are just about to take off again. Of course, I could be looking through my rose-tinted glasses, but if they don't move up the decile rankings next week then they'll be sold. That's one of the advantages of looking at the portfolios each week...if any decisions we make aren't supported by the markets, then we'll soon find out and be able to make amends.”

I remember that one of my first factory manager’s favourite sayings was, “rules are for the obeyance of fools, and the guidance of wise men”. I’m just hoping that I fall into the second category on this occasion.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.