Tapping into India's post-election growth

With India's economic mood boosted after the election, how can investors gain exposure to the country?

8th August 2019 12:20

by Tom Bailey from interactive investor

With India's economic mood boosted after the election, how can investors gain exposure to the country?

The outcome of India's recent general election was announced at the end of May, after six weeks spent counting about 600 million votes. As expected, incumbent prime minister Narendra Modi and his Bharatiya Janata party (BJP) cleaned up. In coalition with other right-leaning parties, the BJP now controls both the upper and lower houses of India's parliament.

This result means Modi will now serve another five years as prime minister of the fast-growing emerging economy. It's an outcome that has been widely celebrated by investors and markets. So what is all the fuss about?

India, with its large, educated population and democratic political system, is often seen as having huge economic potential – and Modi is now seen as the person with the key to unlocking that potential. Rukhshad Shroff, manager of the JPMorgan Indian investment trust, says: "Modi's execution record is immense."

Modi has launched initiatives to improve India's economy that have addressed India's messy banking sector; modified its bankruptcy law; standardised sales tax across the country (by introducing the good and services sales tax, or GST); made tax evasion harder; cracked down on corruption; increased the ease of doing business; pursued large infrastructure building projects; expanded access to digital banking for poorer citizens; and reduced the cost of capital and the rate of inflation – all of which have been welcomed by investors.

Shroff argues that the BJP's victory means the government's reforms will stay in place, while Modi will now be able to be even bolder in his approach.

He says: "Modi is a man with a 10-year vision," and points out that his return to power allows him to continue with that vision.

Where next for Modi's India?

Despite the excitement, growth in the Indian economy has not accelerated much under Modi. Growth, while strong at an estimated 7% in 2019 (though this statistic has been disputed), is no higher than in the pre-Modi years. Indeed, Shroff points out that many of Modi's reforms have acted to depress growth.

He gives as an example the crackdown on corrupt property developers. “There are about 110 developers in jail. The result has been that construction has come to a halt,” he says.

That said, the key point, he argues, is that Modi is now instituting structural economic reforms after almost 60 years of bad practice.

While this is not producing growth in the here and now, these reforms should help India develop a more business-friendly economy and generate growth in the future.

Aneeka Gupta, associate director of research at WisdomTree, says the new government is "likely to undertake reforms in key areas such as land, labour, capital and law to steer India along a more sustainable growth path".

That should boost foreign direct investment, which in turn is likely to boost economic growth and job creation. It may be some time, however, before investors feel the benefits.

Nevertheless, David Cornell, chief investment officer at Ocean Dial, which runs the India Capital Growth Investment Trust (LSE:IGC), says a number of Modi's reforms are already making India a more attractive place to invest. Principally, says Cornell, Modi's reforms are helping make the Indian currency, the rupee, more stable.

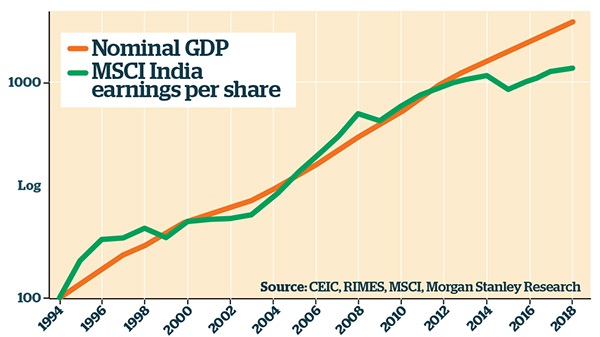

Growth has taken off over past decade

Note: Chart shows Indian GDP+ MSCI India EPS over 25 years, indexed to 100 (log scale)

Under Modi, there has been a welcome fall in the inflation rate in India. Cornell says:

"India has [experienced] double-digit inflation for much of the past 50 years. But over the past four years, inflation has been running at 4.5%, and, looking ahead, inflation is likely to stay in the 2%-6% range."

That, he argues, means India's central bank can keep interest rates lower and more in line with global norms. He says: "Currency volatility is largely a function of the differential between the interest rates set by the US Federal Reserve and those set by India's central bank." Less volatility should benefit UK investors, who have seen returns eaten into by the rupee's swings.

Meanwhile, certain industries are likely to feel the benefits of some of Modi's policies soon. Shroff expects earnings growth to accelerate over the near term.

He points out that earnings growth has been in recession for the past five years, despite moderately strong economic growth.

This was partly the result of headwinds caused by Modi's disruptive reforms. These have now become tailwinds, however, and corporate earnings growth should pick up.

As an example, Prashant Khemka, fund manager of the Ashoka India Equity Investment (LSE:AIE), points out that the implementation of GST is largely complete and has started to benefit corporate profitability.

He says GST implementation has meant that tax-evading firms in the "unorganised" segment of the economy are becoming more tax-compliant.

He adds:

"In doing so, they have become less competitive than and lost market share to the organised tax-paying segment of the economy, where all the listed companies belong."

Financials are also expected to see an uptick in earnings. After years of depressed earnings, "the banking sector is on the mend," Shroff says. Moreover, the sector has a new stimulus: Modi's campaign to get more of India's poorer citizens using bank accounts.

Don't just dive in

Investors should keep in mind that these are short-term pickups, and that India, for most DIY investors, should be a long-term play.

The focus should be on India's story of long-term growth, and its creation of a more favourable economic and business environment.

Khemka notes that India's demographics, increasing productivity, growing domestic consumption and aspirational middle class make India a multi-generational, long-term investment opportunity.

It would be advisable for investors to limit their India exposure to a small percentage of their portfolio, however – Emily Whiting, an investment specialist at JPMorgan Indian investment trust (LSE:JII), says single-digit exposure might be most appropriate.

Anthony Willis, investment manager in BMO Global Asset Manager's Multi-Manager team, says that, while India's growth potential is an impressive story, the valuation of the Indian market is unreasonably high at the moment.

India's market is currently on a price/earnings ratio of 28 times. That's higher than the US market (20 times), which is repeatedly flagged as being expensive.

The high valuation is the result of rapid growth being priced in. Willis says: "Right now, you are potentially buying at the top of the market. When we look at emerging markets, we look for places where we think there is more value at the moment. We think there are better (mispriced) opportunities elsewhere."

How to access India

Accessing India through a passive investment could entail exposure to firms not focused on India.

India's Nifty 50 index of the country's biggest companies generates 26% of its sales outside India, mainly in the information technology, healthcare, materials, energy and automotive sectors.

With that in mind, investing in an index tracker such as the iShares MSCI India ETF (LSE:IIND) may make sense for those expecting those sectors and the broader economy to benefit from Modi's reforms, although the fact that valuations are high should be kept in mind.

However, investors looking to tap into India's domestic consumer growth story may wish to look elsewhere. JPMorgan Indian investment trust and India Capital Growth (LSE:IGC) both have large holdings in Indian financials (40% and 20% respectively). This makes them plays on the growing Indian consumer market.

For risk control, investors may not want a single-country fund. One option would be Fundsmith Emerging Equities Trust (LSE:FEET). The trust has about 40% invested in India, most of which is in consumer staples.

This trust would also give an investor exposure to other emerging markets – which could be perceived as either a good or a bad thing, depending on an individual investor's portfolio and risk tolerance.

The trust would provide more diversification should India fail to live up to the hype. At the same time, however, that diversity could restrict returns should India outperform.

Another option with a modest India holding is Fidelity Asian Values (LSE:FAS). The fund has 18% invested in the sub-continent.

No hiding from risk

India's economy is vulnerable to rising oil prices, as the country is a large importer of oil. A spike in the oil price can stoke inflation, hit company earnings and derail economic growth.

Over the short term worsening relations between the US and Iran has been putting upward pressure on oil prices, and unless India can find a new energy source, oil price rises will remain an enduring risk.

What's more, over the longer term, says BMO's Anthony Willis, India's current trajectory could be derailed. He adds that the government could change tack, while key policies could be watered down or abandoned should they become politically unpopular. India, unlike China, is a democracy, and ultimately its government has to accede to the wishes of its citizens.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.