Tax year is ending early: use this checklist so you don’t miss out

Bumper bank holiday weekend shortens the time you have left to get your financial affairs in order.

25th February 2021 12:23

by Sam Barker from interactive investor

Bumper bank holiday weekend shortens the time you have left to get your financial affairs in order.

The 2020-2021 tax year ends on 5 April, but taxpayers should be aware that they have less time than usual to get their financial affairs in order before the deadline.

This is because of where the two April bank holidays fall. With one due on 2 April and the other on 5 April, the final working day before the end of the tax year is 1 April.

Myron Jobson, personal finance campaigner at interactive investor, says: “We’ve all left things until the last minute, but it is worth checking with your investment provider to make sure you know just how much time is left on the clock. And the bumper bank holiday weekend means you might want to do this sooner, rather than later.”

Depending on your situation there are many tasks that need to be completed before the end of the tax year, so here’s a list of common things to check.

Top up your ISA, or your child’s Junior ISA

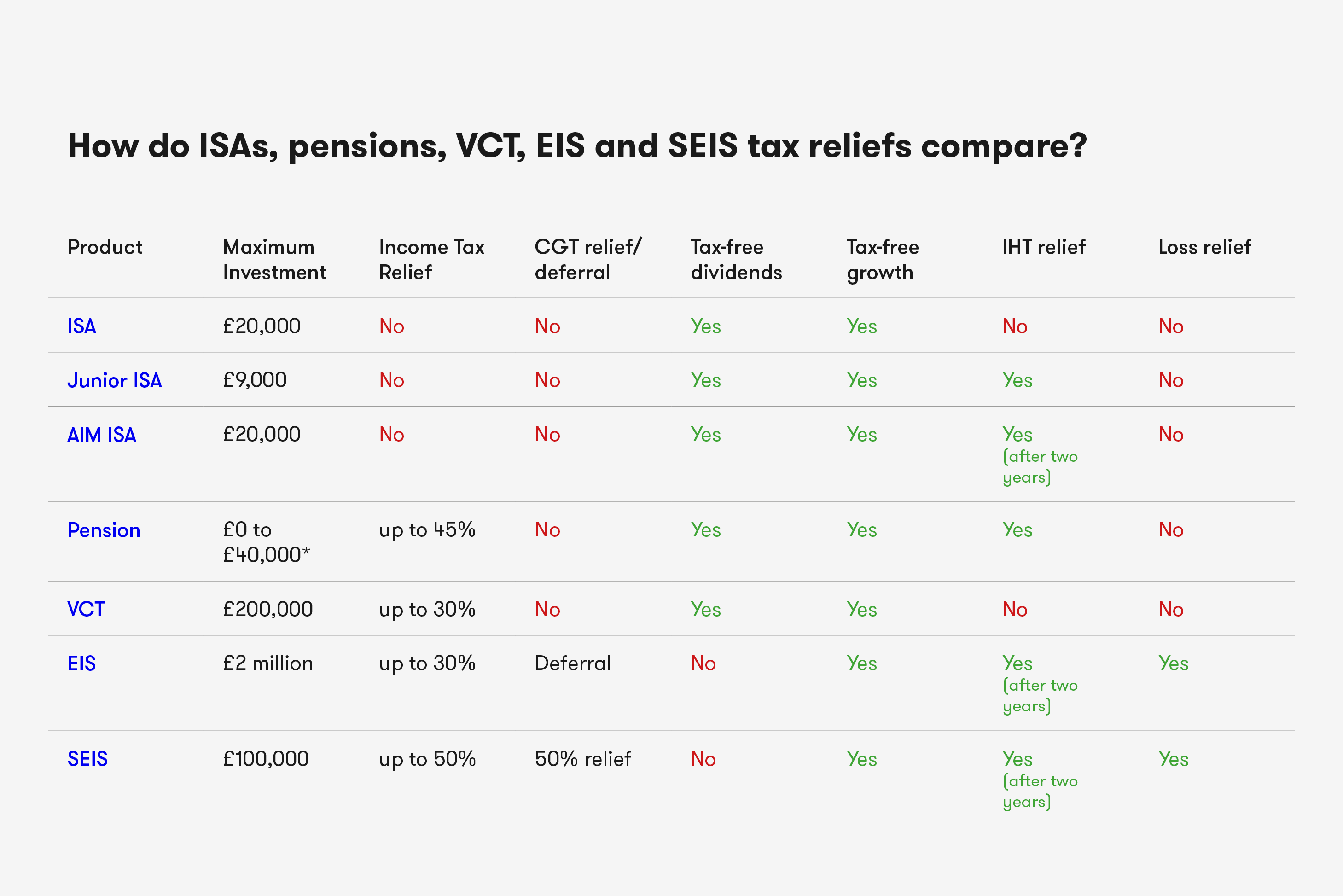

Every tax year you are allowed to put £20,000 into your ISAs, or £9,000 for a Junior ISA.

The Junior ISA limit only increased to £9,000 this tax year, up from £4,368 previously.

Making the most of these allowances maximises the amount you can earn tax free, so it makes sense to top up your ISAs if you have enough spare cash to do so.

Pick your ISA carefully

Britain is in love with cash ISAs. Three-quarters of the money put into these deals last year went into cash versions, according to HM Revenue & Customs.

However, even the best variable rate cash ISA pays just 0.6%, from Al Rayan Bank. Savers would need to pick a Shawbrook Bank three-year fixed rate cash ISA paying 0.75% to even beat the current 0.7% inflation level.

Not only this, but 2021 has so far not led to a typical ‘ISA season’, the period between early February and 5 April when banks normally compete to bring out enticing deals.

The Moneyfacts UK Savings Trends Treasury Report found saving account rates have failed to rise between December and February (in the run-up to the ISA season) for the past two years.

Product choice fell month-on-month to a record low. There are now 1,387 savings deals (including ISAs) on the market, which is 398 fewer deals available than a year ago, according to the report.

The average easy-access ISA today will pay savers 0.24%, down from 0.83% in February 2020.

Savers should also consider stocks and shares ISAs, which almost always pay more over the long term.

Add to your pension

Similarly, you can add £40,000 per tax year to a defined contribution pension. Contributions above this amount will not get tax relief, and you may have to pay an annual allowance charge.

Make gifts to avoid inheritance tax

Inheritance tax, or IHT, is paid on estates of more than £325,000 when the owner dies.

But every tax year you are allowed to make a £3,000 cash gift without it adding to the value of your estate. It’s also known as the ‘annual exemption’.

- Pensions versus ISAs: a beginner’s guide

- Are you saving enough for retirement? Our calculator can help you find out.

You can also gift £5,000 if a child is being married, £2,500 for a grandchild or great-grandchild and £1,000 for someone unrelated to you.

You can give as many small gifts of up to £250 as you want per tax year, provided they do not add to any of the above gifts.

However, if you make gifts within seven years of dying, IHT is still due.

Within three years of death, 40% tax is payable. This tapers down to 8% if you pass away within six to seven years of such a gift.

You can carry the £3,000 allowance forward, but only for a year.

Use your capital gains tax (CGT) allowance

CGT is paid on the gain made when you sell assets that have increased in value.

Currently, basic-rate taxpayers pay 10% tax on capital gains above a £12,300 a year threshold. Higher-rate taxpayers pay 20%.

If you have any assets you’re thinking of selling, doing it before the new tax year means making the most of this allowance.

Reduce your taxable income

Everyone earning up to £100,000 has a tax-free personal allowance of £12,500, which is exempt from income tax.

But those earning more than £100,000 lose £1 of this allowance for every £2 they take in.

Once you earn £125,000 you have no tax-free personal allowance at all.

If you can, cutting your earnings to below £100,000 therefore makes sense.

There are ways to do this that don’t involve taking a pay cut or missing out on income, such as by giving to charity or paying into a pension.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.