Tesco: Reasons why FTSE 100 heavyweight dived to six-month low

3rd October 2018 11:12

by Richard Hunter from interactive investor

It's been a great performer since 2016, with a recovery on track, but these results have gone down badly. Richard Hunter, head of markets at interactive investor, explains the reaction.

Since elephants do not gallop, Tesco can be pleased with its ongoing and measured progress spelled out in these second-quarter and half-year results.

There are any number of incremental improvements within this statement, showing that the supermarket behemoth continues, for the most part, to fend off its competition. In particular, the wisdom of its Booker acquisition is becoming ever clearer, whilst the tie-up with Carrefour which kicks in this month should strengthen its position further.

Within the metrics, group sales and underlying operating profit are strongly ahead, although the latter missed some forecasts, net debt has reduced and the cost savings target seems to be comfortably on track. In addition, UK sales have shown steady growth despite inevitably fierce rivalry, whilst the online offering is also making a worthwhile contribution.

• Why this fund manager is buying Tesco shares

• Why Tesco has a fantastic few years ahead of it

• The week ahead: Tesco, Ted Baker

However, it is not all plain sailing. The proposed Sainsbury/Asda merger would add another level of competition within the sector, the discounters continue to pile on the pressure and Amazon also casts its own long shadow.

Sales in Central Europe and Asia remain laboured, although improving in the latter, whilst the UK consumer will likely look to carry on being driven by price as the economic implications of Brexit emerge.

Although the dividend has been increased, itself a clear sign of management optimism, the yield of around 2% is hardly an attraction given the current interest rate environment.

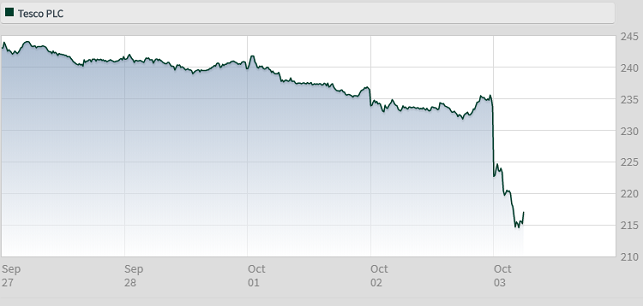

Source: interactive investor Past performance is not a guide to future performance

Even so, Tesco's transformation from the troubles of recent years is evident. Despite an initially punitive reaction to these numbers, the share price has also seen the benefit, having risen 26% over the last year, as compared to a meagre 0.5% increase in the wider FTSE 100, with a spike of 16% in the last six months alone.

The bar has been set high and to maintain the market consensus of the shares as a strong buy, Tesco needs to keep a firm hand on the tiller.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.