Tesla shares crash again: time to buy or sell up?

21st December 2022 08:51

by Rodney Hobson from interactive investor

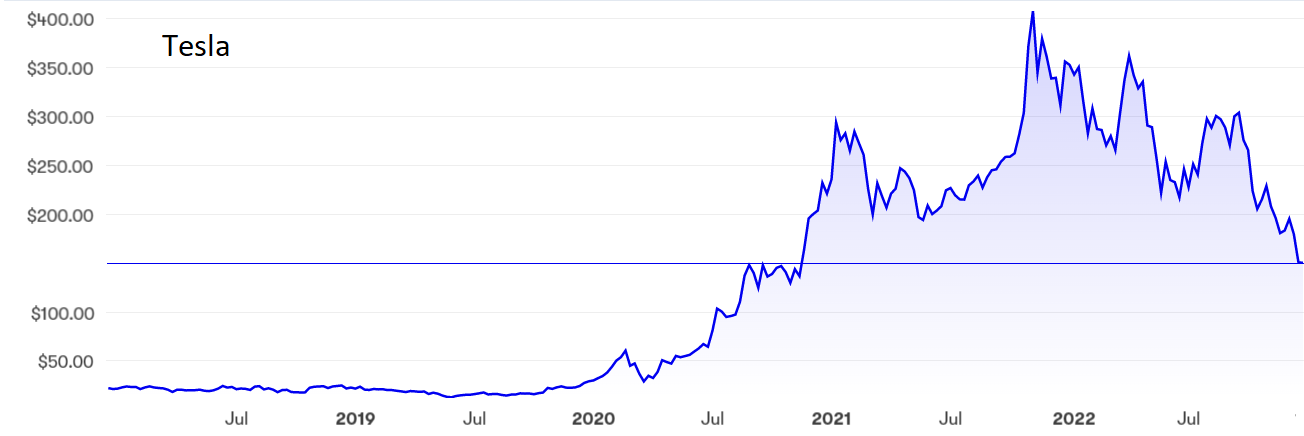

Down 66% since the November 2021 peak to their lowest in more than two years, it looks like a case of trying to catch a falling knife. Here’s what overseas investing expert Rodney Hobson thinks of Elon Musk's Tesla.

Shares in electric car maker Tesla Inc (NASDAQ:TSLA) have crashed while the driving force behind the company, Elon Musk, was looking out of the rear view at his new vehicle, social media site Twitter. Investors need to decide if he is now giving Tesla due care and attention before they think of buying.

The immediate signs are not hopeful. Tesla’s chief executive officer Musk has just sold 22 million shares in the company over three days, raising $3.6 billion. Just a month earlier, when the Tesla share price was higher, he parted with 19.5 million shares worth $3.95 billion. At least some of the cash was to fund his $44 billion acquisition of Twitter in October.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Back in April, when Musk sold billions of shares in Tesla, he said he planned no further such sales. Yet it took only until August before he parted with 7.9 million shares for about $6.88 billion.

Musk’s Tesla holding is now down to 13.4% but he remains the largest shareholder and it is hard to see the company going anywhere without him. Unfortunately, Musk has shown a blatant disregard for the opinions of others and for the rules that bind ordinary mortals, and while that can be a decisive trait in an entrepreneur launching a start-up, it gradually turns into a disadvantage as the company matures.

One reason why he has been heavily distracted by the Twitter saga is that he said he was launching a bid, tried to back out and was then forced into honouring his word by the US Securities and Exchange Commission. Then he wasted time trying to micromanage Twitter, such as restoring banned accounts, changing the pricing system and sacking large swathes of employees. Twitter’s stock market listing has been cancelled.

Some of those disgruntled workers are taking Twitter to court, which will create a further distraction for Musk. There has even been a complaint to the city of San Francisco that he has illegally converted office space into bedrooms so that workers can sleep on site.

In the meantime, Tesla shares have crumbled from above $400 on the first trading day of 2022 to below $138, a drop of 66%.

Source: interactive investor. Past performance is not a guide to future performance.

The company has had its share of technical problems this year. It recently recalled more than 320,000 vehicles because of faulty tail lights. Earlier it had to check 40,000 vehicles for a possible fault in the steering system.

Despite its difficulties, Tesla does actually make money. In the third quarter to the end of September it saw revenue jump more than 50% to $21.45 billion, its best quarter so far, on the back of strong growth in production in spite of constraints in the supply of batteries. Net income doubled from a year earlier to $3.3 billion.

Even after the hefty fall, the shares still look expensive with a price/earnings ratio of 43.5. Shareholders are trusting the company’s promise to raise production by 50% a year. There is no dividend and it is hard to see when there ever will be, since the future will be an expensive one and Musk is short of cash after splashing out so heavily on Twitter. He does have a $50 billion pay package at Tesla but that, too, is under challenge in the courts.

- Baillie Gifford: our latest views on Tesla and Elon Musk

- As Terry Smith’s emerging market trust closes, where should investors turn?

- Three growth areas I’ve been buying, and the next trillion-dollar company

Tesla is still moving in unknown territory and, although it took an early lead in developing electric vehicles, it faces competitors with much longer experience in manufacturing vehicles who are rapidly catching up.

Hobson’s choice: once a company’s shares are in freefall it takes a brave investor to call the bottom. Right now Tesla looks to be a case of trying to catch falling knives. The possible rewards could be considerable but for the moment it looks wisest to sell and await developments.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.