There's plenty of 'cheap' UK shares for bottom-fishing investors

This fund manager tells Tom Bailey he feels like a 'child in a sweet shop'.

16th July 2019 11:57

by Tom Bailey from interactive investor

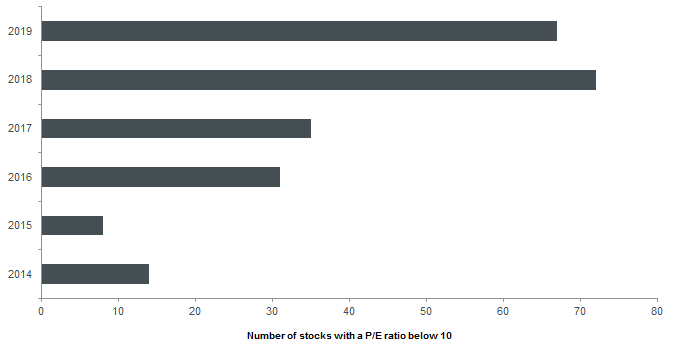

Chart that tells a story: the number of UK companies trading on a low price-to-earnings ratio. This fund manager tells Tom Bailey he feels like a 'child in a sweet shop'.

It is no secret that the UK market is cheap. Ever since the Brexit vote in 2016, the UK market has been unloved, particularly by international investors, wary of the UK's future outside the European Union. Added to this, fears of a government led by Jeremy Corbyn and John McDonnell has also negatively impacted sentiment.

The negativity towards UK shares, many fund managers have argued, creates a potential great buying opportunity. However, the argument is often presented by giving the overall "cheapness" of the UK market.

For example, it has been pointed out that the spread between the yield of the FTSE 100 index and UK gilts is at its highest level since the First World War. Others cite the price-to-earnings ratio of the index.

Those statistics tell you how the cheap the market is in aggregate and are potentially very useful to those considering an index tracker. But how many individual stocks are trading at cheap levels?

According to research from Janus Henderson, the number of companies trading on a price-to-earnings ratio of below 10 has ballooned over the past two years.

As a rule of thumb, a company with a price-to-earnings ratio of below 10 is considered "cheap". As the chart below shows, whereas in 2015 there were only eight such value opportunities, at the end of May 2019 there were a total of 67.

Stephen Payne, lead manager on the Janus Henderson Cautious Managed fund, says he "feels like a child in a sweet shop at the moment" due to the number of "appealing value opportunities in the UK equity market".

However, he cautions that the price-to-earnings ratio is not an absolute measure of value. Instead, it should be used as a helpful indicator of value relative to the market, as part of a more detailed analysis.

At the same time, a company being on a cheap price-to-earnings ratio does not necessarily mean that it is buy. After all, as he points out, "almost by definition, a value stock will have some concerns around its prospects".

Payne highlights tobacco firm Imperial Brands, which earlier this week announced that it will in 2020 abandon its long-running policy of hiking dividends by 10% a year, as an unloved share that he views as attractively priced.

"In the case of Imperial Brands, investors are worried about regulatory issues in the US and the disruption from next-generation products such as vaping. In our view, these are more than reflected in the valuation of the stock, which trades on a relatively low price-to-earnings ratio of 7.4x earnings – a level that does not, in our view, reflect its value or prospects."

Two other sectors of the UK market where shares are currently typically trading on a price-to-earning ratio of less than 10 include housebuilders and mining companies. Examples include Persimmon (LSE:PSN) and Rio Tinto (LSE:RIO).

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.