These top stocks are not just for sporty types

China has turned from opportunity to risk, but better weather and end of lockdown are positive catalysts.

7th April 2021 10:15

by Rodney Hobson from interactive investor

China has turned from opportunity to risk, but better weather and end of lockdown are positive catalysts.

Two of the companies that have fallen foul of tensions between the West and China over human rights abuses are athletics clothing makers adidas (XETRA:ADS) and Nike (NYSE:NKE). Investors could still consider having one or the other of these world-famous brands in their portfolios, though.

The growing economic strength and strategic importance of China on the world stage has caused rumblings about the suppression of Tibet, the destruction of democratic rights in Hong Kong and territorial expansion in the South China Sea, but it is the plight of the Uighur Muslim minority that has finally fired the outcry that China has gone too far.

Foreign brands have started to avoid using cotton grown in the Xinjiang region over allegations that the Uighurs are forced into slave labour there, and China has unsurprisingly responded by organizing a “spontaneous” boycott of Western brands including Nike in the US, Adidas in Germany and H&M (OMX:HM B) in Sweden.

- Terry Smith: why I bought Nike shares

- Want to buy and sell international shares? It’s easy to do. Here’s how

This is admittedly a blow to the sector, as sales were starting to take off among customers in the growing Chinese middle class with a taste for known labels. This boycott shuts out a large and potentially lucrative market of aspiring people. On the other hand, to ignore the burgeoning concerns in the West and many parts of Asia over China’s human rights record would have risked jeopardising sales in other parts of the world and possibly falling foul of US sanctions.

Adidas, in particular, was targeting China as a strategic growth area just before the boycott there started rolling. It aims to double its e-commerce sales by 2025 and boost its record on sustainability, which has become an important issue among its mainly young clientele, by using recycled and natural materials.

It is already well on track, with e-commerce up 53% in 2020, although that boost was artificially inflated by the closure of stores during lockdowns in various countries. This switch in emphasis should help profits by cutting out retailers as sportswear brands in general increasingly concentrate on selling direct to consumers.

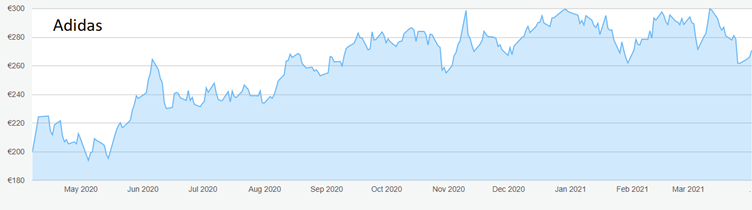

Source: interactive investor. Past performance is not a guide to future performance

Total revenue was expected to grow on average by 8-10% a year over the next four years, and net income by at least 4% annually, though those targets will be harder to reach if sales dip in China.

Adidas has been pushed into a strategic rethink as its sales and profits took a battering during the Covid-19 lockdowns. Net sales slipped 16% for the full year and pre-tax profits plunged 78%. Sensibly, the dividend was reduced from €3.85 to €3, but the payout should start to edge higher.

Also, sensibly, the struggling US arm Reebok is to be sold off, removing an unnecessary distraction for management.

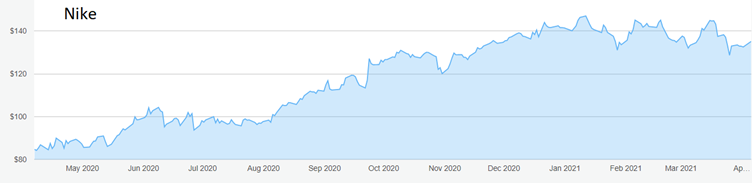

Nike sales have also shown signs of recovery, running 3% ahead of the prior year in the latest quarter, with earnings per share up 70% thanks to higher margins and lower expenses.

Source: interactive investor. Past performance is not a guide to future performance

Adidas and Nike are now running into a period where sales and profits will be compared with the worst period of the Covid-19 crisis, so investors should not get too carried away by massive growth in sales and profits over the next two quarters. Nonetheless, both companies can look forward to a sunlit future as customers embrace new freedoms to venture into the great outdoors, a boycott in China notwithstanding.

- Shares in these two sports giants have further to run

- Open an ISA with interactive investor. Simply click here to find out how.

I first recommended the sector in November 2019, when Nike shares stood at $82 and Adidas €289. Nike has been as high as $147 but is currently available around $137. Three times in the past 12 months Adidas has baulked at crossing €300 and at the current €276 could soon make another attempt.

Hobson’s choice: Investors should bear in mind the risks of the row in China escalating to the disadvantage of both companies. However, Nike is still worth considering up to $138 and Adidas up to €285.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.