Three discounted trust sectors that could spring back into form

Kepler analysts look for value opportunities in three diverse investment trust sectors.

1st March 2024 14:02

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Spring is in the air, and markets are twitching. In fact, ever since October last year, there seems to be a different dynamic in share prices: investors seem to be looking for reasons to buy rather than reasons to sell, as confidence grows that interest rates have peaked and any recession we experience in the developed world is likely to be modest. When recoveries come, they can be quick, and never more so than in the investment trust space where wide discounts can narrow dramatically in short order. Below, our analysts discuss why they think UK equities, Chinese equities and commercial property could present a value opportunity.

UK Equities – Ryan Lightfoot-Aminoff

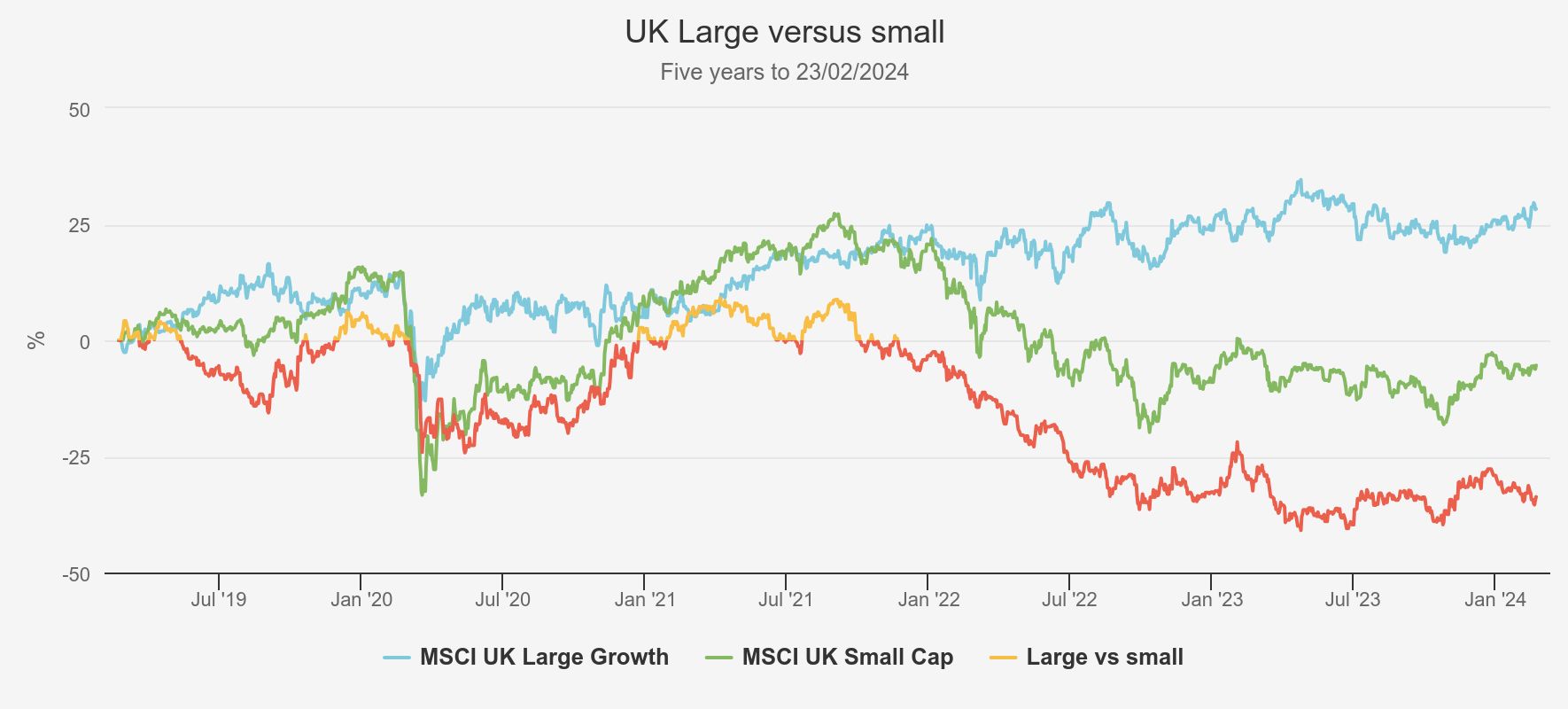

It is no secret that the UK market has struggled in recent years. Not only has the UK’s headline index, the FTSE 100, consistently underperformed global markets, leading to it trading at a 20-year relative low, but smaller companies have notably lagged their larger peers too, despite historically outperforming over the long term. Whilst the past few years have seen challenges, we believe there is a strong basis for a potential recovery.

In 2023, UK small caps had a second year of underperformance versus large caps. In the past 40 years, they have only underperformed for three consecutive years once. Following the weakness, aggregate valuations of the Numis Smaller Companies Index are at crisis level. However, historically, these periods of weakness have been followed by strong recoveries. Every time the index has had a negative calendar year, it has been followed by positive returns over the subsequent three years, at an average rate of 84.4%. Similarly, every time UK small caps have underperformed their large peers over a 12-month period, they have delivered positive returns over the next three and five years. Whilst the caveat emptor of past performance not being a guide to future returns always stands, history gives us plenty of encouragement for a bounce.

Source: Morningstar. Past performance is not a reliable indicator of future results

We believe Rockwood Strategic Ord (LSE:RKW)is in a strong position to capture this, and manager Richard Staveley will be joining us on Monday next week to discuss this. Richard has a value-orientated approach, looking to profit from the extreme price inefficiencies that exist in the micro-cap space due to the lack of research. Richard takes a constructive engagement approach to his holdings, looking to help instigate a turnaround and unlock shareholder value which we believe could play well in the current market where M&A is an increasingly prevalent factor. Sue Noffke, manager of Schroder Income Growth Ord (LSE:SCF), joins us on Friday to discuss where she is finding value in her broader remit. Whilst primarily focused on generating real income growth over the cycle, Sue has a bias to small and mid-cap companies, using a bottom-up stock selection approach to help identify the best opportunities in the under-researched space. As such, we believe SCF offers a differentiated angle to capturing a UK recovery, whilst also generating a growing income to support total returns.

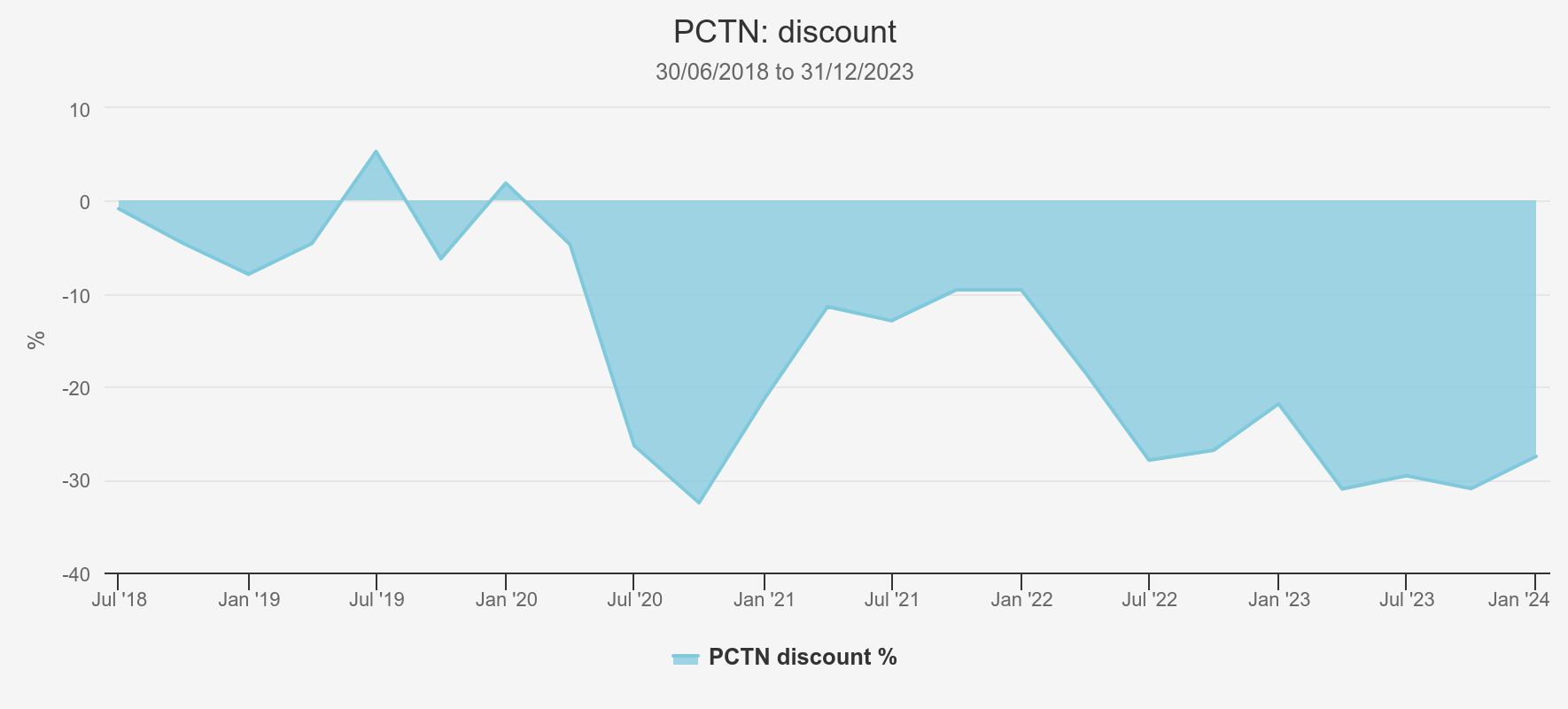

UK Commercial Property – Alan Ray

By now, most investors are clear in their minds about the big picture reason for wide discounts on REITs. Property is an asset class with a very strong correlation to interest rates and so, when rates rise, investors reduce their holdings in anticipation of falling property values. In the investment trust world, this leads to discounts widening, and in a nutshell that's why we find ourselves where we are today, with many UK diversified REITs trading in the 20 to 30% discount range. If we combine that with an investor perception, rooted in fact, that offices and retail are very difficult places to be, then one can start to understand why discounts have been wide for some time now.

On the ground though, there are many positive factors starting to add up. The first is that in some sectors, rental growth has continued to come through. The UK, like every other Western country, is re-programming itself for a less globalised world, with more resilient supply chains. In addition, the UK has been an enthusiastic adopter of the online world and this has big consequences for property. While the decline of traditional retail is very visible to many people, it's perhaps less visible that there is a strong demand for industrial and logistics buildings which increasingly form the backbone of more than just 'industrial' activities. Restrictive planning, and demand for the right locations mean these types of assets are in short supply. But rents, at least to a retailer more accustomed to paying rents in a shopping centre or high street, are still affordable. Picton Property Income (PCTN) has been particularly active in positioning itself to benefit from this, and c. 60% of its portfolio is focused on this sector.

At the same time, while we know that many investors can take or leave ESG when applied to equities, in property it really matters, and importantly it can be quantified and monitored. Energy efficiency, for example, isn’t viewed by tenants as a 'nice to have'. Good heating, ventilation and air conditioning ('HVAC'), and good lighting isn't optional for an office either. Not if it wants to attract high quality tenants. And the roof of an industrial shed is an ideal place to locate an array of solar panels, directly reducing the tenant's energy bill. So, while the entire office stock of the UK certainly does need a collective upgrade for efficiency and HVAC, many REITs (including PCTN) have already anticipated this bifurcation between quality offices and the rest, and have invested capital to make sure they have the right assets. Further, there are signs a more constructive environment for offices to be repurposed for alternative uses is developing, and already PCTN is progressing on plans for some of its office space to be repurposed as residential.

So, while investors understandably continue to fret about the big picture, there are a number of positive trends in property that are less visible than the negative ones, and in many cases managers have seen overall rental increases and high occupancy rates through the period that discounts have persisted. At the same time, M&A activity in the REIT sector is very busy, a good indication that professional property investors view REIT prices as an opportunity. Ultimately, if property can generate real returns at a net asset value level, share prices will have to follow. Next week Michael Morris, chief executive of PCTN, will be joining us on Tuesday to discuss his portfolio and outlook for the sector.

Source: Morningstar. Past performance is not a reliable indicator of future results

China – Thomas McMahon

There are a few reasons why China has fallen out of favour. Political tensions with the US have certainly not helped. There have been a number of restrictions made by the US authorities on trade with China, and we think investors have become wary of further restrictions. Clearly, sabre-rattling on Taiwan has wound the tension tighter, and it is tempting and easy to see the matter purely in this light. However, the sharp re-rating the Chinese index saw in late 2022 implies to us that it is the health of the domestic economy that is the main issue weighing on markets. Between the end of October 2022 and the end of January 2023, the MSCI China Index rose by 50% in sterling terms, and only marginally less in local currency. The trigger for this was anticipation of the dropping of the final major pandemic restrictions on economic activity, and we think this indicates that more positive news on the domestic economy could see a dramatic shift in flows into Chinese equities.

Source: Morningstar. Past performance is not a reliable indicator of future results

China’s domestic recovery disappointed last year. A key factor has been the deflation in the property market, which is an important locus of savings for the Chinese consumer. As construction of new properties has fallen, this has weighed on economic activity too. Additionally, youth unemployment has been high. Overall, consumer spending has been weak, and this has led to poor sentiment towards equities. It is worth noting that Chinese equities have historically been very volatile, and retail flows can be an important driver of returns.

We think any signs of recovery in the Chinese economy could lead to investors reassessing their positioning. Valuation multiples are extremely low, implying the potential for high returns when sentiment shifts. Meanwhile there are lots of interesting developments in the world’s second largest economy which could be leading to exciting investment opportunities. Notably, the country has become the largest manufacturer and exporter of electric vehicles. Meanwhile, the pace of its shift to renewables has surprised observers, and interestingly has led to the prices of iron ore and other industrial metals holding up better than would be expected given the weakness in the construction sector. In other words, the drivers of the Chinese economy are changing, and given the extreme cheapness of its equity markets, we think there could be value in a contrarian move into Chinese stocks. Next Wednesday we will be hearing from Sophie Earnshaw, co-manager of Baillie Gifford China Growth Trust Ord (LSE:BGCG). Among many interesting positions, BCGC has exposure to new industries such as EVs, with top 10 holding Zhejiang Sanhua Intelligent Controls being a supplier of specialist components to the industry. The shares are trading on a circa 6.5% discount at the time of writing, adding to the value story.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.