Three life-saving stocks to buy, hold and sell

22nd February 2023 09:23

by Rodney Hobson from interactive investor

This trio of companies worth over $600 billion treats and cures millions of us every year. Our overseas investing expert reveals what he’d do with shares in each one.

The long shadow – or in some cases afterglow – of the Covid pandemic continues to distort results from companies directly affected, especially drug companies. As always, investors need to read through company results carefully. This year could see a drastic reversal of fortunes.

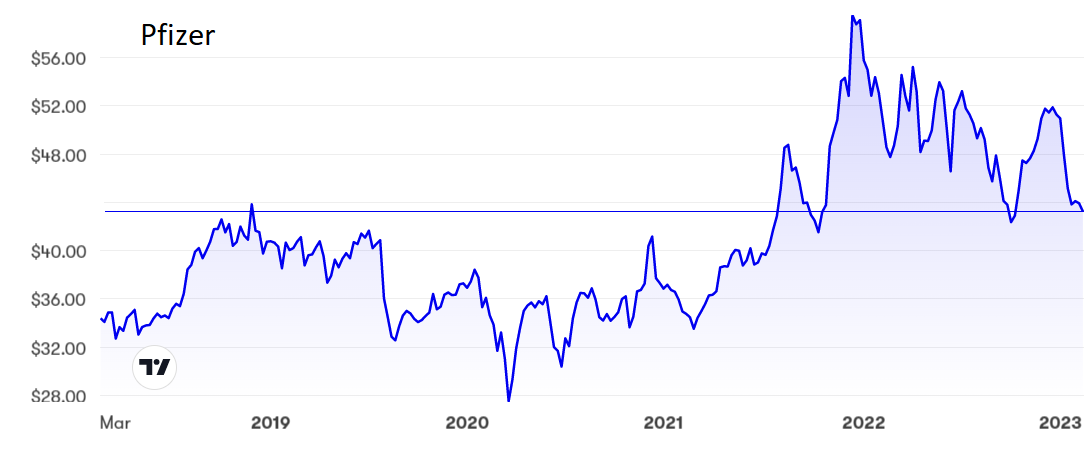

Pfizer Inc (NYSE:PFE) has had a pretty good year thanks to heavy demand for its Covid-19 vaccine but that is unlikely to be repeated this year. Revenue was already slowing sharply by the fourth quarter, with a gain of only 1.9% to $24.3 billion compared with a 23% leap to $11.3 billion for the full 12 months. Even the company itself expects revenue to decline by as much as 33% this year as Covid vaccines slump by about 60%.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

However, it’s profits that count and net income jumped 47% to $5 billion in the final three months of 2022, a slightly better rise than in the previous highly profitable nine months.

Revenue and earnings per share for the full year hit record levels, and Pfizer is confident of another record year in 2023 thanks to plans for the highest number of new product launches it has ever made. Other products are at earlier stages in the pipeline.

This is a difficult area for investors. A great deal can go wrong, even in the later stages of bringing new drugs to market and one can never be sure what the next blockbuster will be, while patents for past successes expire. However, it is reasonable to hope that at least one or two products out of a wide range will hit the target.

Pfizer shares have fallen back after looking to cross $60 in December 2021 and at $43 they are near a level that has proved to be a floor. The price/earnings (PE) ratio is only 7.8 while the yield is quite attractive at 3.7%.

Source: interactive investor. Past performance is not a guide to future performance.

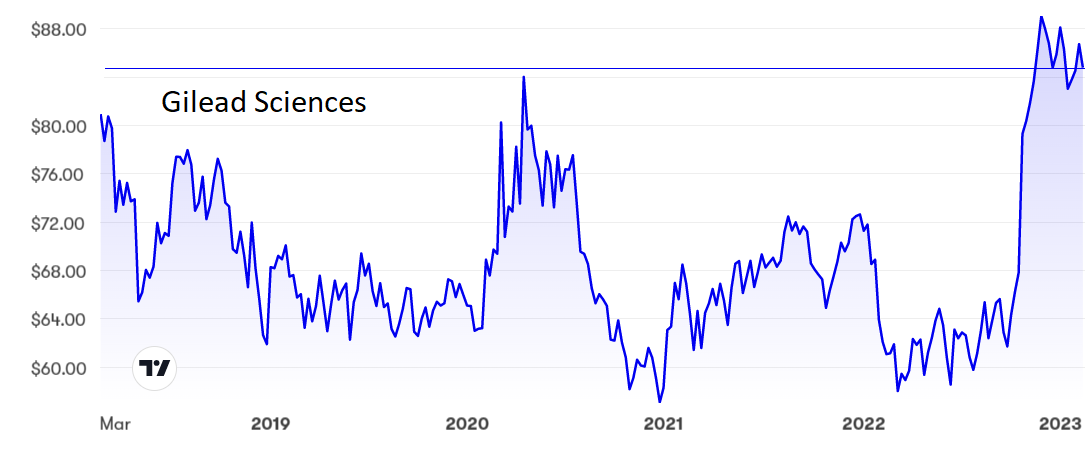

Gilead Sciences Inc (NASDAQ:GILD) also saw sales of its Covid-19 vaccine fall away in the final quarter, but this was balanced out by stronger revenue from oncology, HIV and hepatitis treatments. Total sales growth of 2% to $7.4 billion was satisfactory if rather uninspiring, but at least it was an improvement on the earlier part of the year when revenue was static.

Net profit quadrupled to $1.6 billion but this hefty gain was not all it seemed. The previous year’s profits had been depressed by a $1.25 billion charge for a legal settlement and $625 million spent on an acquisition. Underlying profits were actually down sharply this time.

Gilead shares peaked at $88 in December and have fallen back very little since. The yield is an attraction at 3.5% after the recent dividend increase but the PE is quite demanding at 22.9.

Source: interactive investor. Past performance is not a guide to future performance.

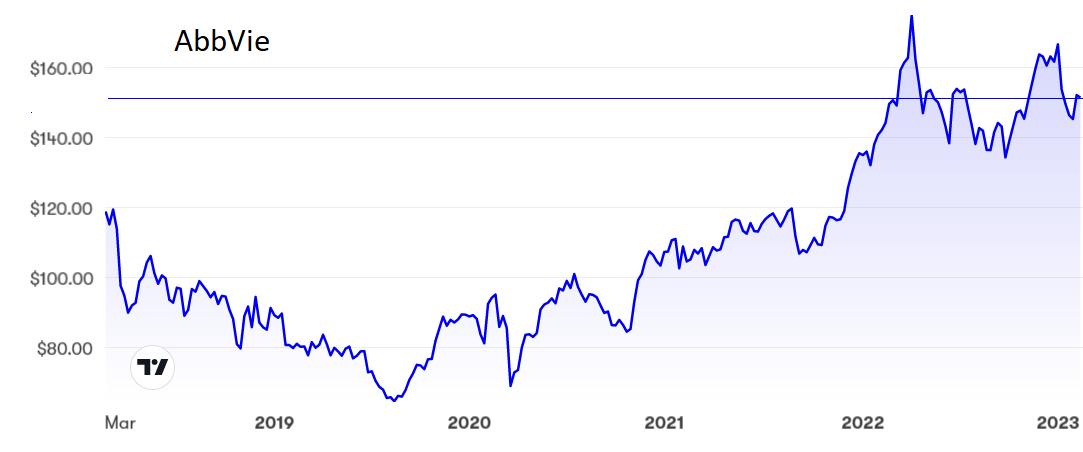

AbbVie Inc (NYSE:ABBV) has not been caught up in the Covid whirlwind. Its blockbuster is Humira, the Botox brand. Revenue rose 3.3% to $58.1 billion last year and with profit margins holding at 20% AbbVie raised net income by 2.7% to $11.8 billion.

The big worry is that Humira has lost its patent protection in the United States and will now come under attack from cheaper alternatives. AbbVie will probably maintain market leadership but will have to cut its prices and profits.

The company does have other drugs that sell well but none rank alongside Humira. Revenue is likely to grow in low single digits this year, well below the 15% growth forecast for the biotechs sector.

Even so, the share price has held up above $150 compared with only $65 in 2019. The PE looks unrealistically high at 22.5 but the big attraction is the 3.8% yield, and the dividend looks safe for now.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I am confident that the floor will again hold for Pfizer, which I have recommended several times, and that the PE ratio more than adequately factors in potential problems. Buy.

I cannot feel the same enthusiasm for Gilead, where the upside looks limited and the potential downside stretches as far as 25% of the current price. Sell.

AbbVie is a hold for dividend seekers but it is hard to make out a case for buying in now given the uncertainties surrounding its best-selling product.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.