Three trusts to own if you predict a Tory majority

If you think the election result will trigger a sterling rally, this analyst picks the big winners.

11th December 2019 11:31

by Graeme Evans from interactive investor

If you think the election result will trigger a sterling rally, this analyst picks the big winners.

Polling Day Eve is here at last, bringing relief for investors and fund managers after weeks second guessing the impact of the General Election result on sterling and UK plc.

The various scenarios have been crunched, with a Conservative majority the most likely to convince investors that the time is right to narrow the discount on UK valuations.

A note published by Peel Hunt in the run-up to the election - How to be bullish on UK plc - offers a helping hand should Friday the 13th remove some investment clouds and make a sensible Brexit deal seem more achievable.

Peel Hunt's analysts have looked at the investment trusts with the greatest sterling correlation so that investors can rebalance their portfolios towards domestic value.

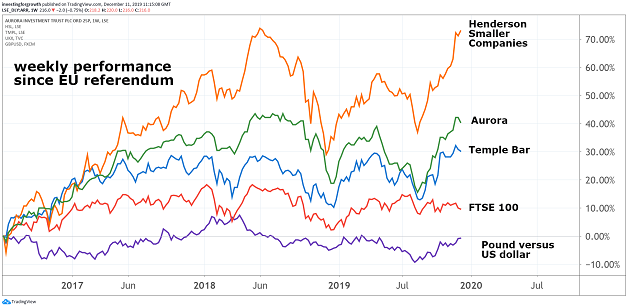

Their headline findings identify the clear sterling winners as being Aurora (LSE:ARR), Henderson Smaller Companies (LSE:HSL) and Temple Bar (LSE:TMPL). Those inversely correlated include Nick Train's Finsbury Growth & Income (LSE:FGT) and Troy Income & Growth (LSE:TIGT).

Source: TradingView Past performance is not a guide to future performance

The study is based on the 33 most-liquid trusts across the three AIC UK Sectors — UK All Companies, UK Equity Income and UK Smaller Companies.

The sub-sectors that showed the highest correlation to sterling in Peel Hunt's research were banks, life insurance, construction, real estate and retailers.

Conversely, those sub-sectors most negatively correlated were beverages, telecom services — due to the high level of overseas holdings — leisure goods, precious metals and mining.

The findings come with sterling close to a seven-month high as the odds of a Conservative majority have shortened. The note warns that election polls have been wrong before and that a hung parliament would likely lead to material downside for sterling and UK plc.

Peel Hunt said:

“For the last three years, investors have been paid handsomely to avoid UK equities; however, the General Election offers a chance to make UK plc more investible and remove one of the many clouds of uncertainty that hang over it.

“While Brexit will dominate the headlines for years to come, the possibility of a political majority should help reassure businesses and investors that the discount on UK plc is too wide.”

Aurora provides the biggest sterling correlation, followed by the long-established equity income trust Temple Bar. Finsbury Growth & Income, which has performed strongly over the year to December, is listed as the most sensitive to sterling.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.