The three UK funds we’re backing

Saltydog Investor is hoping that last month wasn’t just a flash in the pan and that UK sectors will continue to make up lost ground from over the past couple of years.

4th June 2024 10:08

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

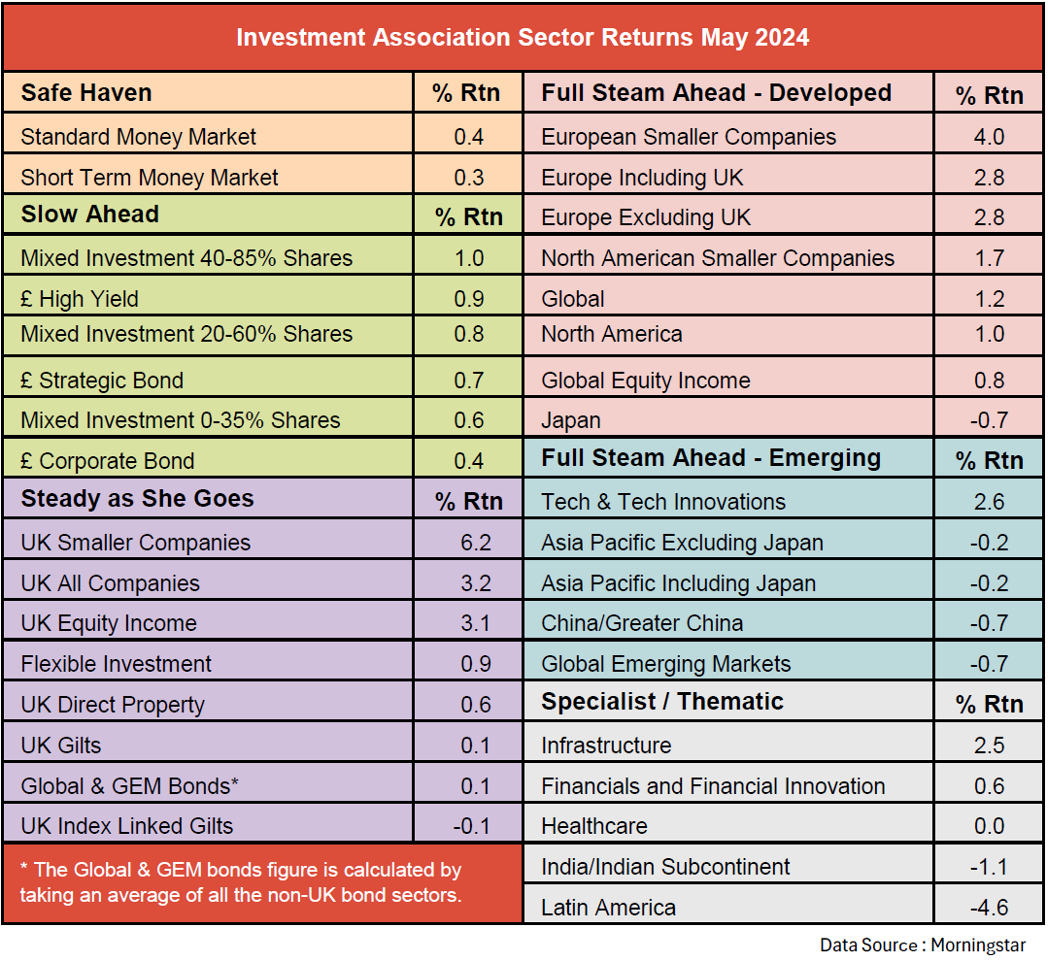

The best-performing sector in May was UK Smaller Companies, with a one-month return of 6.2%.

It is one of the three Investment Association (IA) sectors for funds investing in UK equities. The other two are UK All Companies and UK Equity Income, which also made reasonable gains.

- Invest with ii: ii Super 60 Investments | Transfer an Investment Account | Free Regular Investing

Past performance is not a guide to future performance.

The UK All Companies sector is for funds which “invest at least 80% of their assets in UK equities which have a primary objective of achieving capital growth”.

As the name suggests, the UK Smaller Companies sector is for funds which “invest at least 80% of their assets in UK equities of companies, which form the bottom 10% by market capitalisation”.

The UK Equity Income sector is for funds which “invest at least 80% in UK equities, and which intend to achieve a historic yield on the distributable income in excess of 100% of the FTSE All-Share yield at the fund's year end on a three-year rolling basis and 90% on an annual basis”.

At Saltydog Investor, we like investing in these sectors for several reasons.

The first is familiarity. It is reassuring because they invest in companies that we may already know, and if not, they are usually relatively easy to research.

The second is regulatory standards. UK companies operate within a familiar regulatory environment, which gives a sense of security and transparency. Regulatory standards, accounting practices, and corporate governance frameworks in the UK are well-established, offering investor protection.

Currency risk mitigation is another key draw. As these funds invest in UK companies, currency risk is mitigated for UK-based investors since investments are typically denominated in sterling. This reduces exposure to fluctuations in foreign exchange rates compared to investing in overseas companies. However, it is worth noting that many of the large FTSE 100 companies do generate a significant proportion of their income overseas.

Last but not least, political awareness. We probably have a better understanding of the current political and economic landscape in the UK compared with further afield.

Unfortunately, the problem with investing in funds from the UK equity sectors, is that until recently they have not performed as well as some of the overseas sectors. In 2023, the UK Smaller Companies sector went up only by 0.4%. The UK All Companies and UK Equity Income sectors did much better, both increasing by more than 7%. However, Japan rose by 11%, Europe excluding the UK made 14%, while North America gained an impressive 17%. Latin America beat them all, increasing by 23%.

Hopefully, last month was not just a flash in the pan and the UK sectors will continue to make up lost ground. UK companies, and smaller companies in particular, have been significantly undervalued and out of favour among investors for an extended period.

Although the UK economy briefly went into recession at the end of last year, activity has since revived. An improving economic environment could spark renewed interest in the more domestically focused companies, especially if we start to see interest rates coming down.

- Nick Train: UK market is ‘pregnant’ with value and opportunity

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

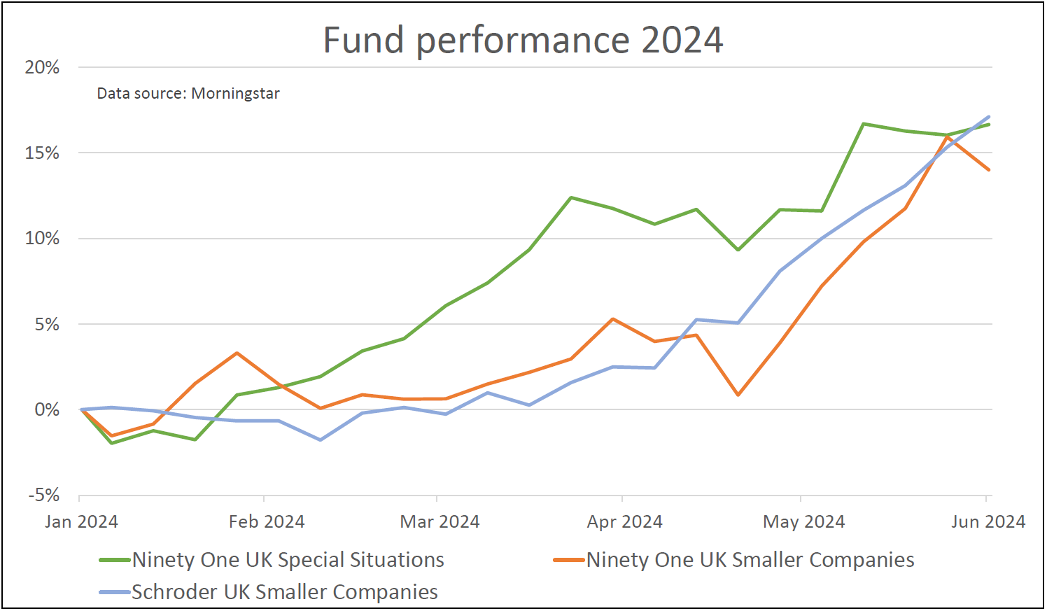

We currently hold three funds, which invest predominantly in UK companies.

We went into the Ninety One UK Special Situations fund, from the UK All Companies sector, in December last year. Since then, it has gone up by 22%.

Last month, we bought the Schroder UK Smaller Companies fund, which has already increased in value by 4.9%.

Last week we added the Ninety One UK Smaller Companies fund.

Here is a graph showing how they have all performed so far this year.

Past performance is not a guide to future performance.

As you can see, they have all done pretty well. The best, Schroder UK Smaller Companies, has gone up by more than 17%. While the worst, Ninety One UK Smaller Companies, has risen by 14%.

The Ninety One Special Situations fund shot ahead during February and March, but in the past couple of months the two UK Smaller Companies funds have closed the gap.

There is obviously the general election coming up, which could cause some short-term volatility, but hopefully this will provide more stability for the UK funds once it is over.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.