This trendy stock just sunk to a new low: time to buy?

2nd March 2022 08:53

by Rodney Hobson from interactive investor

Our overseas investing expert called it right when he urged investors to sell this stock. After a massive decline, here’s what he would do now.

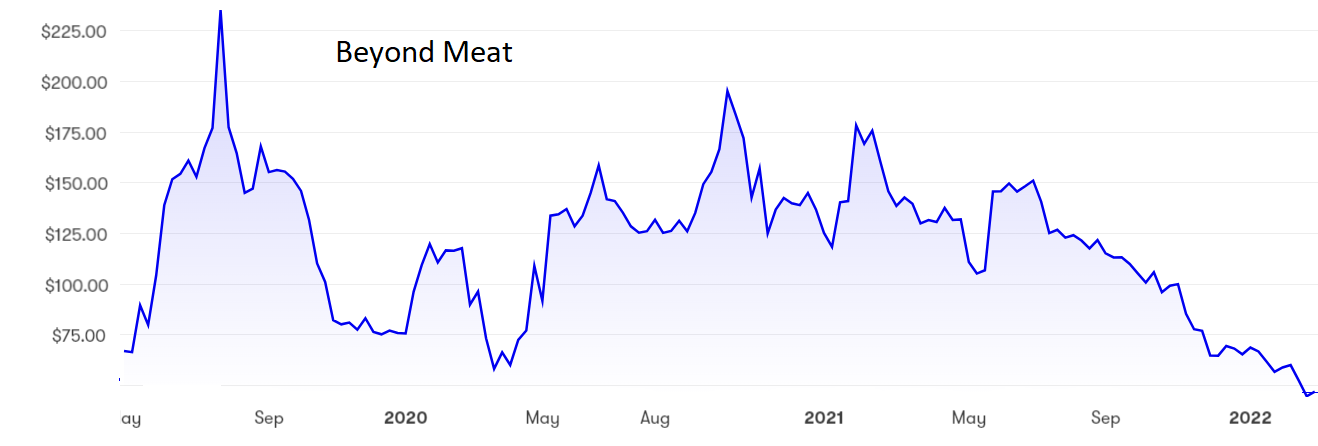

Results from plant-based food manufacturer Beyond Meat (NASDAQ:BYND) are becoming increasingly unpalatable. The slide in the share price from a peak of $156 last June has been nothing short of alarming. There is no sign that the trend is coming to an end at $47.

Fourth-quarter results were as disappointing as those for the third were in November. For the three months to the end of December, revenue slipped 1.2% year-on-year to $100.7 million, while gross profit was slashed in half at $14.2 million as margins were squeezed. These are hardly good figures from what is supposed to be a growth stock, especially coming at a time when investors are tending to switch to defensives.

Net losses tripled to $77.7 million compared to a loss of $24.5 million a year earlier. This is worse than it seems at first sight: last year’s figure was affected by Covid-related costs that did not recur this time.

Revenue and profit both fell short of expectations, so it was no surprise that the shares slumped 10.8% in after-market trading as soon as the figures were issued

Source: interactive investor. Past performance is not a guide to future performance.

While foodservice supplies remained strong across the board, retail sales were soft. Beyond Meat blamed the pandemic, though it is hard to see why Covid-19 would specifically deter shoppers from picking a non-meat alternative.

The fact that there were five fewer shipping days in the quarter does not explain away the fact that higher trade discounts had to be conceded. Beyond Meat’s share of what was expected to be a growing retail market is slipping, as it fails to achieve its expected leadership among a growing number of vegans and carnivores willing to try something else.

- Beyond Meat: catching a falling knife?

- Could the S&P 500 really fall 20%?

- Want to buy and sell international shares? It’s easy to do. Here’s how

On the other hand, the surge in sales to restaurants has as much to do with the ending of pandemic restrictions as it does to the introduction of new products and improved distribution channels. Meanwhile, manufacturing costs are rising, hitting both sides of the business.

Beyond Meat remains ever more optimistic than investors are. It reckons the current quarter will produce revenue between $85 million and $110 million, a wide range that allows for joy or disappointment in equal measure. Analysts believe that the problems of the recent past will not go away soon.

Non-vegans will, rightly or wrongly, tend to regard a substitute for meat as being an inferior product. Why pay more than you would for the real thing? Yet that is precisely what retail customers are sometimes being asked to do. While pork and poultry substitutes are not particularly at a competitive disadvantage, prices in supermarkets for many Beyond Meat products are more expensive than for an equal weight of beef.

On that basis it will be hard to persuade the non-vegans who form a substantial majority of consumers to join the bandwagon and, therefore, earlier predictions that sales would hit $2.2 billion by the mid-2020s look fanciful.

- Want to know more about US stocks?

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

In the meantime, inflation is taking off, leaving Beyond Meat among a wide range of companies across the spectrum scrambling to pass on costs to consumers who are also being squeezed. Supply chain issues have eased but have not gone away entirely.

The other big worry is that it is easy for rivals to compete in what is admittedly still a growing market, even if it is not growing as quickly as once seemed likely.

Hobson’s Choice: It is not too late to sell.There is no prospect any time soon of a dividend to compensate shareholders for any fall in the share price.Stay well clear until the slide comes to an end, and do not be tempted to believe that the downward trend is necessarily over if short sellers decide to cover their positions.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.