Tristel: Directors gamble on share price doubling

7th December 2018 15:21

by Richard Beddard from interactive investor

Tristel has almost everything to justify a place in a long-term shareholder's portfolio, believes analyst Richard Beddard. There's just one thing, it seems everyone wants to make money out of it in the short-term.

As usual I am scoring Tristel to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

Tristel manufactures disinfectant, primarily for medical devices, but also for laboratories and vets. Success has come from decades of research and development in a wide variety of chlorine dioxide based wipes, sprays, and foams for the decontamination of medical implements. It focuses on specific hospital departments that use small simple instruments like nasendoscopes and ultrasound probes, which are most efficiently disinfected by hand.

Tristel says it is the only company using chlorine dioxide for high-level disinfection. It is safe enough to be used by hand and just as effective as more toxic disinfectants.

The company has 250 patents protecting how the chlorine dioxide is delivered and decades of trials results demonstrating the products work. Hitherto, this has deterred competitors, allowed Tristel to dominate its niches in the UK, and move into overseas market uncontested.

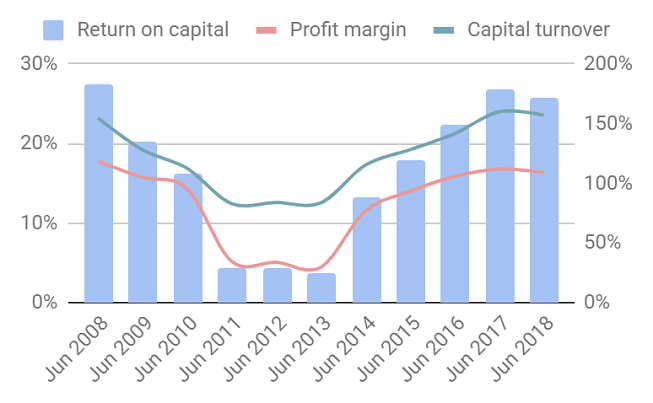

It has not made good profits consistently, but I think we can ignore the period between 2011 and 2014, when it didn't:

Source: interactive investor Past performance is not a guide to future performance

That was when the company's current range of disinfectants were still being established and the products that had made Tristel so profitable in prior years were in catastrophic decline.

Crucially, those products used the same chlorine dioxide chemistry but in washing machines, typically used to clean larger more complex devices. The washing machine manufactures squeezed Tristel out of the market by recommending their own disinfectants. Since these disinfectants were used in machines it didn't matter they were more noxious. Cannily, Tristel had developed disinfectants that could be applied by hand, a win-win for customers who could lessen their reliance on expensive machines.

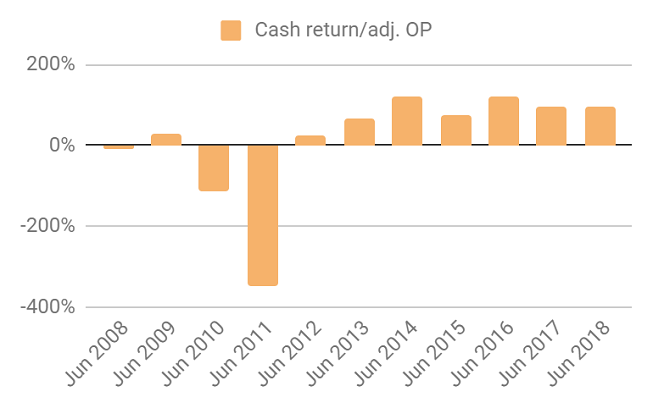

We can see the effect of the transition in other sections of Tristel's financial statements. Cash flow improved: Over the last four years cash flow including capital expenditure has just about equalled operating profit:

Source: interactive investor Past performance is not a guide to future performance

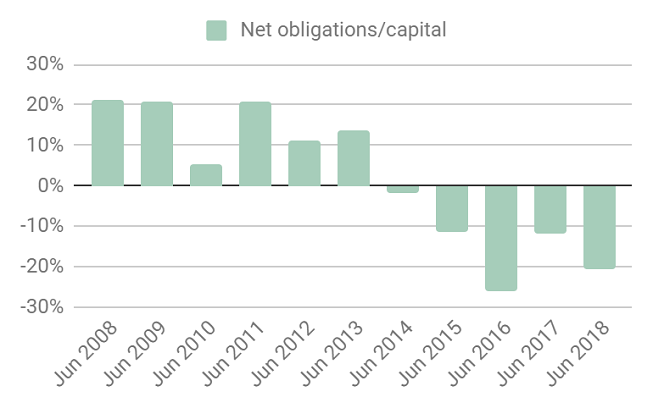

And that has put the firm on a very firm financial footing:

Source: interactive investor Past performance is not a guide to future performance

Adaptable: How will it make more money?

Score: 2

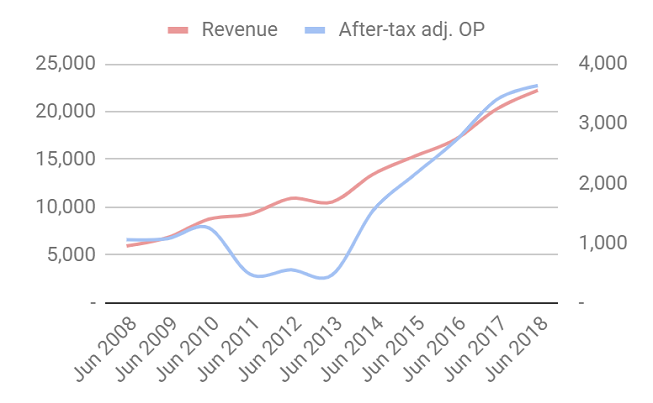

Averting our eyes again from years of transition, Tristel’s revenue and profit has grown impressively:

Source: interactive investor Past performance is not a guide to future performance

In 2018, for the first time, Tristel earned a majority of revenue abroad, (a slim majority, much of it from Germany) which is important because Tristel has saturated some of its markets in the UK.

The big opportunity, though is the US where it is chasing regulatory approval and has yet to earn any revenue. Tristel's profits were reduced by £0.5 million spent to secure regulatory approval in 2018.

This is a prolonged process, requiring multiple submissions to the Environmental Protection Agency and the Food and Drug Administration, and the negotiation of commercial arrangements to manufacture and distribute one product, Duo, initially.

Tristel has achieved approval from the EPA for intermediate level disinfection and expects to start manufacturing in the current financial year. The bigger prize though is approval for high-level disinfection from the FDA, which will establish the company in markets that have been very lucrative for Tristel in the UK: ultrasound, nasendoscopes and some ophthalmic devices.

Tristel's manufacturing and distribution partner will be Parker Laboratories, which is the market leading supplier of ultrasound conductive gels. Since ultrasound is an important market for Tristel, the attraction is obvious, but once established in a market Tristel usually prefers to distribute directly and capture more of the profit from its products. In 2018 the company acquired its Hong Kong distributor for this reason.

Another interesting development is Tristel's partnership with Mobile ODT. It has a minority investment in the company, which combines smartphones and medical devices to provide diagnostics usually away from hospitals. The two companies are collaborating. Mobile ODT supplies Tristel Duo with some of its products, Tristel has become the UK distributor for some of Mobile ODT's.

Resilient: What could go wrong?

Score: 2

Tristel may run into unexpected hurdles abroad, but when it comes to the businesses, I do not see much trouble ahead. I think the company is effectively developing and exploiting valuable intellectual property.

Brexit will have an impact. The company is building up stocks and has advised continental customers to prepare for less frictionless trade. But Tristel believes achieving CE marks for its products will be sufficient evidence they meet European quality standards.

Equitable: Will we all benefit?

Score: 0

Were it not for a sharp rise in the charge for share based payments, profit growth in 2018 would have been considerably higher than the 7% I credit the company with, at 17%. The company excludes this charge in judging whether the business has met its target of 17.5% pre-tax profit margins (and 10 to 15% annual profit growth) because it is not a cash cost. It does represent a cost to shareholders though.

The valuation of the share-based component of remuneration is complicated because it is performance related. I do not understand it, but note that the company's auditor identifies the valuation of the options as a "significant risk" due to the "nature and quantum" of the awards. Reassuringly, perhaps, it found no errors in the calculation, but the nature (its complexity) and quantum (nearly 1 million shares awarded in the year) concern me too.

Tristel says the share options align the interests of the company's two executive directors with the interests of shareholders. Share price targets are superficially appealing. They are unequivocal. Either the company achieves the target or it doesn't, and shareholders profit if the share price goes up so it is easy to argue interests are aligned.

But share price targets create perverse incentives because, in the short-term, share prices are mostly about perception. A company can manipulate perceptions and consequently the share price to achieve a big payout for its executives by being selective about the information it makes public, and it can use financial accounting tricks to fabricate profit.

Though I would rather Tristel included the cost of share based payments in its performance measures, generally I think its accounting is fine. But the very fact these incentives exist make me wary of the company’s communications.

Chief executive Paul Swinney's shareholding is relatively modest considering he co-founded the company in 1993. He owns just under 500,000 shares, which is 1% of Tristel or a £1 million holding in round numbers. In July he exercised 502,915 options and sold the same number of shares. In April 2017, he exercised 242,500 options, and sold 689,371 shares.

Using SharePad, which contains a list of directors' dealings going back to May 2006, it would appear that he has been a net seller of shares having acquired (by exercising share options mostly, but also through purchases) 1.1 million shares and sold 3.6 million shares for a net gain of £4.2 million. To my mind the ownership of shares aligns directors and shareholders, but Tristel's policy places no requirement for directors to retain shares.

Other elements of the directors' salaries and cash bonuses are not excessive by modern standards. Excluding share sales, Swinney earned £289,000 including bonuses in 2018 and Liz Dixon, Tristel's finance director, earned £222,000, but the share options have the potential to launch them into a different league.

According to the scheme approved at the 2017 AGM, the two executive directors will be awarded about £4.5 million in shares split between them if the average share price exceeds 500p for three months before June 2021, when they will be able to sell the shares. Tristel's total revenue in 2018 was £22 million, and its operating profit was less than £4 million.

Today, the share price is 235p so it will have to more than double if they are to get the money. It seems like a big gamble. One could take the view that management's willingness to take the gamble means the outcome, 500p, is very likely. I can’t reconcile myself to it. To my mind that kind of thinking turns us all into gamblers.

Perhaps an example will demonstrate why I don't believe the share price is a suitable target for performance related pay. In retrospect, when I bought shares in Tristel for 35p the share price did not in any way reflect the achievements of Tristel. Why then should the share price on any other day be any more reliable a measure of performance?

One more remuneration related issue makes me question whether the board's interests are truly aligned with long-term shareholders'. David Orr, chairman of the remuneration committee that decides executive pay, is also a director of two packaging companies that supply Tristel. Since Tristel paid these companies about £450,000 in 2018, he is not an independent non-executive director. We must trust he is sufficiently independent of mind.

Cheap: Is the firm's valuation modest?

Score: -1

No, at 235p the shares trade on a debt-adjusted PE of 32.

Tristel is a straightforward business still building a strong competitive position, and on a personal level chief executive has helped me to understand its strengths over the years.

But I believe the best opportunities for investors are in businesses like this where the rewards are not as keenly anticipated by management and investors.

A score of 5/10 means I cannot recommend the shares.

Richard owns shares in Tristel.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.