Trusts that should gain from a Brexit deal

Small-cap investment trusts may be the best way to gain exposure.

30th September 2019 09:38

by Tom Bailey from interactive investor

Small-cap investment trusts may be the best way to gain exposure.

Whether the UK will leave the European Union is uncertain, nor is it clear whether any exit will be on the basis of a negotiated withdrawal bill with the EU.

However, anyone who thinks that leaving with some sort of a deal is a possibility should look at investment trusts with exposure to UK smaller and mid-cap companies, says Stifel.

"These companies tend to be in sectors which are relatively highly focused on domestic companies, notably sectors such as housebuilders and leisure and entertainment," says the financial services company.

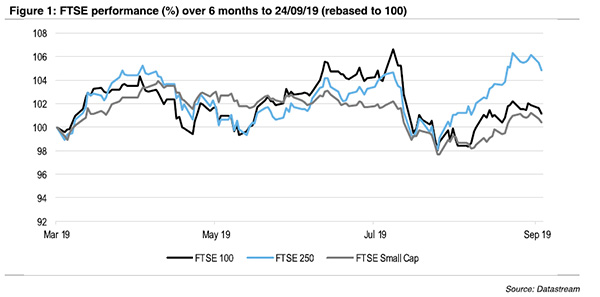

According to Stifel, the performance of the FTSE 250 is heavily correlated with the likelihood of a no-deal Brexit. The broker argues that the index saw its biggest falls in August, as shown on the graph below, when talk of a no-deal Brexit reached its peak.

It continues: "We have also noted that on days when there has been newsflow suggesting a deal may be possible, many of the UK-focused companies such as the housebuilders have seen their share prices move up sharply.

"The reverse has been true when there has been newsflow suggesting a deal is less likely. This suggests that this segment of the market is likely to remain volatile in the next few weeks, but if a deal is done, there may be scope for a significant re-rating."

In that scenario, Stifel says that small-cap investment trusts may be the best way to gain exposure, with funds in the UK Smaller Companies sector having a high exposure to the index.

Stifel's preferred funds in the sector for value stocks include Henderson Smaller Companies (LSE:HSL), with 60% of its portfolio in the FTSE 250 and BlackRock Throgmorton Trust (LSE:THRG).

For a trust with a tilt towards value stocks, the broker names Aberforth Smaller Companies (LSE:ASL). Meanwhile, investors looking for a trust trading on a desirable discount could look at Mercantile (LSE:MRC), currently trading on a 10% discount from its NAV and with about three-quarters of its portfolio in FTSE 250 companies.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.