UK deal could be a game changer for this security company

Coronavirus hurt these shares, but this ‘immune’ business can bounce back from the stock market panic.

4th March 2020 09:59

by Rodney Hobson from interactive investor

Coronavirus hurt these shares, but this ‘immune’ business can bounce back from the stock market panic.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It’s the stock that nearly got away, the stock that soared off any sensible investor’s radar but has been dragged back to earth by the general stock market crash. Once again, it is worth taking a look at American private security and protection company The Brink’s Co (NYSE:BCO).

Brink's was named after its founder Perry Brink’s and was originally based in Chicago but now has its headquarters in Richmond, Virginia. It is divided into two segments. The larger core services side transfers cash between business and financial institutions including central banks. It also manages ATM. The smaller side offers high-value services such as moving diamonds and jewellery and managing cash for wealthy individuals.

Since it spun off its home security operations into a separate company in 2008, it has been in expansion mode and now has operations around the globe. It employs more than 62,000 people in 40 countries, although the United States remains easily its largest market.

The company was virtually unknown to most UK investors until reports emerged last summer that it was preparing to make a £1 billion bid for the international cash-handling division of London-listed security group G4S (LSE:GFS). This operation transports and stores money for banks and retailers.

Last week, agreement was finally reached on a deal for the majority of the division for £727 million, including some debt and pensions liabilities. Excluded were operations in Britain and South Africa and the technology unit.

- Time to follow this $1bn investor into Twitter?

- Three good reasons why stock market investors must look beyond the UK

- Want to buy and sell international shares? It’s easy to do. Here’s how

The acquisition fits well into the Brink’s business, adding annual turnover of £600 million. It’s a service that will always be in demand and should be reasonably sheltered from any possible impact from trade wars.

There are caveats, not least that this is a large acquisition for a company with a market capitalisation of $4.2 billion. However, there were fears that other potential buyers such as Prosegur Compania De Seguridad (XMAD:PSG) could well emerge, forcing Brinks into overbidding. That has not happened and G4S has been looking to get out for the past 12 months, so it was unable to stick out for an unrealistic price.

It looks as if Brink’s has been able to cherry pick the best bits, and analysts in the UK reckon that the price should have been £100 million higher. So often it is a keen buyer who gets the worst of any acquisition, and the outcome is that damaging cost cutting is necessary to justify the price paid. In this case it is G4S that is seen to have fared worse.

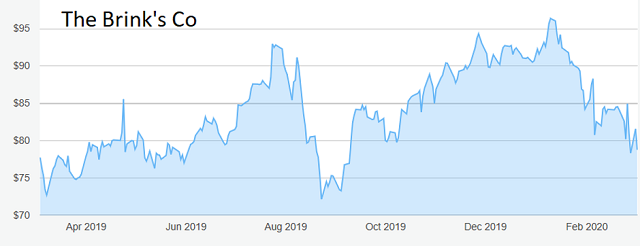

This could be a game changer for Brink’s, whose last big move was the demerger of its home security operations in 2008. After that happened, the shares moved sideways between $20 and $30 for eight years before shooting rapidly to $87 in September 2017 and subsequently peaking at $93 early last year.

Source: interactive investor Past performance is not a guide to future performance

When they came off the boil in the summer, I intended to point to the buying opportunity that had opened up, and actually had a column half written when the shares were starting to recover and had reached $76. Alas, as I was writing they shot well above $80 in two trading days and I felt I could no longer recommend the stock at that stage.

It can be a tough choice whether to chase shares higher or walk away and put it down to experience. In fact, they were still worth picking up for a short-term gain, as they ran as high as $96.35 at the start of this year, but the coronavirus scare has dragged them as low as $78.

This seems unfair, as this type of business is relatively immune from the supply chain issues besetting manufacturers who buy from China. The stock should be among the first to bounce back from the stock market panic.

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It has to be admitted that results for 2019 fell short of analysts’ expectations. While revenue at $3.7 billion were up to scratch, that didn’t translate into earnings, which were only half the expected level at 55 cents per share.

However, analysts remain optimistic for this year, expecting revenue to rise by nearly 3% and earnings per share to bounce back sharply to nearly $4. They see the share price recovering to top side on $100 before this year is out. The G4S deal could be a game changer.

Hobson’s Choice: The shares are currently below $79. Buy below $85. That price, which I do not expect to be achieved for a little while, represents a reasonable balance between risk and potential reward. Don’t chase the shares any higher at this stage, though. Be prepared to miss out again if the stock market rebounds and pulls Brink’s higher.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.