Uncovering the secrets of this mystery AIM share

Our companies analyst read 19 annual reports to discover if one of AIM's great performers is a 'buy'.

1st November 2019 15:35

by Richard Beddard from interactive investor

Our companies analyst read 19 annual reports to discover if one of AIM's great performers is a 'buy'.

Why the furrowed brow, Richard?

James Halstead (LSE:JHD). Ground-hog day. Every year as winter approaches it publishes its annual report and I pick it up hoping to find the answer to a great mystery within it.

Let me guess... Why is a company as profitable as James Halstead not growing more quickly?

That's right. How do you know?

Every year you write about it, Richard.

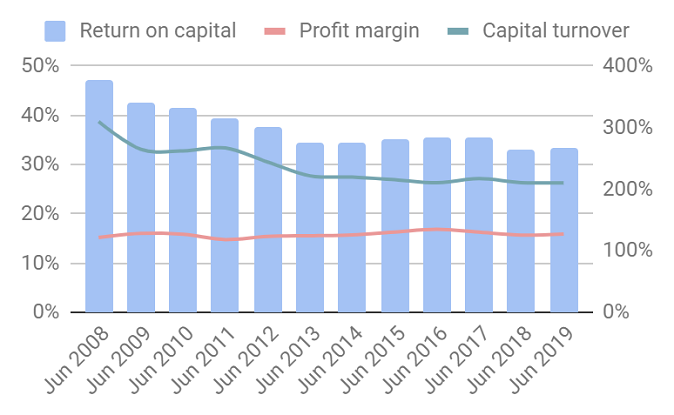

Well then, here we go again. But first, let me explain why it matters. This chart shows return on capital has fallen over more than a decade but it is still remarkable:

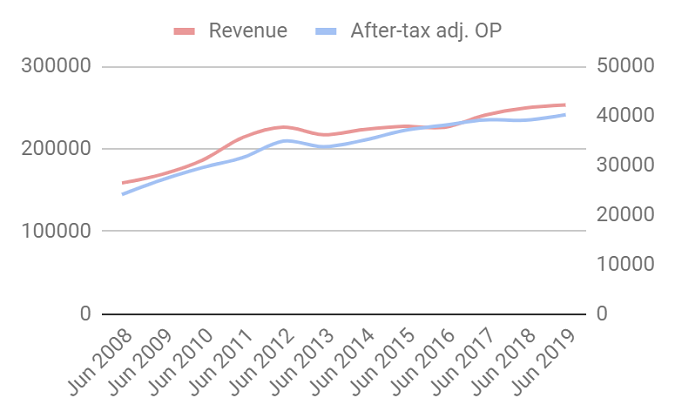

In theory, a company that earns such high returns ought to be able to invest the money it is earning in doing more of the same thing, by building more factories, warehouses, and showrooms, and earn equally high returns on the additional investment. Returns are just another name for profit, so the greater the investment the greater the profit. But profit's not growing very much. In the year to June 2019 James Halstead grew revenue by 1% and adjusted profit by 3%. Over the last five years it has grown revenue 11% and profit 8%:

To understand the slow growth, I spent most of yesterday skim-reading the annual reports as far back as 2000 looking for answers.

Wow, what was the company like then?

James Halstead was founded in 1915 but I'll spare you the ancient history, this isn't the Times. It turns out 2000 was something of a pivotal year. Two decades ago, James Halstead was a much more diversified business, although vinyl flooring was to the fore. It had just disposed of Driza-Bone, which makes a kind of Aussie Barbour jacket - a flappy oilskin coat invented in the nineteenth century to protect ranchers from the rain. It was about to sell Conway Products, a supplier of trailers and trailer tents.

Although it took the company more than a decade longer to give up on Phoenix, a distributor of motorcycle gear, since 2000 James Halstead has been almost entirely a manufacturer and seller of vinyl flooring. In its first decade, the renewed focus and a growing economy combined to produce rapid and very profitable growth.

OK, I'll make this easy for you. Let's deal with one question at a time. Why is it so profitable?

The company only really talks about strategy in broad brush strokes. It has bigger and more diversified multinational competitors, which, it says, scour its annual reports for answers to this very question. Having read 19 annual reports I've gleaned a few ideas though.

First off, in the UK, where James Halstead earns 35% of revenue, it has home advantage because it is the only significant UK manufacturer of vinyl flooring, which means the finished product incurs no import costs and lower transport costs. It has long established relationships with big customers, particularly in the public sector, and by dealing with them directly it ensures it gets repeat business and shares less of the profit with the distributor. By making the sale, providing training and technical backup to customers, distributors are relegated to fulfillment. Its principal brand, Polyflor, has supplied the NHS for its entire 70 year history.

Polyflor excels at making homogeneous vinyl sheet, which is easy to clean and very hard wearing, ideal for unglamorous corridors, toilets, and staircases. Many of James Halstead's competitors have been focusing on the faster growing Luxury Vinyl Tile category and flashier forms of flooring found in lobbies and executive suites, which allows for prettier designs but harbours more dirt and requires more maintenance. James Halstead sells Luxury Vinyl Tile too, but I am not sure if it manufactures, or that it is as profitable.

And why isn't James Halstead growing?

Frustratingly, James Halstead does not divulge the profitability of its UK and overseas operations but it has probably sewn the UK market up, so it probably cannot grow here much faster than the economy generally. Although it sells direct from warehouses overseas, when it is sending stock from the UK it will be incurring cost. Where it uses other suppliers, that also reduces its control of cost, and perhaps the product itself. So perhaps overseas expansion is more costly, and generally the company's products are less competitive.

In the naughties, the UK government spent freely on improving the nation's hospitals and schools, but money has been a lot tighter since then. Brexit and the increasingly fractious trade relations between the USA and its trade partners are holding companies back from investing too. James Halstead is probably right when it defends modest progress in the face of "a particularly difficult climate." That it has grown at all may be down to the fact that it is improving the product all the time, producing ever more natural looking and functional vinyls, that also find their way into more glitzy locations when money is tight and vinyl's twin virtues, cheapness and durability, are appreciated more keenly.

Then there is the dividend...

The dividend? You don't often talk about dividends...

I do when they gobble up cash that could be invested at high rates of return. The company is investing in other ways that do not count as capital expenditure, developing new ranges and its salesforce, for example, but still, James Halstead seems to be prioritising the dividend, which is money it is not investing. In the year to June 2019 it spent £4 million on capital expenditure (maintenance and growth) compared to £28 million on the dividend.

Does James Halstead make good money?

Undeniably (see above)

Score: 2

What could prevent it from growing profitably?

Something is preventing it from growing, probably a combination of sluggish economic growth, particularly in the UK and Europe, its biggest markets, and competition, particularly in Europe, where obviously the terms of trade could worsen depending on the Brexit outcome, and China, which could become a big market if James Halstead can establish its reputation. James Halstead's product is generally not suited to the American market, where vinyl is supplied in different sizes and more gaudy colours.

Large dividend payments may imply a lack of ambition, or may reflect a lack of profitable new investment opportunities.

Score: 1

How will it overcome these challenges?

I do not know if it can. James Halstead's strategy, to deal with end-customers and specifiers (architects and consultants) directly, helps it defend profitability and market share, but it is not obvious it will lead to substantial growth if as I imagine, there is little room for growth in home markets, and overseas markets are more competitive.

Score: 1

Will we all benefit?

Quoting its founder, James Halstead, the company says "Quality is when the customer comes back, not the product", and it is clear the company's reputation is founded on good customer service. Staff are incentivised by a long-standing share scheme and trained to a high standard at the company's fifteen year old training centre. Mark Halstead is the current chief executive and fourth generation of the family to run the company since it was founded in 2015, and its stewardship is probably a big factor in the company's constancy.

Score: 2

Are the shares cheap?

No! That's another mystery. Traders seem to believe James Halstead is a growth stock even though it's barely growing. A share price of 512p values the enterprise at about £1.13 billion or 28 times adjusted profit. The earnings yield is just 4%. If profit continuously inches up, the theoretical return you can expect on your investment is little higher. I think there are better prospects.

Score: -1.2

Though it is a good company, it is mature and highly priced. A score of 4.8 means I cannot recommend James Halstead for long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.