Understanding Science is worth the effort

6th April 2018 16:28

by Richard Beddard from interactive investor

Now the reporting season is in full-swing, I'm busy updating my Decision Engine with new insights. The numbers go into a spreadsheet that spits out a valuation, and the valuation is married to an assessment of the business to produce a score.

Generally speaking, if a share has a score of seven or more out of ten I consider it suitable to buy and hold, perhaps for decades.

This is my assessment of . Each section contributes a maximum of two points to the company's score:

How does Science make money? 2 points awarded (out of 2)

Science is a gun for hire. If your business needs scientific research or a technology product developed, Science can do it for you, for a fee. If it needs help and advice on technology strategy, markets, or regulation, Science provides that too.

Consumer giants like , tech startups and all manner of companies use Science to innovate new products, make old ones better, and ensure they comply with regulations. Its main assets are hundreds of scientists and two modern laboratories, the headquarters in Cambridge, and a food lab in Epsom.

About a decade ago, Science rationalised its business model. Previously, it had operated at least three: Sometimes it owned a stake in the innovations it developed, sometimes it worked for a fixed fee, and sometimes it charged on a time and materials basis. The company was not consistently profitable though.

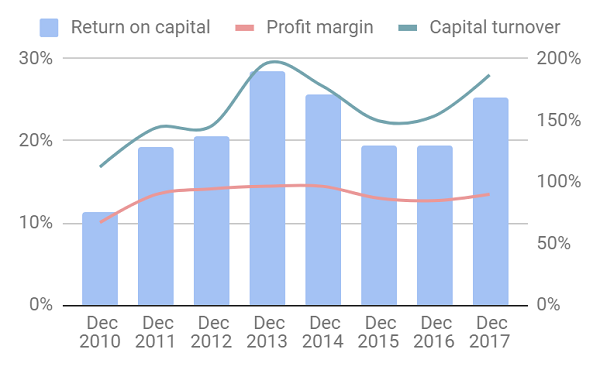

It decided venture consultancy was too speculative, and working for a fixed fee was too risky. Almost all the work it does today is on a time and materials basis, and its results this decade look nothing like the results in the previous decade. It's earned high and consistent returns on operating capital:

Source: interactive investor Past performance is not a guide to future performance

I think Science has found the right business model, but to sustain profitability there needs to be something special about it. Science isn't explicit in its communications with investors, but I have some ideas, which boil down to its location and the way consultancies operate.

Cambridge is home to many of the world's non-military technology consultancies, because of its university and the associated ecosystem of businesses. Companies located nearby have a natural advantage recruiting scientists and benefit from the City's reputation. Science also earns much of its revenue in the US giving it a cost advantage over US consultancies and US companies that do their own scientific research, because scientists here are not paid as much as they are there (even though they're just as good).

It's more difficult to appreciate what makes Science distinctive from other Cambridge consultancies like PA Consulting, TTP, or Cambridge Consultants. When there is a natural oligopoly, I think companies gravitate towards their strongest technology niches and avoid competitors in niches where the competitor is obviously stronger. That may explain Science's high profit margins.

How will it make more money? (1/2)

My description of Science's business model feels coherent, but scratch beneath the surface, visit Science's websites to find out what the company does on a day-to-day basis, and you'll discover baffling complexity. When you employ a bunch of scientists, it appears you can do almost anything.

The complexity is intensifying because Science is diversifying. Over the last five years the original company, Sagentia, which focused on scientific research and product development for medical and consumer goods companies, has been joined by four other consultancies.

The five firms have overlapping capabilities in the medical, consumer, food, chemicals, oil and gas, industrial and agricultural sectors. Some of the consultancies don't do research and development, they just offer strategic and regulatory advice. I had a go at mapping out all Science's overlapping services and markets, and it broke me.

I can see what Science is trying to achieve, though. It's written on Leatherhead Food Research's website. Leatherhead formulates and reformulates foods and beverages to meet current tastes (for example, for superfoods and sugar reduction), and creates and verifies cooking instructions. It provides advice too. Through big brother Sagentia, it can develop food related devices, and through another sibling, Oakland Innovation, it can supply technology and market insight. Some subsidiaries focus on doing the research, others focus on advising clients who do the science. Each subsidiary has its own market specialisms. By selling the services of one subsidiary to clients of the others, Science can grow.

Science is also sending some of its most experienced managers to its offices in the US. Chasing dollar revenue has profited Science recently because a dollar of revenue is worth more in pounds than it used to be, but the US focus may also be strategic. If I'm right about the cost advantage of using the services of UK-based scientists, the more business Science can drum up in North America, the better.

I think the strategy is coherent, but it also feels chaotic. The company says it's "evolving", which is a good thing, but I think it's at a fairly early stage of evolution. I never really feel like I know where it's going, and sometimes I feel it's going in every direction.

What could go wrong? (1/2)

Acquisitions can be a cost effective way to recruit new scientists, gain new capabilities, and sell more services. They can also be expensive mistakes. Science's first acquisition, oil and gas consultancy OTM falls into the second category. Soon after it bought OTM, oil prices tanked and demand for advisory services fell along with it. Science wrote off two big chunks of its investment in 2015 and 2016, indicating it no longer expects to earn sufficient returns to justify the purchase price.

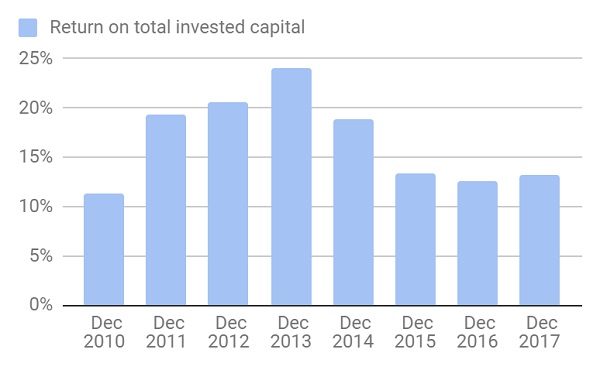

Operationally, Science is highly profitable. Factor in the cost of acquisitions, and its performance is less convincing:

Source: interactive investor Past performance is not a guide to future performance

Return on total invested capital, including goodwill and acquired intangible assets at cost, has diminished following the acquisition of OTM in 2013. The two acquisitions in 2015 have not had such an obvious impact. Leatherhead, the food consultancy, may have been a particularly canny buy, as it was bought out of administration.

Despite the OTM mistake, a 13% after tax return on capital is healthy, and barring further mistakes, ROTIC may improve as the company grows and the significance of the money invested in OTM diminishes.

Although Science is a different company to the one that weathered the financial crisis of 2008, the business model has not been tested in a bad recession. As we've seen at OTM, companies reduce research and development during a downturn, and they may choose to bring work in-house if they have the capacity.

Science's high profit margins give me some confidence that it could weather a temporary drop in revenue and remain profitable, though. Diversification should help it weather downturns in specific markets.

Will shareholders benefit? (2/2)

Chairman, chief executive and majority shareholder Martyn Ratcliffe earned £385,000 in 2017, substantially more than my benchmark of ten times the national median wage.

Ratcliffe combines two roles, and his salary is not augmented many times by bonuses and benefits. In fact, he receives no bonus or benefits and he's received share options only once, in 2010. The board as a whole is inexpensive because it only has one other executive member.

Neither am I concerned about yawning pay disparities. Science must reward its scientists well because it depends on them. Seventy-two of the 184 employees earn more than £60,000, and subject to approval at this year's AGM Science plans to enlarge its share option scheme, to motivate and retain employees.

What does the Decision Engine say? (7/10)

To get a final verdict, the Decision Engine takes the score I've given to the business [6/8], and adds it to a valuation score which can range from minus two to plus two. Science's valuation score is positive, [1/2]* suggesting the shares may be good value. Science scores [7/10].

Science should make a good long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Science.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.