US earnings preview: six stocks and themes to watch

As an ugly first quarter reporting season looms, our head of markets discusses results and recession.

2nd April 2020 10:36

by Richard Hunter from interactive investor

As an ugly first quarter reporting season looms, our head of markets discusses results and recession.

The first quarter of 2020 had, to some extent, been building on the market success of 2019 until the outbreak of coronavirus gained traction globally.

The weekend of the 7-8 March tipped what was an increasingly nervous investing environment over the edge, following the breakdown in oil talks between OPEC, Saudi Arabia and Russia.

Given those concerns, many global indices have swung firmly into bear market territory and are likely to remain there or thereabouts until such time as the economic impact can be fully quantified.

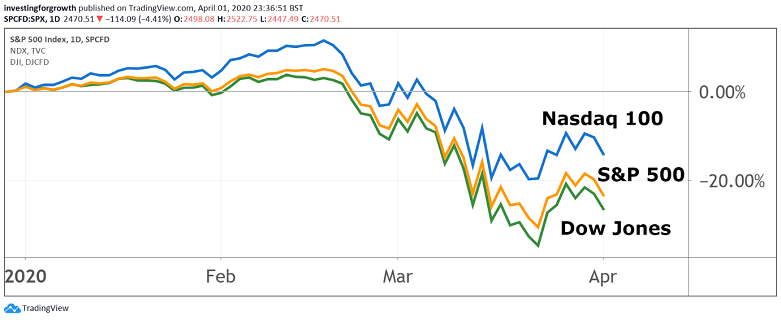

The US market was certainly no exception. Even after a multi-trillion dollar stimulus package involving both monetary and fiscal boosts – with more expected to come - the Dow Jones Industrial Average is down 23% in the year to date, the S&P500 has lost 20% and the previously all-firing Nasdaq 100 has given up 10.5%.

Source: TradingView Past performance is not a guide to future performance

As such, the impending first quarter reporting season is likely to make ugly reading and, as things currently stand, this will not only be mirrored in the second quarter but will almost certainly be accompanied by a global recession.

Quite apart from the likely woeful Q1 numbers, an additional issue is that it is difficult to see a sustained improvement in sentiment until there has been a plateau of cases in the US, where the country is currently on the upward curve of incidences.

There will also be a lack of earnings visibility by normal standards, with the economic fallout being impossible to predict, and this will continue to be a thorn in the side of any kind of recovery.

There is also likely to be a retrenchment from the extremely important US consumer, who contributes an estimated 70% of US GDP. In particular, consumer discretionary stocks will be scrutinised, since they are often seen as being the canary in the coalmine in establishing whether the US economy is showing signs of recession.

In addition, interest rates had already been at historically low levels, which encouraged companies to “lever up”, in an effort to boost earnings growth in an economy which had already been showing some signs of fatigue.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

More positively, major global banks are now generally in a much stronger capital position, as a result of a number of regulatory requirements following the financial crisis of over a decade ago, so the ongoing availability of credit should not be much of an issue.

In the absence of any meaningful outlook statements from companies during the season, what has the market made of the effects of the Covid-19 outbreak?

A scan of the biggest winners and losers from the S&P500 in the year to date provides an excellent summary of what we have already heard, as well as some of the themes we are likely to continue hearing.

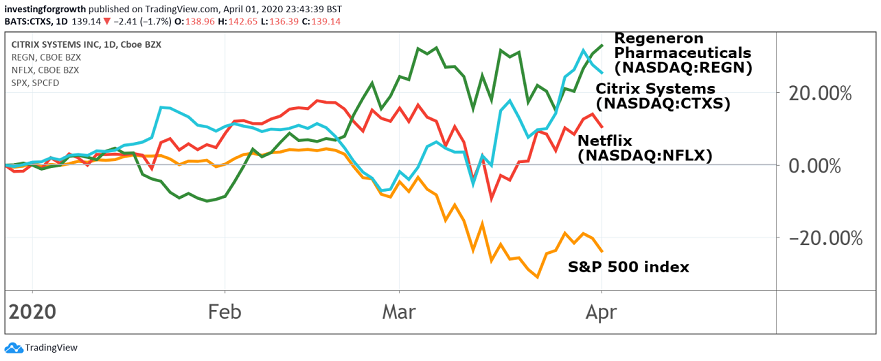

On the upside, three of the largest winners (all of which are also coincidentally Nasdaq stocks) are Citrix Systems (NASDAQ:CTXS), Regeneron Pharmaceuticals (NASDAQ:REGN) and Netflix (NASDAQ:NFLX).

Source: TradingView Past performance is not a guide to future performance

Citrix Systems are up 28% in the year to date and have become known as one of the “work from home” stocks, since they not only enable solutions for the workplace, but also facilitate home-working even without the need for office laptops to be brought home.

Regeneron Pharmaceuticals, ahead by 30% so far this year, are emblematic of the current race to quell the spread and then recurrence of the coronavirus. For its part, Regeneron has found an existing arthritis drug which could potentially be used as a Covid-19 treatment.

Then there is the question of downtime at home following what has become something of a global lockdown. It is perhaps not surprising that Netflix has managed to post a gain of 16% in the year to date.

The losers mirror the most obviously affected sectors following the outbreak.

Staying within the S&P500, real estate company Macerich (NYSE:MAC) has plunged 79% in the face of a potentially skewered property market. Royal Caribbean Cruises (NYSE:RCL) has also lost 76% in the year to date, as the tourism and travel sector has succumbed to the closure of many country borders and the unwillingness or inability of tourists to travel.

In terms of the problems in the energy market, Apache Oil and Gas (NYSE:APA) has seen a plunge of 84% in its share price in just three months.

Poor earnings and a lack of visibility will be key features of the reporting season to come, but as time goes on the six stocks above could prove to be a microcosm of the wider issues facing investors, if not yet in actual monetary terms then at least in helping to identify where recession – and recovery – could hit hardest.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.