US stocks enter bear market, but there’s a silver lining for funds

14th June 2022 09:58

by Sam Benstead from interactive investor

Rising inflation and a cooling economy is spooking investors.

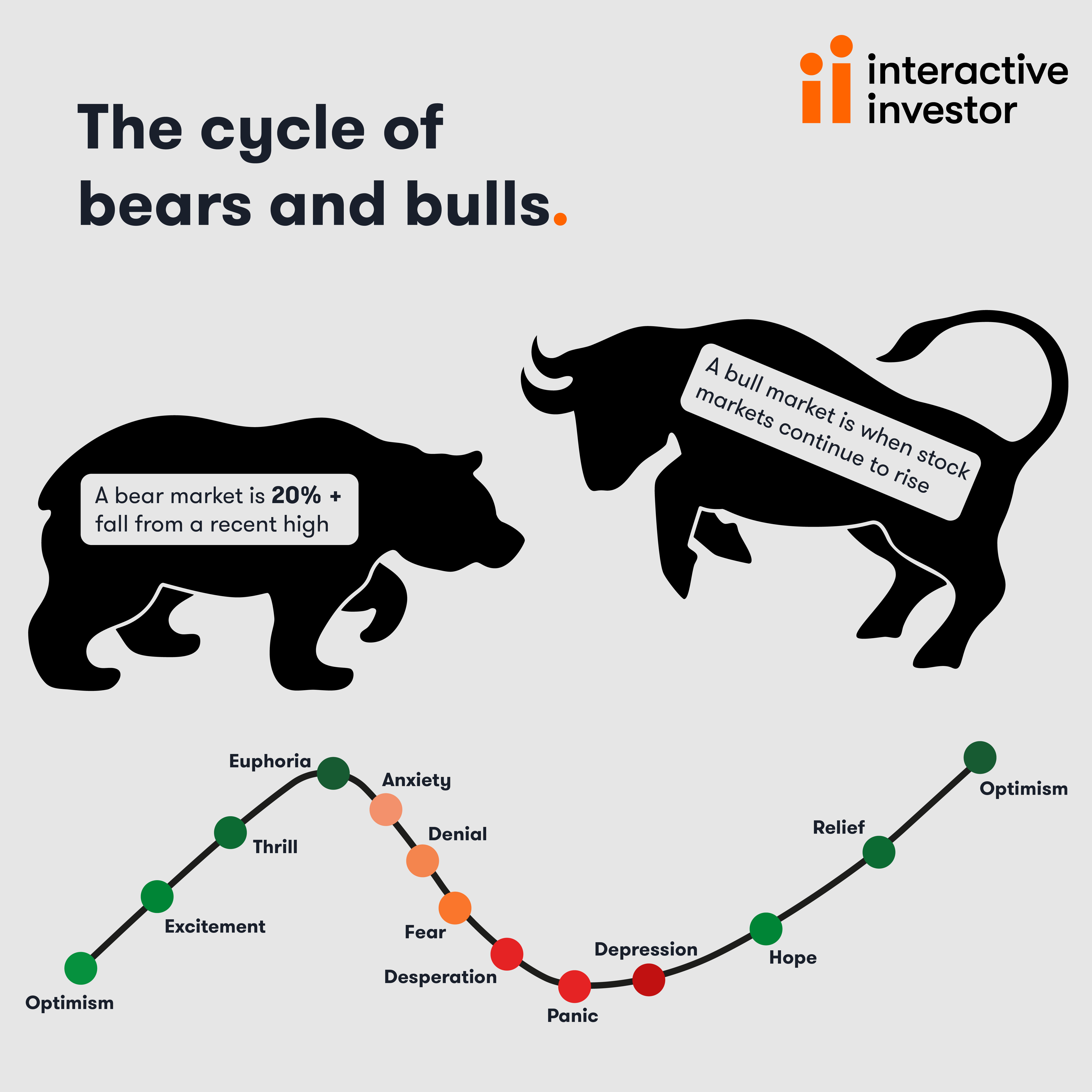

American shares have fallen more than 20% from their all-time high reached in December 2021, officially entering into a “bear” market.

The S&P 500 opened 2% lower today, following a 3% drop last Friday, to take the closely watched index of America’s largest shares to a 21% fall since the start of January this year.

Its technology stocks, as tracked by the Nasdaq Composite index, entered a bear market in April and are now down more than 30%. Global stocks indices are also teetering on the edge of a 20% drop.

However, there’s a silver lining for fund investors. This year, the dollar has risen 11% against the pound, which has cushioned the falls of dollar-priced assets for British investors. The iShares Core S&P 500 ETF has fallen just 10% year-to-date, while the iShares Core MSCI World, which is priced in dollars, has dropped 9%.

- A tactic to ride out the inflation storm using these funds and trusts

- The US funds beating the S&P 500 over the short and long term

Meanwhile, the average actively managed US fund is down 11.8%. Some active funds are in positive territory year-to-date, with BNY Mellon US Equity Income, Quilter Investors US Equity Income, and Fidelity American Special Situations standing out, up 8.65%, 7.3%, and 5.6%.

It is not a surprise to see US equity income funds fare well. The dividends the funds generate are now worth more when converted into sterling, giving UK investors an additional boost.

Why the US has entered a bear market

Shares are plummeting as investors weigh up the consequences of higher interest rates and higher inflation. Greater costs of borrowing should slow down the economy, denting corporate profits. Inflation exacerbates the slowdown as consumers will be worse off as price rises outpace wage rises.

Rising interest rates also increases the return from safe government bonds, putting pressure on companies that promise big profits in the future but have little in the way of cash flow today.

This is hindering American shares, which are more expensive relative to profits than global peers. In contrast, “cheaper” UK stocks have avoided the worst of the selling this year, with the FTSE 100 dropping just 4%.

Inflation in the US hit 8.6% for the year to May 2022, after falling from 8.5% in March to 8.3% in April. The May figure was 0.3% above expectations, which spooked markets as it suggested that the American central bank would have to raise interest rates faster and higher than previously thought.

The market consensus was that inflation had already peaked and would steadily fall to around 3% or 4% next year. However, this latest reading, which showed that inflation in stickier indicators such as housing costs and services remained high, has cast doubt on that view.

- Recessions are becoming more likely – here’s how to invest

- How Terry Smith is investing as markets crash

Dan Boardman-Weston, chief investment officer at BRI Wealth Management, said: “The current conflict in Ukraine and the Covid-induced lockdowns in China are putting further upwards pressure on the rate of inflation and we’re likely to see persistently high readings over the coming months.

“The significant increases in the cost of living and the interest rate increases are starting to have a detrimental impact on current and future growth for the American economy and this is likely to bring inflation meaningfully lower over the medium term.”

Boardman-Weston adds that the Federal Reserve has the tricky task ahead of it of trying to ensure that inflation expectations don’t become entrenched.

“But they are likely to continue tightening policy into a slowing economy. The ‘softish’ landing they are hoping for continues to look like a big ask,” he added.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.