Vanguard says ‘bonds are back’ following worst spell for 150 years

2nd August 2022 09:54

by Sam Benstead from interactive investor

Yields now deliver inflation-beating income for investors with a five-year investment horizon.

An historically bad first half of 2022 for the bond market means that opportunity awaits for investors looking for high yields and the chance of capital gains.

Vanguard, the American fund giant, argues that “bonds are back” following the worst six months for fixed income in at least 150 years.

Emerging market bonds have fallen about 20% this year, while US high yield and global corporate bonds are down around 15%.

- Discover our resources on: Buying Bonds | Free regular investing | General Investing with ii

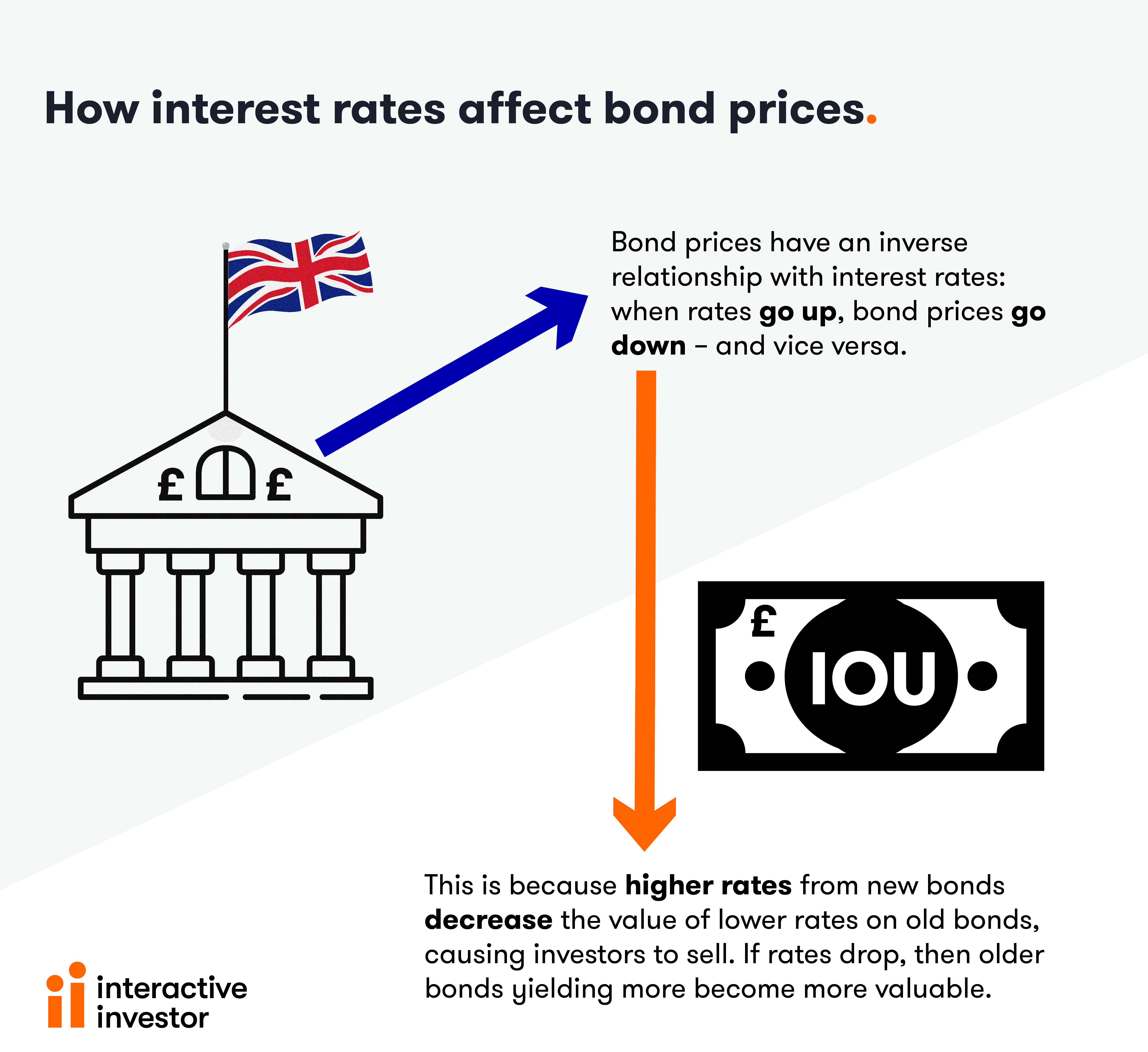

However, yields, which move inversely to price, now offer income above inflation forecasts for the next five years.

Vanguard’s active fixed income team said: “Positive real yields now exist, with bond yields higher than expected inflation over the next five years and beyond. Corporates, municipals, high yield, and emerging markets present more opportunity than at any time in the recent past.

“TINA (there is no alternative) has resigned: bonds offer an alternative with reasonable income again and have re-established their role as a portfolio hedge to equity risk."

- Economic woes mean bonds are finally worth investing in

- Why bonds are back after a record-breaking sell-off

The fund group says that investment grade bonds, which are the least likely to default, can now yield 5%, with pharmaceuticals, utilities and financials offering the best value.

With a 20% decline in emerging market bonds so far this year, there are attractive entry points among the highest-quality borrowers, it adds.

Meanwhile, riskier “high-yield” bonds now yield around 9%. Vanguard said: “Behind the improving valuations lies a fundamental credit picture that remains strong even in the face of a likely economic slowdown ahead.

“Long-term investors should cheer — yields above the inflation expected over the next five years or longer exist in the Treasury market for the first time since a brief spike during the initial Covid panic of March 2020. For those looking for tangible income, that exists now, too.”

Moreover, Vanguard argues that bonds have also started to behave as a stable hedge to equities after spending most of the year correlated with risk assets.

“Signs of a weaker economy ahead are likely to validate the role of bonds as a portfolio diversifier. That has been the case over the long term, and we believe it will be going forward as well,” it said.

- Recessions are becoming more likely – here’s how to invest

- Why bonds are at a major turning point, according to veteran investors

Market outlook

The increasing risk of recessions around the world, and the likelihood that inflation has peaked, means investors expect interest rates to begin to fall next year.

“Markets now see the US Federal Reserve increasing interest rates faster, but pulling back more quickly. Investors expect the US interest rate to peak at 3.5% in December, followed by 0.50 percentage points of cuts next year,” Vanguard said.

Falling interest rates and stable inflation is generally good for bond prices, and would likely therefore provide capital returns alongside the inflation-beating income on offer today.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.