The week ahead: Lloyds Bank, BP, Rolls-Royce, Next

27th July 2018 16:34

by Lee Wild from interactive investor

We're spoiled for choice this week as the high street banks are joined by an army of blue chips announcing latest results. Lee Wild picks out the potential highlights.

Monday 30 July

Trading Statements

Senior, Keller Group, Cranswick, CYBG

AGM/EGM

Redstone Connect, National Grid, Trader Media East, G3 Exploration, All Asia Asset Capital, China New Energy, Kibo Mining

Tuesday 31 July

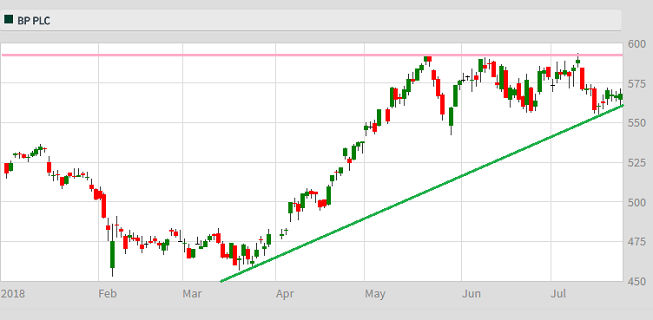

BP

Higher oil prices will give BP's second-quarter profits a big boost. Hot on the heels of its best quarter in three years, net income is tipped to have almost quadrupled year-on-yearto over $2.6 billion. Look for earnings per share to exceed 13 cents versus less than 4 cents a year ago. Seasonal maintenance will likely mean a dip in production from the first quarter, but a number of big new projects should guarantee good growth in output versus last year.

Future production will get a further fillip from Bob Dudley's "transformational acquisition" of a portfolio of US shale assets from BHP for $10.5 billion (£8 billion). Factor in the sale of some Alaskan assets and US production jumps by almost 20% to 885,000 barrels of oil equivalent per day. As well as this sensible acquisition, confirmation of a $6 billion share buyback programme and first increase in the dividend since 2014 is highly encouraging.

Source: interactive investor Past performance is not a guide to future performance

Trading Statements

Greggs, LSL Property Services, IMI, Novolipetsk Steel, Standard Chartered, Just Eat, Sabre Insurance, Elementis, BP, Centrica, Shire, Weir, Rentokil Initial, 4imprint, Coats Group, Provident Financial, Travis Perkins, Taylor Wimpey, Thomas Cook

AGM/EGM

Tatton Asset Management

Wednesday 1 August

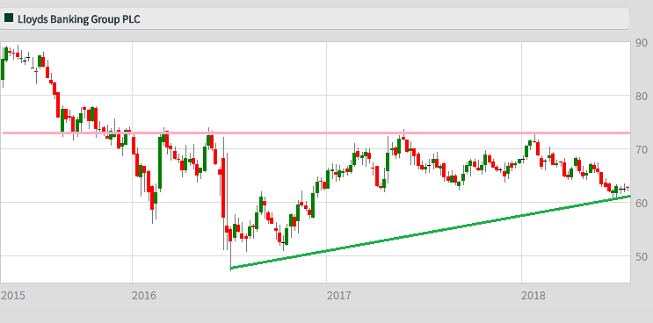

Lloyds Banking Group

Lloyds Bank is the most widely owned stock in the UK and all of us will have some stake in the business. But it's had mixed fortunes since the EU referendum two years ago. Even before the vote, Lloyds shares had struggled to make a break above 73p stick, and there has been no lasting success up to now.

Lloyds was first of the high street banks to recover from the financial crisis, confirmed by its return to the dividend list in 2015. Progress has been slower than hoped for, however, and the much-anticipated interest rate rise, which would typically be great for bank sector margins, hasn't come. Best hope is for 25 basis points at the Bank of England's next meeting on Thursday.

Second-quarter results are expected to show an underlying profit of £1.82 billion, down from just over £2 billion both a year ago and also the previous quarter. At a discount to the sector, Lloyds shares look cheap and offer a prospective dividend yield in excess of 5%. That's still attractive enough to maintain buying interest in the shares.

Source: interactive investor Past performance is not a guide to future performance

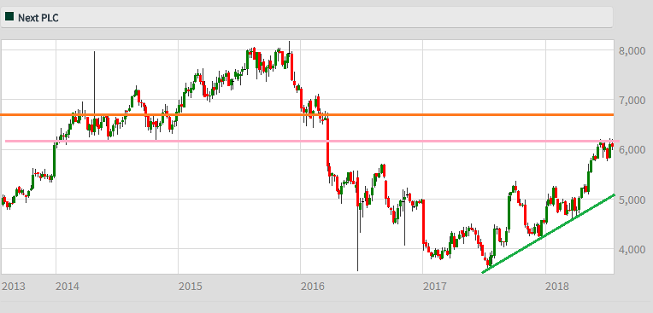

Next

Next has the ability to surprise the market, both positively and negatively. Results can easily trigger a 10% shift in the share price in either direction. Like-for-like sales are expected to have increased by around 3% in the second quarter, but it's unclear how England's surprisingly good World Cup run and the summer heatwave have affected consumer spending.

Apart from the weather, these results will also tell us how Next is benefiting from problems at rivals elsewhere in the sector.

Things have been looking up for Next recently. A 6% increase in first-quarter sales was better than expected, and latest industry sales data implies Next is both able to pass on higher supply chain costs to customers and also grow market share. An aggressive share buyback scheme is also underpinning the share price, currently near levels not seen for over two years.

Source: interactive investor Past performance is not a guide to future performance

Trading Statements

StatPro, Smurfit Kappa, Rio Tinto, St James's Place, Capita, Direct Line Insurance, BBA Aviation, BAE Systems, Aggregated Micro Power, Man Group, Dignity, Lloyds Banking Group, Aggreko, Getbusy, FBD Holdings, Hargreaves Services, Next

Thursday 2 August

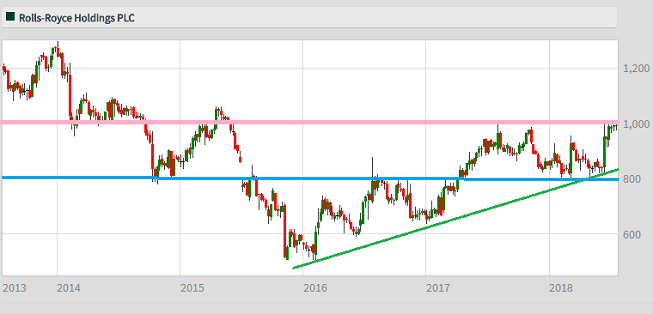

Rolls-Royce

Rolls-Royce has been dogged by a series of problems, most recently with the Trent 1000 engines that grounded Boeing Dreamliner jets. But the latest phase of Warren East's restructuring of the unwieldy business has reignited the share price ahead of these second-quarter results.

This update will be watched closely for further comment on forecasts for free cash flow of £450 million in 2018, give or take £100 million. There's already been progress at the problematic Marine division, where the loss-making commercial operation has just been sold for £500 million and naval work integrated into the defence business.

Rolls is a hugely complicated company, and costs at some divisions remain unacceptable. Thousands of jobs have already gone, but further big cuts may be necessary if East is to deliver on his promised £1 billion of annual cash flow by 2020.

Source: interactive investor Past performance is not a guide to future performance

Trading statements

Spirent Communications, UK Commercial Property Trust, Serco, Vivo Energy, London Stock Exchange, ConvaTec, RSA Insurance, Barclays, Aviva, Mitchells & Butlers, Inmarsat, Merlin Entertainments, RPS Group, Rolls-Royce, Clipper Logistics, Mitchells & Butlers, Sage Group

AGM/EGM

Civitas Social Housing

Friday 3 August

Trading statements

William Hill, Royal Bank of Scotland, Mondi, Millennium & Copthorne Hotels, International Consolidated Airlines, Essentra, Cobham, Pets At Home Group

AGM/EGM

Grand Vision Media Holdings

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.