What is the post-election reality for investors?

We consider the implications for investors and taxpayers of the Conservatives’ election victory.

3rd February 2020 10:10

by David Prosser from interactive investor

From the UK market and property to tax and pensions, we consider the implications for investors and taxpayers of the Conservatives’ election victory.

Santa rally or election elation? The UK stock market posted its biggest gains for more than three years in the week following Boris Johnson’s landslide election victory on 12 December, despite a simultaneous jump in the value of sterling that might have been expected to hit large firms with hefty international earnings.

Other world markets performed strongly too, and the well-documented phenomenon of stocks posting pre-Christmas gains may be part of the story, so the Conservatives can’t take all the credit. That said, there’s no doubt that many in the City were pleased with the result, if only for the greater certainty it brings.

“Investor sentiment is being driven as much by relief that Labour’s hard-left agenda of nationalisation, increased taxation and higher government spending is off the radar,” says Tom Stevenson, investment director for personal investing at Fidelity International. However, he warns of challenges to come. “Looking beyond the initial market response, there remain question marks over the sustainability of any rally given the ongoing uncertainties in the Brexit negotiations.”

Indeed. In the aftermath of the election, the prime minister moved swiftly to quash suggestions that he may be prepared to extend trade negotiations with the EU if they do not bear fruit by the end of the year, when the Brexit transition period is due to end. If that prospect looms large, investors will become increasingly anxious.

More broadly, what does the Conservatives’ election victory mean for your finances? In truth, we don’t yet have the full picture. Johnson and his chancellor, Sajid Javid, have promised a budget within 100 days – now confirmed for 11 March – but for now we have only their election campaign promises to go on. Since a central plank of the Conservative strategy was to avoid trouble by keeping policy announcements to a minimum, that leaves significant question marks in some areas.

Still, there is much we do know – and just the fact that the roadmap to Brexit itself is now so much clearer makes a significant difference for the markets.

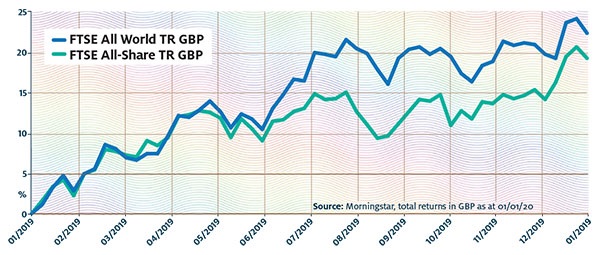

UK market recouped some lost ground in December

UK market prospects

In the short term, many analysts are hopeful that UK equities can enjoy an extended post-election bounce, if only because they have underperformed international markets by around 25% since the beginning of 2016 – December’s gains saw them claw back just a fifth of that.

“The UK market continues to look cheap and trades on a price-to-earnings ratio of just 13 times,” says Rupert Thompson, head of research at wealth manager Kingswood.

“This amounts to a discount of around 20% to other markets, double the UK’s average discount over the past decade. Their relative cheapness suggests UK equities have some scope to outperform further, even if the economic outlook remains somewhat cloudy.”

Ed Smith, head of asset allocation research at Rathbones, is also convinced UK equities can close what has become the biggest valuation gap against global markets since the 1970s. “There are large companies with grave, idiosyncratic problems that deserve to trade below international peers,” he says.

“But the bulk of the UK market’s underperformance started shortly after the [Brexit] referendum. We believe that holdings of UK large- and small-cap stocks should do well, especially while the global business cycle finds its floor.”

After the catch-up phase, much will depend on the extent to which the UK economy can shrug off its recent sluggishness. If it does revive, it has the potential to be a rare bright spot in a world where improving economic performances look to be in short supply in 2020 and beyond.

The good news for UK growth is that the new government is committed to higher spending, which will provide a boost. Easing Brexit uncertainty could support increased business investment, which offers another reason to be hopeful, albeit with the caveat that what companies really want is a trade deal offering long-term stability.

On the other hand, there appears to be little surplus capacity in the economy, with unemployment still at close to an all-time low. And any significant economic recovery would be likely to prompt the Bank of England to finally move decisively on monetary policy by raising interest rates to choke off inflationary pressure. The sunlit uplands, in other words, may remain tantalisingly out of reach.

Turning to the subject of small companies versus large, the former have outperformed over the past few months, courtesy of their greater exposure to the domestic economy. But small-cap stocks still look undervalued by historical comparisons (mid-caps less so), so they may have further to climb. However, large-cap stocks can make progress too. Following its post-election bounce, it will be difficult for the pound to climb significantly higher until the Brexit picture becomes much clearer, which should help UK-listed multinationals as they bring overseas earnings home.

On a sectoral basis, the immediate winners have been stocks in industries where Labour’s radical manifesto proposals had unnerved investors. Utility companies, transport businesses and Royal Mail (LSE:RMG) all faced the prospect of nationalisation and have bounced back since the election; so too has the telecoms sector, where Labour’s plans for free high-speed broadband caused such a stir.

Moving forward, the Conservatives’ plans for £100 billion of spending on infrastructure projects, including new transport links and flood defences, offer a fillip to what is often regarded as a defensive sector. “Infrastructure typically has stable, defensive and inflation-protected cash flows and capital growth opportunities,” argues Sheridan Admans, an investment manager at The Share Centre.

Housing stocks could also reap a post-election dividend, suggests Darius McDermott, managing director at Chelsea Financial Services – particularly if the Conservatives can finally kickstart a more urgent phase of housebuilding. “Transaction volumes should now pick up and bring new impetus to the UK housing market,” McDermott says.

“If the economy picks up and individuals feel more confident, this should also help.”

The banking sector is another potential winner. Freed from the threat of new taxes proposed by Labour and potentially buoyed by an improving economy, banks’ prospects are improving. Alastair George, chief investment strategist at Edison, points out that banks are even more “significantly undervalued” than the rest of the UK market. “The potential for upgrades to consensus earnings forecasts should not be understated,” he says.

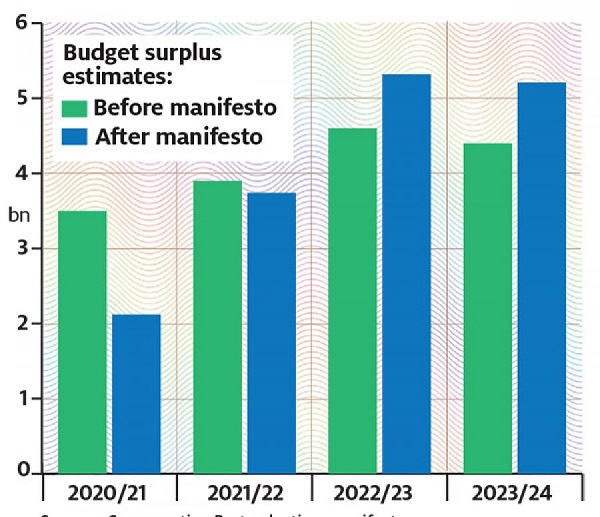

Tory spending pledges

Source: Conservative Party election manifesto (figures may not add up due to rounding)

Personal tax pledges

Johnson’s campaign pledges not to raise income tax, national insurance or the VAT rate in this parliament provide the backdrop for tax policy over the next few years, though bear in mind there’s plenty that clever chancellors can do with thresholds and allowances without breaking these promises.

March’s Budget will provide more detail, but the Conservatives have already said they will get going with plans to cut taxes, as they move towards raising the earnings level at which people begin paying national insurance to £12,500. From April, the threshold will rise from £8,632 today to £9,500, saving around £100 a year for 30 million or so taxpayers.

Elsewhere, Johnson had previously promised to raise the threshold at which 40% higher-rate tax becomes payable from £50,000 to £80,000. But this commitment was ditched during the election campaign amid complaints that it handed a tax cut to richer households rather than those who need most help. While the Conservatives’ large majority might tempt the prime minister to return to this idea, it’s not a policy that will resonate with the working class voters in northern seats whom the new government is now anxious to keep onside.

Other tax changes

The Conservatives’ victory means no radical changes on inheritance tax, which both Labour and the Liberal Democrats had hoped to reform. The government will stick with the £350,000 allowance and continue phasing in the additional relief on people’s main home. By 2021, that will effectively increase the size of the estate that homeowners may pass on tax-free to £500,000, or £1 million for couples.

However, watch out for an announcement on lifetime gifts, where the Conservatives have promised to review the rules following a report from the Office of Tax Simplification. Currently, you must live for seven years after making such gifts – known as potentially exempt transfers – before they fall out of your estate for inheritance tax purposes, but the OTS suggests reducing this to five years. It also recommends combining some of the myriad inheritance tax allowances on gifts that make planning complicated.

On capital gains tax (CGT), there have been no announcements at all, so the annual allowance stays at £12,000, at least until the Budget. Just bear in mind that this is one area where the chancellor still has wriggle room if he wants to raise revenues, so it’s sensible to continue with CGT planning – by using the allowance each year and considering tax-free individual savings accounts (Isas), for example.

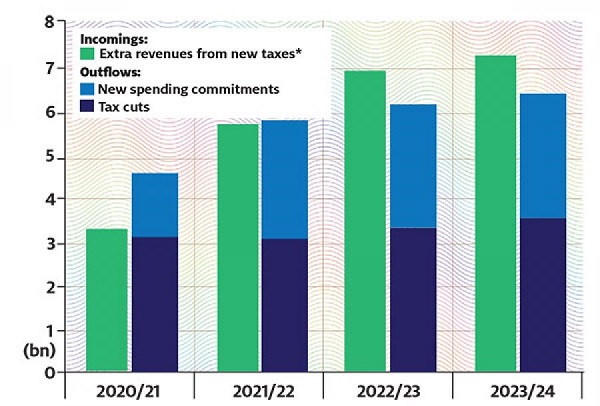

Tax revenue to fund spending spree

Note: *Largely corporation tax reduction cancellation. Source: Conservative Party manifesto (figures may not add up due to rounding)

Housing outlook

Estate agents were delighted by the emphatic Conservative victory, hoping it would herald an end to the political and economic uncertainties that have held the housing market back in recent years. Rightmove (LSE:RMV), for example, has already uprated its forecasts for house prices in 2020, though it still expects a national average increase of just 2%.

It helps that one significant issue acting as a drag on the market – the prospect of stamp duty reform – now appears to be on the back burner. The prime minister had previously floated the idea of raising stamp duty thresholds and cutting the top rate, but these proposals have now been quietly dropped.

Instead, Johnson is planning a 3% stamp duty surcharge for foreign buyers, to be paid on top of the existing 3% extra charge on purchases of second homes and buy-to-let investments.

Of course, house price inflation won’t help people struggling to get on the property ladder, and here we’ll have to wait for further policy announcements.

The Conservative election campaign reheated previous promises on housebuilding targets and floated the idea of long-term fixed-rate mortgages for first-time buyers funded by pension funds.

However, Martijn van der Heijden, chief strategy officer at mortgage broker Habito, warns: “In the UK products such as these have been almost unheard of due to banking regulation and very high switching penalties.” Watch this space – but don’t hold your breath.

Pension triple lock looks sure to stay

Every political party would love to get rid of the expensive and inflexible ‘triple-lock’ mechanism, which guarantees that the state pension will rise by the higher of inflation, average earnings or 2.5%. But with the grey vote so crucial, none dares. The Conservatives are especially conscious of their older voter base and have once again promised to keep the triple lock.

State pensions will therefore rise by 3.9% in April, with winter fuel payments, the older person’s bus pass and other pensioner benefits all protected too.

On private pensions, the chancellor’s priority will be to find a permanent fix for the tapered annual allowance problem whereby higher earners end up with nasty tax bills on even relatively modest pension contributions.

With senior doctors refusing to take on extra work because of this problem, the government has already agreed a one-year deal with the medical profession that largely negates the issue.

But it must now find a long-term solution – and address complaints that doctors aren’t the only high earners deserving of special treatment. “The solution is to abolish the taper outright, even if this means a lower across-the-board annual allowance for all,” argues Steve Webb, director of policy at Royal London.

Savings and investments

As you were on tax-efficient savings and investment schemes, including ISAs, venture capital trusts and the enterprise investment scheme. The March Budget may include some surprises, but the Conservative party’s general election victory means these schemes are likely to remain untouched. It’s even possible that the £20,000 ISA allowance, which has been frozen since April 2017, will be raised.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.