Where to invest in Q1 2021? Four experts have their say

Our asset allocation panellists have turned more bullish on equities.

19th January 2021 10:25

by Jim Levi from interactive investor

Our asset allocation panellists have turned more bullish on equities. They explain why and name their favoured regions.

You don’t have to rely on Boris Johnson or Matt Hancock promising lights at the end of tunnels to boost your morale in these dark times. There is optimism aplenty for stock markets around the world.

Since I last surveyed the opinions of our panel of asset allocation experts three months ago, global equities have checked in with some very strong - in some cases spectacular - performances.

The strong final quarter in a number of markets has been followed by a new year rally as well, and our four-strong panel recognise that three major positive events in recent weeks do much to explain current optimism. We now have a vaccine to fight the pandemic, there is a new president in the White House with control over both Houses of Congress, and finally for the UK we have a Brexit deal.

On Wall Street, the S&P 500 index gained 12.2% in the final quarter, while emerging markets (powered by China and other Asian markets) had their strongest quarterly returns for more than a decade. The MSCI Emerging Markets index rose 20% in the final three months of 2020. Japanese equities forged ahead 20% in the last couple of months of the year.

Even UK shares - for so long the laggard among the major global markets - managed a final quarter bounce back with the FTSE All-Share Index up 12.6% in sterling terms. Although for the year it was down nearly 10%.

- UK equities at a turning point: the shares the pros are backing

- Funds and trusts four professionals are buying and selling: Q1 2021

Panellists turn more bullish at start of 2021

With varying degrees of enthusiasm our panel offer their reasons to be cheerful.

Rob Burdett at BMO Global Asset Management is perhaps the most bullish although he remains underweight the US (with a score of four) and keeps a high cash score as he thinks recent heady performances may lead to a correction.

“What Covid-19 did was to bring the longest upswing in the economic cycle to a grinding halt and triggered a recession - probably a double-dip recession,” he explains. “That then sets up a new economic cycle for later this year - at least that is what the market is pinning its hopes on.”

His argument is supported by low interest rates, the prospect of a big fiscal stimulus for the US and the willingness of other major governments and central banks to spend money to let the world economy “run hot” to support a post-pandemic recovery.

But downside risks remain. Burdett notes that shipping freight rates have trebled in recent months as shipping shortages have been exposed by recovery in China and elsewhere. Is this a harbinger of increasing inflationary risks?

“Market memories can be quite short and a lot of investors have never seen significant inflation or big interest rate increases,” Burdett warns. “You could only justify current stock-market ratings because bond yields are so low. These are very interesting times and at the very least you need a balanced portfolio.”

His answer is to stay underweight in the US, keep a high cash score, take some profits in emerging markets and corporate bonds - they had an exceptional run in 2020 - while edging up exposure to UK and European equities and keeping high exposure to Japanese equities. He is neutral on government bonds (with a score of five) having edged up his UK bonds score to reflect better prospects for the pound after Brexit.

- Two ETFs to consider if you are worried about a tech bubble

- Trust tips pull way ahead of benchmark indices in 2020

Interest rates won’t rise until 2024

Keith Wade at Schroders shares some of Burdett’s doubts about high valuations in US equities. But overall he has the most bullish stance on equities of all the panel members. Keeping his US score unchanged at 6 he is boosting exposure in the UK, emerging markets, Europe and Japan in an impressive display of confidence in global recovery. Like Burdett, he is taking profits in corporate bonds.

“Before we get to that recovery we are going to have to go through a difficult period,” he admits. “We are going to have to downgrade our forecasts for European companies, for instance, and maybe this new wave of the pandemic will force us do the same in other regions. But the market itself is looking beyond that and is pretty much underpinned by low interest rates.”

Wade agrees the market’s mood would be seriously upset by any threat to the low interest rate climate, but he does not foresee any rise in interest rates before 2024.

He has kept his exposure to bonds low. “In an era of low interest rates, they are not such an attractive hedge. Finding hedges is one of the challenges facing asset allocators. We are increasing risk levels, so we are using gold and various currency plays as attractive hedges,” says Wade. He keeps his gold score at 7.

If vaccine does not work against variants – all bets are off

David Coombs at Rathbones is less confident about prospects believing this year may see investors having to deal with a number of bearish signals. “There is obviously greater optimism because of more political stability and the roll-out of the vaccine but if the vaccine does not work against the variants all bets are off.”

He claims we are certain to get inflationary signals by the middle of the year. “You have to wonder how central bankers and governments will react to those signals,” he says. “I think it is going to be a very difficult year but a very different difficult year to 2020.”

Given this cautious verdict it is surprising to see him boost his US score from 6 to 8. “I only hold one or two tech stocks which have driven up the indices on Wall Street,” he says. “I believe there is a huge amount of opportunity in medium- and smaller-cap stocks in the US where valuations are not so horrendous.” He still believes the US is the best place to generate good returns. “It is worth remembering that some of the US mid-caps would be big enough to fit into our FTSE 100 index.”

He has raised his UK equities score from 3 to 5 and might raise it to 6 “if the vaccination rate improves”. Like Burdett, he is surprised at how little sterling has reacted to the Brexit deal.

He is not at all happy, however, about the prospects in Europe. He edges the score up there from 2 to only 3, foreseeing increasing political instability. “People seem to be underestimating the impact of the absence of the UK’s contribution to the EU budget,” he says.

When it comes to emerging markets, he raises his score from 1 to 4 but says these markets are like chalk and cheese and would give a 9 score for China and perhaps only a 1 for markets in Eastern Europe. He shows little interest in bonds or property but keeps a score of 7 for gold.

Panellists most positive on equities

Richard Dunbar at Aberdeen Standard sees a trade-off in markets between the influence of the vaccination and the lockdown, but he expects economies that have not already done so like China to “get back to work” in the second half of 2021.

“There is less uncertainty than there was three months ago and although markets have already reflected that I remain positive on equities within a diversified portfolio,” he says.

He has raised his UK score from 4 to 5 but kept all other scores unchanged apart from corporate bonds where, like other panel members, he is taking profits and cutting from 7 to 5. Echoing the views of Coombs, he says the uncertainties about “inflation versus deflation” are greater than before. “We discuss inflation a great deal these days, but over the last decade inflation has not shown itself to be a problem, while the impact of the virus has been deflationary.”

His broad verdict: “We are going to get some kind of recovery and pick-up in the world economy and some of the cyclical and value stocks are going to perform better - some of them quite a lot better.”

He keeps gold at only 5 but still regards it as “a good hedge against our predictions going wrong”.

- Top-performing fund, investment trust and ETF data: January 2021

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The property sector remains completely out of favour, but for Burdett the worst may be over. “I am not betting the ranch,” he says, “ by raising my score for property from 2 to 3. Most of the bad news for commercial property is known by now and it was one of the worst-performing asset classes in 2020.”

But what of the star of the show last year? I am talking about the cryptocurrency Bitcoin, of course. It started last year at under £6,000 and finished it at over £30,000. Our panel do not seem to want to go near it even though some pundits think it is digital gold. “It is Wizard of Oz territory,” says Coombs. “It has no regulatory or legal legitimacy.” His fellow panellists seem to agree.

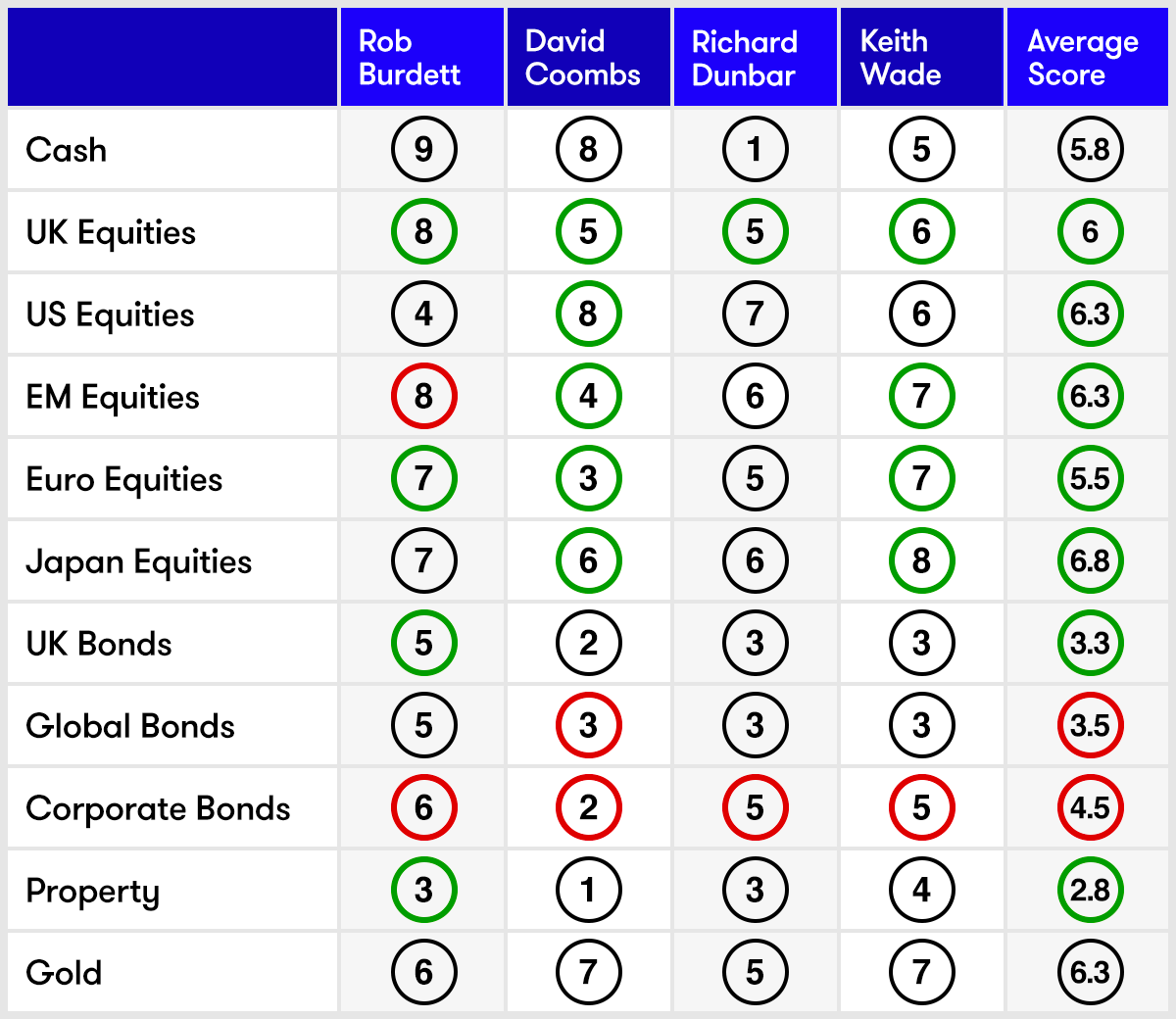

Note: the scorecard is a snapshot of views for the first quarter of 2021. How the panellists’ views have changed since the fourth quarter of 2020: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at Aberdeen Standard.

Keith Wade is chief economist and strategist at Schroders.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.