Why Alumasc shares are good value right now

26th October 2018 16:35

by Richard Beddard from interactive investor

Performance at the building products manufacturer was hit by a number of one-off factors in 2018, but it is probably a good trade, argues analyst Richard Beddard.

What a difference a year makes, or indeed a quarter year. To be more precise, what a difference the third quarter of Alumasc's financial year, corresponding to the first quarter of calendar year 2018, makes.

For about five years, Alumasc has been growing more profitable while jettisoning underperforming businesses and focusing on the supply of premium building materials.

But the company says a cold snap last winter stopped builders building. The harsh winter, economic uncertainty and the collapse of Carillion (which made lenders more reticent to finance building projects) combined to sap work from Alumasc's order book. Revenue did not grow in the UK, Alumasc's home market.

Alumasc had expected export sales to largely replace revenue from a big North American solar screening project it had completed. Instead, they slumped.

Overall, revenue fell 3%, but adjusted profit fell 25%. The figures are flattered though, by the acquisition of Wade International. Without its contribution, revenue would have fallen 11% and profit 38%.

At the year end in June, Alumasc's order book was lower than it was at the beginning of the year, but it was anticipating large orders and a recovery.

As usual, I am scoring Alumasc to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1/2

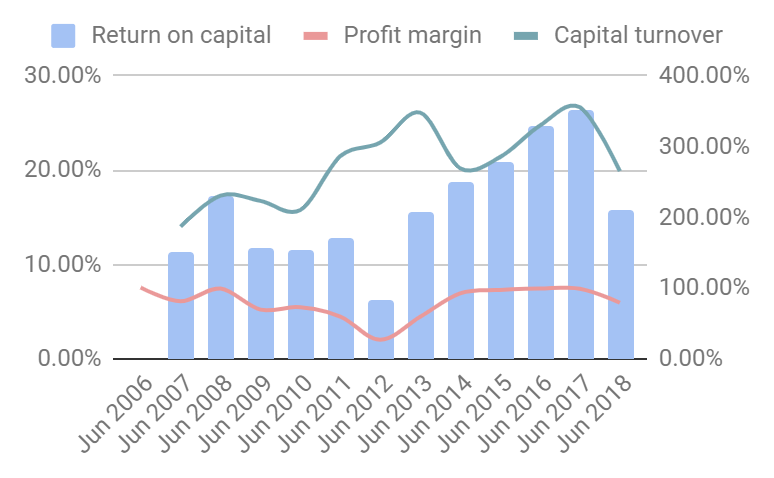

Despite the slump in profit, Alumasc made a 16% return on capital in 2018. Disappointing by recent standards, the company performed better than it did between 2009 and 2012 when the construction industry experienced recession and Alumasc was trying to turn Alumasc Precision around. It sold the loss-making engineering business in 2015.

Source: interactive investor Past performance is not a guide to future performance

During the period from 2013 to 2017 Alumasc's profits grew nearly 50%, but the amount of money invested in the business barely grew at all. That changed in 2018 with the acquisition of Wade, which substantially increased Alumasc's capital invested at the same time profit slumped.

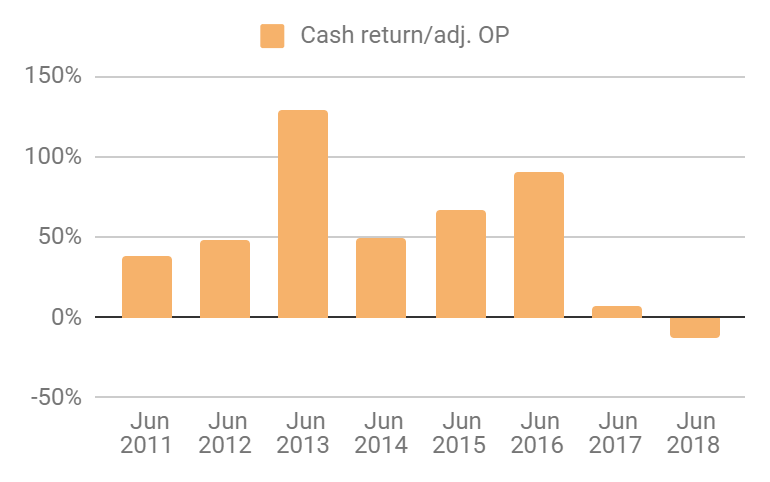

Although 16% return on capital is good, Alumasc made a loss in cash terms. The chart below shows the total of operating cash flows and capital expenditure was negative.

Source: interactive investor Past performance is not a guide to future performance

The company explains the big discrepancy between accounting profit and cash flow occurred because it booked revenue and therefore recognised profit in a strong final quarter, but it had not yet collected payment. Also, earlier in the year it splurged on stock to avoid price rises. As it does every year, it paid large amounts into its pension fund to plug the deficit.

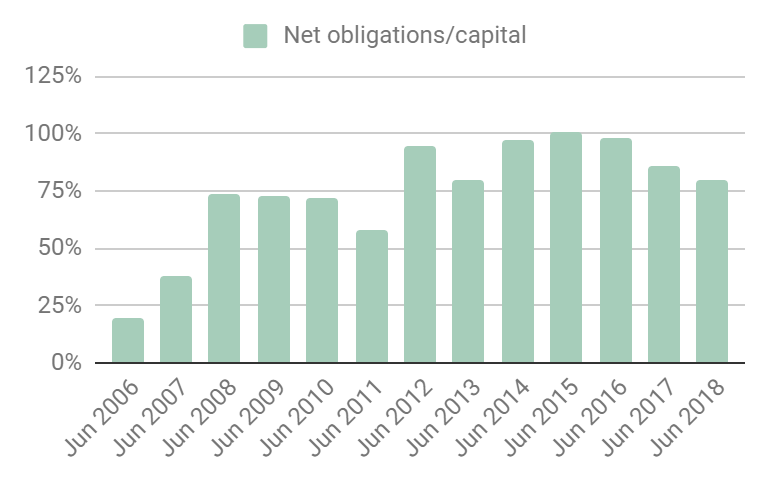

In any normal year this cash loss would have made Alumasc more reliant on other people's money, the deficit in its own pension fund, landlords and lessors, and bank debt. For once though the many convoluted factors in calculating how much the company owed its pension scheme moved in the company's favour and reduced the pension dependency, and the overall level of financial obligation even though the company also borrowed to buy Wade:

Source: interactive investor Past performance is not a guide to future performance

Overall, Alumasc remains heavily reliant on external finance.

Adaptable: How will it make more money?

Score: 2

Alumasc specialises in products with technical specifications often determined by building and environmental regulations. While some of its business manufacture, its main focus is design, ensuring the products are easy for builders to install. The products are typically installed on or around building exteriors, solar shading, cladding, roofing, gutters, downpipes and drains, which means it has complementary products to sell and complementary expertise to lend customers.

The company claims market leading positions in the UK for a number of its businesses including Levolux (solar shading and screening), Alumasc Rainwater (aluminium guttering), Harmer and Wade (metal drainage systems) and Gatic (engineered access covers and high capacity drainage). Most of the other businesses are challenger brands.

This strategy probably explains Alumasc's high profit margins, which it defends through new product development and by selling businesses that do not meet its performance requirements and acquiring businesses that do.

Alumasc seeks 10% operating profit margins and 15% return on investment from its subsidiaries. In 2018, it disposed of SCP, a scaffolding business operating at break-even, and acquired Wade for £8m. Wade added £5.3m in revenue and £1.3m operating profit, earning operating margins of 25% and a 16% return on investment. Wade’s filing history at Companies House reveals high levels of profitability but little growth. If it finds new customers under the Alumasc umbrella, it could prove to be a very good investment.

Resilient: What could go wrong?

Score: 1

I think Alumasc's specialist strategy addresses competitive risks, but the big worry with building material suppliers, especially those dependent on external sources of finance, is what happens during recessions, when builders stop building.

Because different products are required at different points in the construction of a building, and because Alumasc supplies a wide range of public, private, house building and commercial projects, the company believes it is fairly insulated from construction cycles.

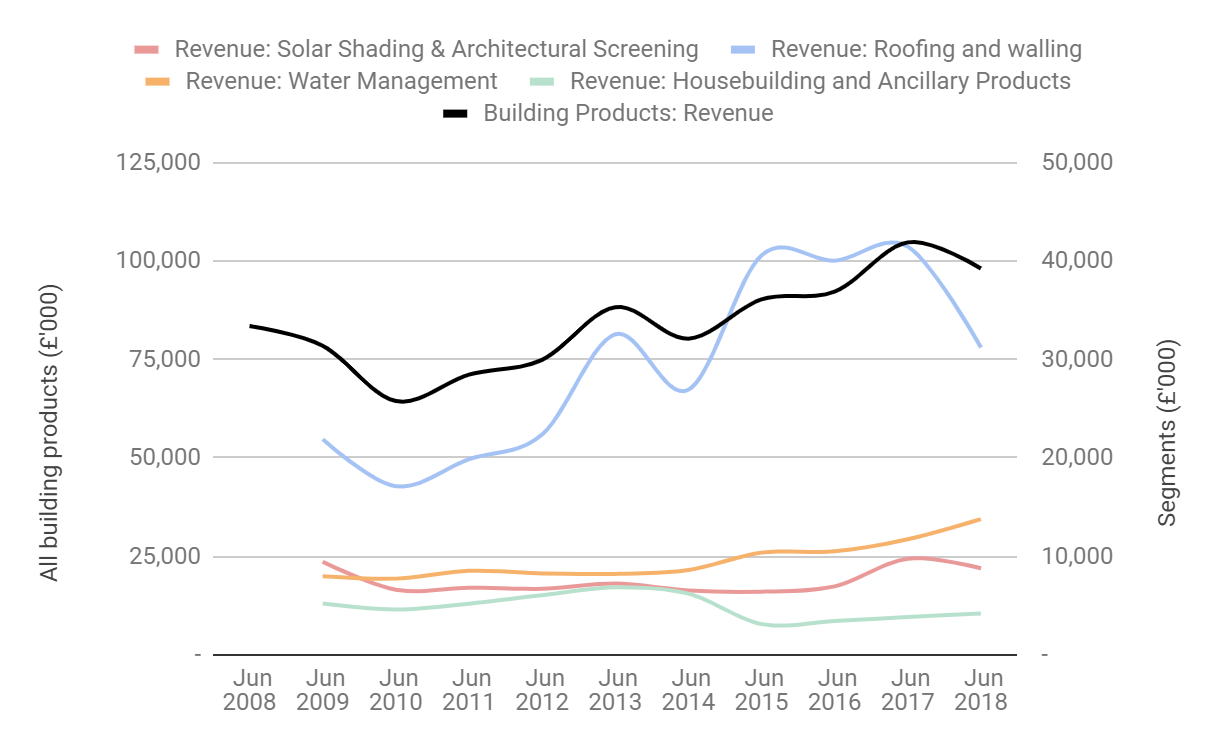

Nevertheless, a three month contraction that produced a 38% decline in underlying annual profit and negative cash flow is alarming. Only two of Alumasc’s five divisions grew revenue in 2018:

Source: interactive investor Past performance is not a guide to future performance

A big decline in revenue from roofing and walling was exacerbated by another one-off factor, the tragedy at Grenfell Tower in June 2017, which temporarily reduced demand for external wall insulation while specifiers worked out what products they could safely use. Alumasc says its cladding products are high quality and fire resistant.

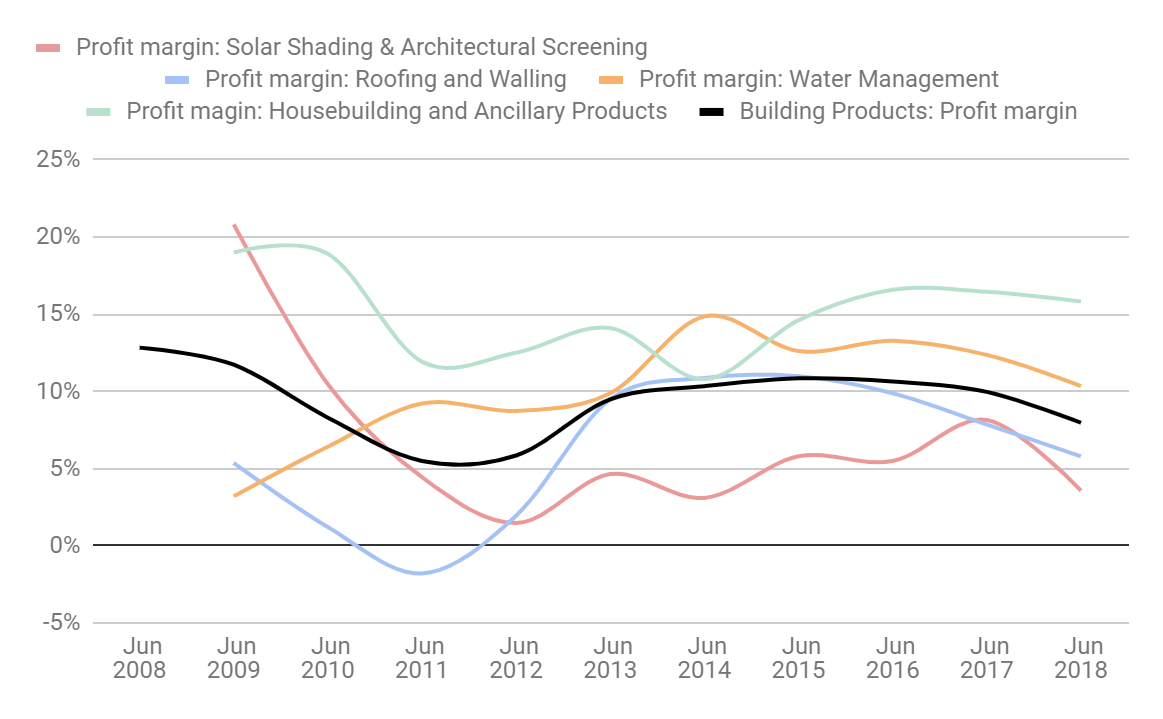

Operating profit margins fell sharply at all of Alumascs divisions bar the smallest, Timloc, a supplier of housebuilding products:

Source: interactive investor Past performance is not a guide to future performance

In mitigation, having decided the third quarter was a "blip", Alumasc kept spending as it continued to build capacity in the USA where it is supplying a lot more quotes than actual building products, and invested in a new Timloc factory in the UK.

Equitable: Will we all benefit?

Score: 1

I detect a slightly revisionist tone in Alumasc's newsflow. This is how the chairman describes the slump in export sales in the 2018 report:

"As anticipated a year ago, we also experienced lower export sales reflecting project timing after last year's record. This should now begin to recover as the project pipeline grows."

And this is what he anticipated in the 2017 annual report:

"We anticipate further underlying growth in export sales in 2017/18, and this is expected to largely mitigate a high concentration of large export projects in 2016/17."

The words are not contradictory, but I think Alumasc gave the impression there would not be a major impact following the completion of large projects.

Underestimating the impact of events that have not yet happened is forgivable, spin perhaps less so. Whichever is the case, yesterday, at the AGM, Alumasc reported brisk business at most of its subsidiaries but delayed the export surge again, saying:

"Levolux and Gatic continued to see fewer larger construction projects being delivered in the first quarter, including exports, despite pipelines for future work remaining strong. A number of these projects are expected to convert into revenue later in the financial year."

Cheap: Is the firm's valuation modest?

Score: 2/2

An investment in Alumasc is complicated. Profitability is high, but variable and not always backed by cash flow. Even so, the shares are probably good value. They trade at about 14 times adjusted profit in 2018, a year in which profit was probably below-par.

A score of 7/10 indicates Alumasc is suitable for investment, but maybe not for the long-term. The low valuation is appealing, but should the share price rise substantially, the inconsistent performance of the business may make mean it is worth taking the market's offer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.