Why I’m downgrading this sector after successful tip

15th June 2022 08:07

by Rodney Hobson from interactive investor

Even after the recent stock market rout, these four share tips are showing a tidy profit on his tip price, but overseas investing expert Rodney Hobson thinks it's time for a change in tactics.

Sharply rising inflation, the prospect of a series of interest rate hikes and possible recession offer a discouraging outlook for the US housing market. Although a lot of bad news is now factored into the share prices of American housebuilders, it could be too early to buy for recovery.

Inflation in the United States hit its highest level for 40 years at 8.6% in May, dashing overoptimistic hopes that a slight dip in April heralded an easing in price pressures. The Federal Reserve Bank will very likely raise interest rates this week and again next month. The only question is by how much, with a total of one full percentage point the most likely outcome.

This will further exacerbate a slowdown in the American economy. The Organisation for Economic Cooperation and Development has just forecast a sharp slowdown from 5.7% growth last year to 2.5% this year and 1.2% next, with real incomes slashed by higher food and energy prices, the kind of spending that particularly hits those who are already strapped for cash.

- A tactic to ride out the inflation storm using these funds and trusts

- The US funds beating the S&P 500 over the short and long term

- Recessions are becoming more likely – here’s how to invest

- Want to buy and sell international shares? It’s easy to do. Here’s how

Shares in the housebuilding sector made a decent start to the year, but have fallen back sharply over the past three months despite continuing strong demand for housing helped by a shortage of homes for sale, steady employment and rising wages due to labour shortages.

D.R. Horton Inc (NYSE:DHI) shares slumped to $32 early in 2020 as the pandemic hit cyclical stocks badly, but they recovered to peak at $103 then $109 the following year. They are now back around $66, a level at which they have found buying support on several occasions over the past two years. The price/earnings (PE) ratio is a meagre 5 while the yield is a modest but sustainable 1.24%.

Source: interactive investor. Past performance is not a guide to future performance.

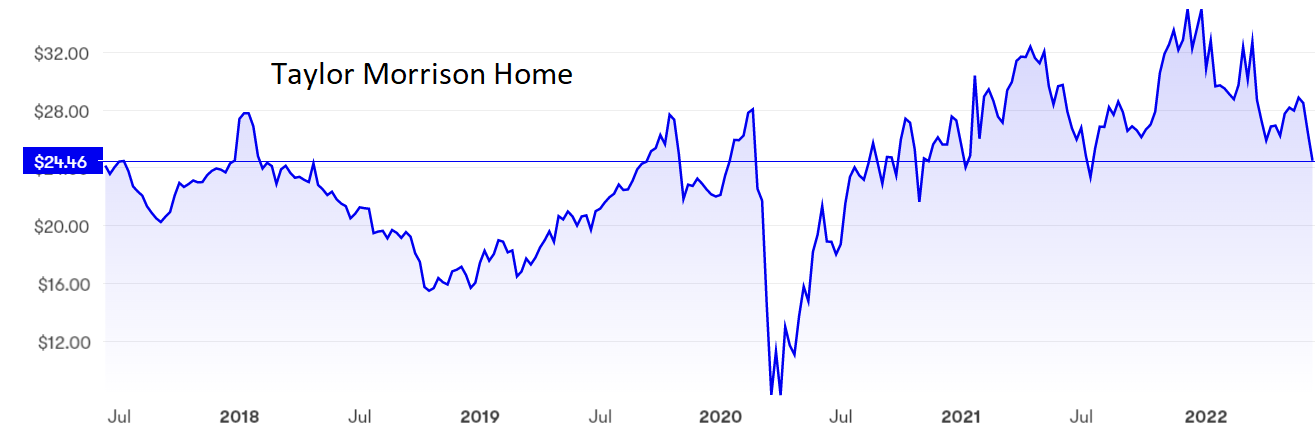

Taylor Morrison Home Corp (NYSE:TMHC) shares follow a similar pattern, rising from $9 to $35 before slipping back to around $24.50. The PE is only 4.5% but then again there is no dividend to provide a modicum of comfort. There is a possible floor at $23, though.

The company reported net income up 80% year on year to $177 million in the first quarter with revenue higher and margins widened. It is unlikely to disappoint in the current quarter.

Source: interactive investor. Past performance is not a guide to future performance.

KB Home (NYSE:KBH) rebounded from $13 to $50 but has now settled back to $129, where it should find support. The PE is 4.5 and the yield is the best of the bunch at 2%. However, the lowly rating reflects the fact that it has suffered most from supply chain issues and labour shortages.

Source: interactive investor. Past performance is not a guide to future performance.

Lennar Corp Class A (NYSE:LEN), the largest housebuilder in the US, has followed a wilder journey from $34 to $119 and back down to $70, where the PE is 5.5 and the yield 1.8%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: All four shares remain well above my very timely tip level in April 2020. I repeated my "buy" stance earlier this year after they had slipped back from their peaks. A brief rally has petered out and I believe this sector is once again undervalued.

So far the rising price of supplies has been passed on to homebuyers and, while that state of affairs will come under increased pressure, the sector is in far better shape than it was in 2008 when the widespread issuing of subprime mortgages caused a global financial crash. Housebuilders have been increasingly prepared to work together on joint ventures to mutual benefit and have been able to replenish land banks at reasonable prices.

However, the downward trend in share prices could well continue whatever the fundamentals may say, so the sector should be reclassified to "hold" until the economic picture brightens. If you want to take a punt, consider KB Home as the PE ratio is the joint lowest and the yield the best.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Source: interactive investor. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.