Why Johnson & Johnson is a world leader worth owning

It’s involved in the race for a Covid vaccine, but shareholders should concentrate on the bigger picture.

21st October 2020 10:18

by Rodney Hobson from interactive investor

It’s involved in the race for a Covid vaccine, but our overseas investing expert believes shareholders should concentrate on the bigger picture.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Don’t pile blindly into pharmaceutical companies that are involved in the hectic rush to produce a Covid-19 vaccine. It is still unclear which company will win the race and victory will be worth more in kudos than in financial gain. Far more important for investors in the health sector is to find the players with long-term futures rather than short-term glory.

Johnson & Johnson (NYSE:JNJ) is one of many companies involved in the very expensive and uncertain lottery of testing a vaccine that will obliterate the virus without harming the humans. It has more than 40 rivals and J&J’s is among 11 potential vaccines that have reached phase 3, where testing is on human beings.

The J&J vaccine does have an edge because it is being tested on the 65 and over age group, the one that is most at risk, as well as 18-55 year-olds. It also involves just one jab rather than two, as is the case with most rivals, and could be ready early in 2021.

- US results season preview: Q3 2020

- Use our helpful calendar to find out when the world's largest companies are reporting

- Want to buy and sell international shares? It’s easy to do. Here’s how

Unfortunately, one person on the trial, which began at the start of September, was taken ill and the process had to be suspended – as has happened with other possible vaccines. It shows what an uncertain business these pharmaceutical trials are.

What is more, J&J has promised to sell its vaccine at no profit for as long as the pandemic lasts. That secures the moral high ground but not the dividend. So, although the US Department of Health has promised to buy 100 million doses of J&J’s vaccine for $1 billion if it works, that does not have a big impact on the company’s profits overall.

Shareholders should concentrate on the bigger picture. J&J is the largest healthcare company in the world. It had revenue of $82 billion last year from its wide range of existing drugs, medical equipment and consumer products.

The only section suffering from the coronavirus crisis is medical devices, due to the widespread cancellation of elective surgery. Meanwhile, blockbuster drugs Imbruvica, Darzalex and Stelara go from strength to strength.

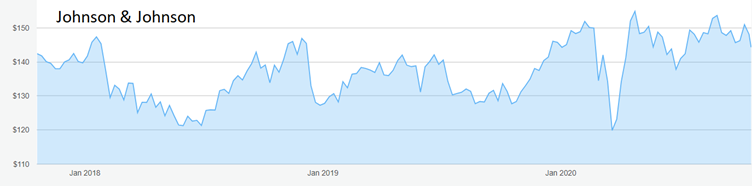

Source: interactive investor. Past performance is not a guide to future performance.

Results from the latest quarter to the end of September were highly encouraging. Sales were up 1.7% at $21.1 billion and net earnings doubled to $3.55 billion. What was particularly encouraging was a better-than-expected recovery in medical devices, where sales were only 3.9% adrift. Consumer health sales were 1.3% better than in the same quarter last year and pharmaceuticals climbed by 4.6%. The best region was on home turf in the United States.

The figures meant that guidance for underlying full-year sales was raised to 0.5-1.5%, and total sales will at worst fall only 1%, pretty good in all the circumstances.

One continuing worry is lawsuits alleging medicines, most notably opioids, caused personal injury to patients. This is an occupational hazard for healthcare companies operating in the US. J&J is paying $5 billion to settle outstanding cases. While this draws a line under an issue that has hung over the group for some time, there is no guarantee that more cases involving the same or different drugs will not crop up in future. At least J&J has the financial strength to cope with them.

- Investing in the US stock market: a beginner’s guide

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It also has the financial strength to expand through acquisition. In August it agreed to pay $6.5 billion cash for Momenta Pharmaceuticals, based in Massachusetts, which specialises in neurology, medicines for foetuses and new-born babies, and haematology. This deal widens the range of group products even further.

Hobson's choice: Last October I advised buying at up to $134, and the shares rose steadily to $154 in February before the coronavirus crisis hit the stock market, plunging the stock to $111. The shares are now back to $144.50. J&J pays four well covered dividends totalling $4.04, giving a yield of 2.8%.

Buy up to $146. There could be resistance around $150 but the downside looks limited to $138.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.