Why Pfizer is much more than a Covid vaccine

It saves lives every day, but are its shares worth owning? Our overseas investing analyst gives his view.

24th February 2021 08:48

by Rodney Hobson from interactive investor

It saves lives every day, but are its shares worth owning? Our overseas investing analyst gives his view.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

As we start to see an end to the Covid-19 shutdowns, with the UK and Israel leading the way and other countries major playing catch-up, some investors have lost interest in pharmaceutical stocks. That has opened up a buying opportunity, because vaccine makers will continue to find opportunities in a world where new viruses can sweep across large areas with frightening speed.

Two quite different American companies in the sector offer attractive yields that provide a bulwark against the vagaries of a sector where fortunes can change dramatically over time.

Pfizer (NYSE:PFE) has annual sales of nearly $50 billion and a wide range of products emerging from its hefty annual research budget of nearly $8 billion. Prescription drugs and vaccines are its main lines, with bestsellers including a pneumococcal vaccine, a cancer drug, a cardiovascular treatment and an immunology drug.

It also has a wide geographic spread, with international sales accounting for roughly 50% of turnover, and there is a heavy presence in emerging markets where the scope to ramp up sales is greater.

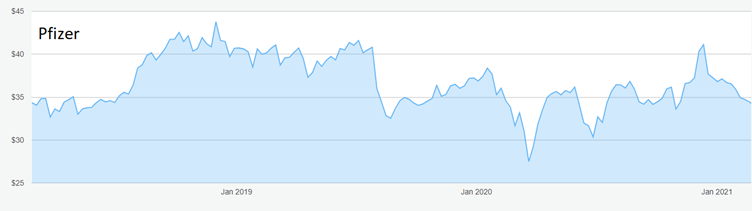

Source: interactive investor. Past performance is not a guide to future performance

Pfizer was at the forefront of the Covid-19 research effort, although the advantage of being first with an approved vaccine was somewhat offset by the disadvantage that it had to be stored at minus 70 degrees celsius.

Even so, Pfizer’s reputation will have been enhanced by the fact that quality was not sacrificed to speed. Analysis just published by Public Health England showed the vaccine reduces the risk of catching infection by more than 70% after a first dose alone, and drastically lowers the risk of hospitalisation and death among those who are not fully immune.

Among the over-80s, data on more than 12,000 people found at least 57% protection against coronavirus 28 days after vaccination with a single dose rising to 88% after a second dose. This will allay concerns over whether vaccines work well for older people who tend to suffer worse effects if they contract Covid-19.

A recent Israeli study showed the first dose of the Pfizer vaccine is 85% effective against infection only two to four weeks after inoculation and the second jab is 95% effective just a week later.

Now Pfizer claims its vaccine can be stored at -15 to -20 degrees for up to two weeks and that earlier guidance that a much lower temperature was required simply reflected sensible caution. New data has been submitted to the US Food & Drug Administration and clearance, assuming it is forthcoming, will make this vaccine usable more widely.

- What changes has Warren Buffett made to his investments?

- Don’t write off this Covid vaccine developer

Pfizer shares are back below $35, where I have previously suggested they represent great value. Those who followed that advice have had solid dividends to compensate for the sideways movement in the share price, while shorter term investors have had the opportunity to take profits above $40.

AbbVie (NYSE:ABBV) is a smaller drug company specializing in immunology and oncology. Its top drug, Humira, accounts for nearly half its profits, which is great for now, but it is a worry to be so reliant on just one product in a world where new discoveries can replace old favourites.

Source: interactive investor. Past performance is not a guide to future performance

I suggested 14 months ago that investors should buy up to a recent peak of $89. There was an anxious period in March 2020 when the stock slumped to $69, but patient holders are now well ahead at $106.

- interactive investor comment on Pfizer and Novacyt

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Hobson’s choice: These two companies are attractive because they have yields around 4.5% at current share prices.

My longstanding advice to buy Pfizer below $35 still stands. We should see $40 again before too long. The best chance to buy AbbVie has gone and is unlikely to recur but latecomers could consider coming in below $110.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.