Why the stars are realigning for emerging market funds

Falls in global stocks are expected for rest of the year, but that should give investors opportunities.

14th November 2019 09:40

by Andrew Pitts from interactive investor

Falls in global stocks are expected for the rest of the year, but that should give investors useful opportunities.

The stars are aligning – but the pattern forming does not look propitious for developed market equities, particularly the US after its blistering run over the past decade. Meanwhile, long-suffering investors in emerging markets, relative to global developed markets, are set to have their faith repaid.

The arguments for investing directly in emerging markets are well-rehearsed. Emerging economies offer superior economic growth increasingly fuelled by domestic rather than export-led growth; superior demographics featuring young and well-educated populations; and untapped potential via fast-growing companies harnessing technological innovation in anything from finance to energy supply.

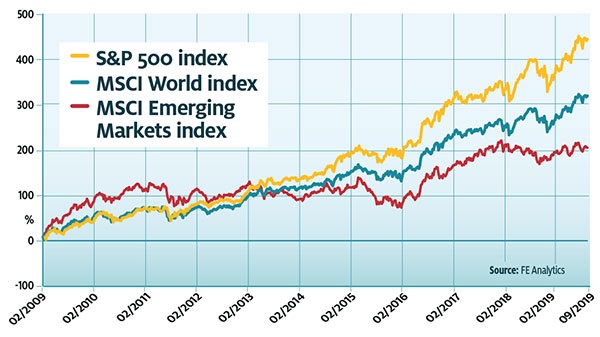

These plus points have not resulted in superior returns for emerging market fans, however. Since March 2009, when markets began their rebound from the global financial crisis, the MSCI Emerging Markets index has returned 185% to end September. That’s not too shabby, but it's half the 370% bull charge from the US S&P 500 index and also trails the 265% return from all global developed markets as represented by the MSCI World index.

How equities have performed for sterling investors

Fleeting recovery

These figures are all expressed in local currencies, but as the chart below shows, seen through the lens of a sterling investor the disparity is even more marked, with gains magnified by sterling's depreciation against global currencies. Essentially this confirms that it has paid to invest overseas throughout the decade, with gains of up to 200% for EM and a whopping 440% for the US.

So, you may justifiably ask, how exactly are the stars realigning in such a way as to make the developing world a more appealing place to invest? Bull markets don't die of old age, as this one has eminently proved, but they do get murdered.

The US Federal Reserve was up on a charge of attempted murder late last year, with rising interest rates its chosen weapon. But following its policy u-turn earlier this year, charges were reduced to assault with a deadly weapon and stock markets recovered quite quickly from their injuries.

The recovery, arguably, is nonetheless fleeting. There are deep ailments that continue to fester. The 10-year cyclically adjusted price earnings (Cape) ratio for the S&P 500 remains elevated at 31 times, versus a long-term median reading of 16.2, strongly suggesting it remains overvalued. Ongoing trade wars, particularly between the US and China, are taking their toll on economic activity, with skirmishes between the US and the EU also not to be underestimated.

These issues have contributed to the first meaningful reduction in global trade since the global financial crisis (it is down 2% year on year) and also help to explain why manufacturing PMIs (purchasing managers' indices) are below 50 in all major developed economies. A reading below 50 signals contraction.

This would appear to confirm what bond markets have been telling us since May: the so-called ‘inverted yield curve' (where the 10-year Treasury bond yield falls below the 2-year bond yield) has been a reliable predictor of recession for the past half-century.

The global recession in manufacturing has not yet been seen in services, however, which is important because this super-sector has a far greater weight in global economic numbers than manufacturing. Among the G20 nations there is not one with a services PMI below 50.

But it looks as though investors have good reason to be worried: the signals from the bond markets should not be ignored and neither should trends in profitability. A recent report from investment bank JPMorgan notes that global profits growth in all 10 major areas of economic activity has experienced a sharp slowdown. Taken as a whole, profit growth has fallen to zero, in tandem with global economic growth.

The numbers are not yet as bad as the mini-recession in early 2016, but the recessionary indicators are pretty clear: in particular, that the rise in the cost of labour is not being compensated for by a commensurate rise in profits. This profits squeeze "has historically preceded the start of recession dynamics," JPMorgan states.

Where does this leave investors?

In one sense, equity market valuations are being supported by a lack of meaningful gains to be found elsewhere – $17 trillion (£13.8 trillion) is invested in global bonds that have a negative yield. It means that investors are willing to pay issuers for the privilege of buying their debt.

Here's where the asset allocation forecasts from respected sources give a steer as to where gains can be made and losses avoided. GMO, a US-based investment management firm with a decent record of getting it more right than wrong, suggests a fairly aggressive tilt towards emerging market equities, primarily at the expense of US equities. Bear in mind that the US accounts for more than 60% of global developed market index-tracking funds such as iShares Core MSCI World ETF, so US fortunes have a supersized bearing on global markets.

GMO forecasts the average annual real (post-inflation) loss from large US companies will be -3.3% over seven years (see chart above). More positively, it expects real returns of 5.3% from emerging market stocks and over 10% from such stocks that are in the ‘value' camp. But arguably just as interesting is the expected return from the aforementioned bonds – a negative real return from all of the major fixed income asset classes.

Pete Chiappinelli, a member of the asset allocation team at GMO, notes that the volatile events of August saw the 10-year US Treasury yield decline by 52 basis points, bringing yields "to within a whisper of their 150-year historic low". Nevertheless, he adds:

"We are still witnessing extremely high and optimistic valuations of stocks – especially, if not particularly, in the US. Our seven-year forecasts reflect these shifts. We see the least attractive return prospects in US stocks and the most attractive returns in emerging value."

The UK-based consultancy Capital Economics, which also has a good record in macro calls, provides little solace for equity investors in the short term.

The firm's inaugural asset allocation quarterly forecasts that cash will be king for the remainder of 2019, punctuated by steep falls in global equities – particularly in the US – and even the safest of government bonds will fail to beat the return from cash. Asian emerging equities are viewed as being second worst to those in the US due to trade war tensions, but haven-seeking flows into the yen may serve to limit falls in Japan's stock market.

Emerging market returns substantially above US equities

US global leadership

On the plus side for investors who believe the US will continue its leading role in global equities, Capital Economics sees an average return from US shares in 2020/21 of almost 12%, a little more than it expects from emerging market shares.

But for those inclined to believe that the hegemonic role of the US has peaked, the predicted downturn in markets should offer an opportunity to top up both in unloved European stocks (including the UK) and in the emerging markets that have fallen so far behind.

Among global Rated Funds with a larger focus on emerging markets, investors should consider income funds Murray International (LSE:MYI) and Artemis Global Income, and to a lesser extent Henderson International Income Trust (LSE:HINC).

For more growth-oriented options, Monks (LSE:MNKS) and Artemis Global Growth have a relatively high weighting to emerging market stocks. There is also plenty of choice among funds and trusts dedicated to emerging markets, and those in the emerging Asia Pacific region as well.

There are some signs of stirring interest: emerging market equities and bonds experienced net foreign inflows of nearly £31 billion in September, according to the Institute of International Finance.

Despite the short-term concerns, emerging markets seem poised to regain their place in the sun.

The author was editor of Money Observer from 1998 to 2015.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.