Why we just bought this biotech fund

There are several reasons why this sector will continue to grow in importance.

2nd December 2019 13:01

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There are several reasons why this sector will continue to grow in importance.

Each week we look at the performance of all the UK domiciled Unit Trusts and Open-Ended Investment Companies, along with a selection of Investment Trusts and ETFs.

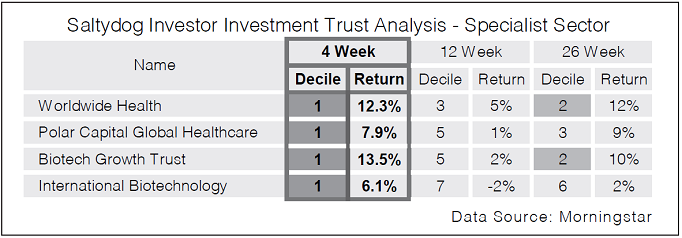

In each of these groups there are a number of funds that focus on biotechnology and healthcare which appear in our 'Specialist' categories. In last week’s reports they featured at the top.

In our Investment Trust specialist sector analysis, there were four funds at the top of the table based on their performance over the last four weeks.

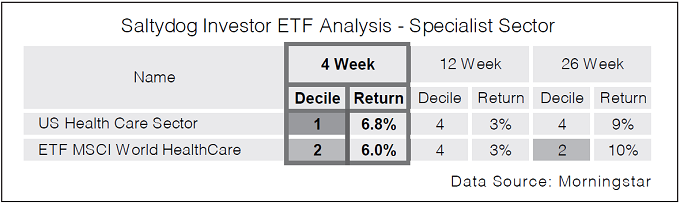

There were another two funds in our ETF report.

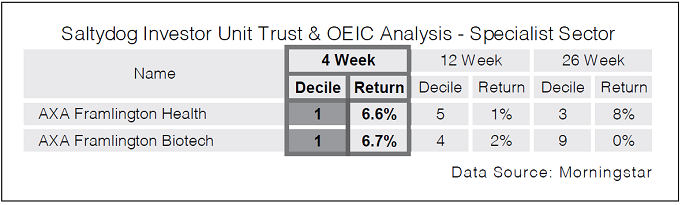

And two more in the Unit Trust and OEIC table.

In our demonstration portfolios we only invest in Unit Trust and OEICs. This is because there are more of them, they tend not to have a bid / offer spread any more , they haven’t got the additional complication of discounts and premiums, and they cover fixed income and equity sectors along with managed funds (which can invest in both).

The Biotech funds demonstrate that if a particular area of the market is doing well, then we would expect this to be reflected in the Unit Trusts, OEICs, Investment Trusts and ETFs (assuming funds are available).

Over the long term there are several reasons why the Healthcare and Biotech sectors will continue to grow in importance. Life expectancy continues to increase and as people live longer they require more prescription drugs and more healthcare. As developing countries get richer their populations will expect better medical services, which will also increase the demand for drugs. With developments in gene technology, and the rapid expansion of computer power, scientists are better equipped than ever to understand how diseases progress, and to develop tools to fight them.

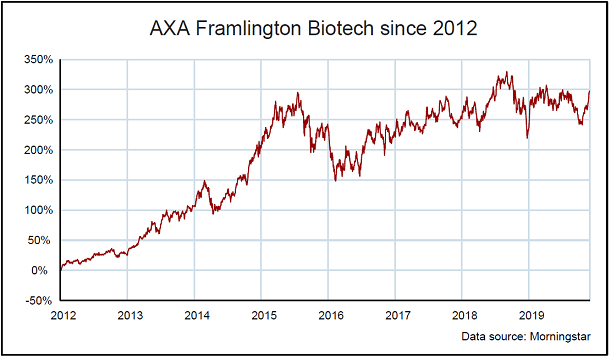

Last week we invested in the AXA Framlington Biotech fund. We’ve been in and out of this fund many times since we launched towards the end of 2010. In 2011 it was in the top 10% of all the funds that we analyse, and it was there again the following year. In 2013 it was the best performing fund with an annual return of 65%. In 2014 the Indian funds took top spot, but the AXA Framlington Biotech fund came in fourth having gone up a further 47%. 2015 started well, but then it fell sharply in the second half of the year.

Here’s a graph showing its performance since the beginning of 2012.

Since the low in 2016 it has been going up, but it has been volatile. It’s still lower than it was in much of 2018, but it has recovered strongly in the last few weeks.

We’ve only made a small investment and will watch it carefully. If the current rally falters, then we will sell our holding, but hopefully this is the beginning of a more sustained trend like we saw up until the middle of 2015.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.