Why we’re adding another UK fund to our portfolios

Saltydog Investor explains why its turning more bullish on the prospects for the UK market, which has led it to add a third UK-focused fund.

22nd July 2024 13:51

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

UK stock markets have picked up over the past few months, but they have still got a lot of catching up to do.

After a disappointing 2022, when the FTSE 100 went up by only 0.9% and the FTSE 250 lost -19.7%, the UK market started to recover in 2023. The FTSE 100 gained 3.8%, while the FTSE 250 rose by 4.4%. A distinct improvement, but they still did not do as well as most other stock markets around the world. The German DAX went up by 20%, the S&P 500 made 24%, the Japanese Nikkei 225 ended the year up 28%, and the Nasdaq beat them all, up 43%.

- Invest with ii: Top ISA Funds | What is a Managed ISA? | Open a Stocks & Shares ISA

The UK stock markets were also fairly slow out of the blocks this year and at the end of February were showing year-to-date losses. However, the UK market picked up in March when both the FTSE 100 and the FTSE 250 rose by more than 4%.

They made further gains in April when the FTSE 100 finally set a new all-time high, closing above 8,100 for the first time. In May, the FTSE 100 rose by 1.6% and the FTSE 250 added another 3.8%.

In June, both indices went down in the run-up to the general election, but since then have started to rise again.

Opinion polls had pointed to Labour securing a decisive victory.Markets do not like uncertainty, so the election result being broadly in line with expectations was reassuring. The fact that the government has a large majority should also help bring some political stability.

There has also been some encouraging economic data.The UK economy grew quicker than expected in May, with the Office for National Statistics (ONS) reporting that gross domestic product increased by 0.4%, exceeding predictions of 0.2% growth.

In addition, another positive is that UK inflation remained unchanged in June at the 2% target for the second successive month.

- ii Top 50 Fund Index: most-bought funds, trusts and ETFs in Q2 2024

- Where to invest in Q3 2024? Four experts have their say

We were concerned that there might be some short-term volatility in the UK stock markets after the election, but they seem to have taken it all in their stride. The FTSE 100 and FTSE 250 are currently showing month-to-date gains. The pound has also strengthened against the dollar and the euro.

So far this year, the FTSE 100 has risen by over 6% and the FTSE 250 has gone up by more than 7%.

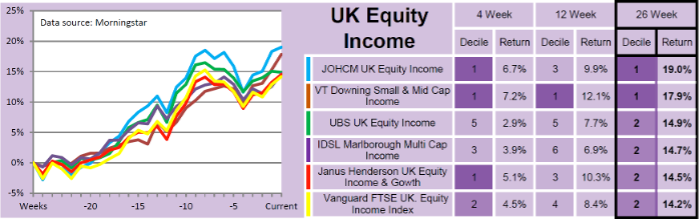

In last week’s Saltydog analysis, the best-performing sector, based on the four-week performance of all the funds that we track, was UK Equity Income, up 3.7%. Next was the UK Smaller Companies sector, up 3.5%, and the UK All Companies sector was not that far behind, with a four-week return of 2.9%. All three sectors have risen by more than 10% in the past 26 weeks.

- Funds and trusts four pros are buying and selling: Q3 2024

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- UK dividends hit record quarterly high, but 2024 outlook cut

We already hold a couple of funds from the UK equity sectors in our demonstration portfolios. Last December, we invested in the Ninety One UK Special Situations fund, from the UK All Companies sector, and then in May we added the Schroder UK Smaller Companies fund. We have just added a fund from the UK Equity Income sector.

There were plenty to choose from, but in the end we went for the J O Hambro Capital Management, JOHCM UK Equity Income fund. It was at the top of our 26-week performance table and also featured in our four-week table.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.